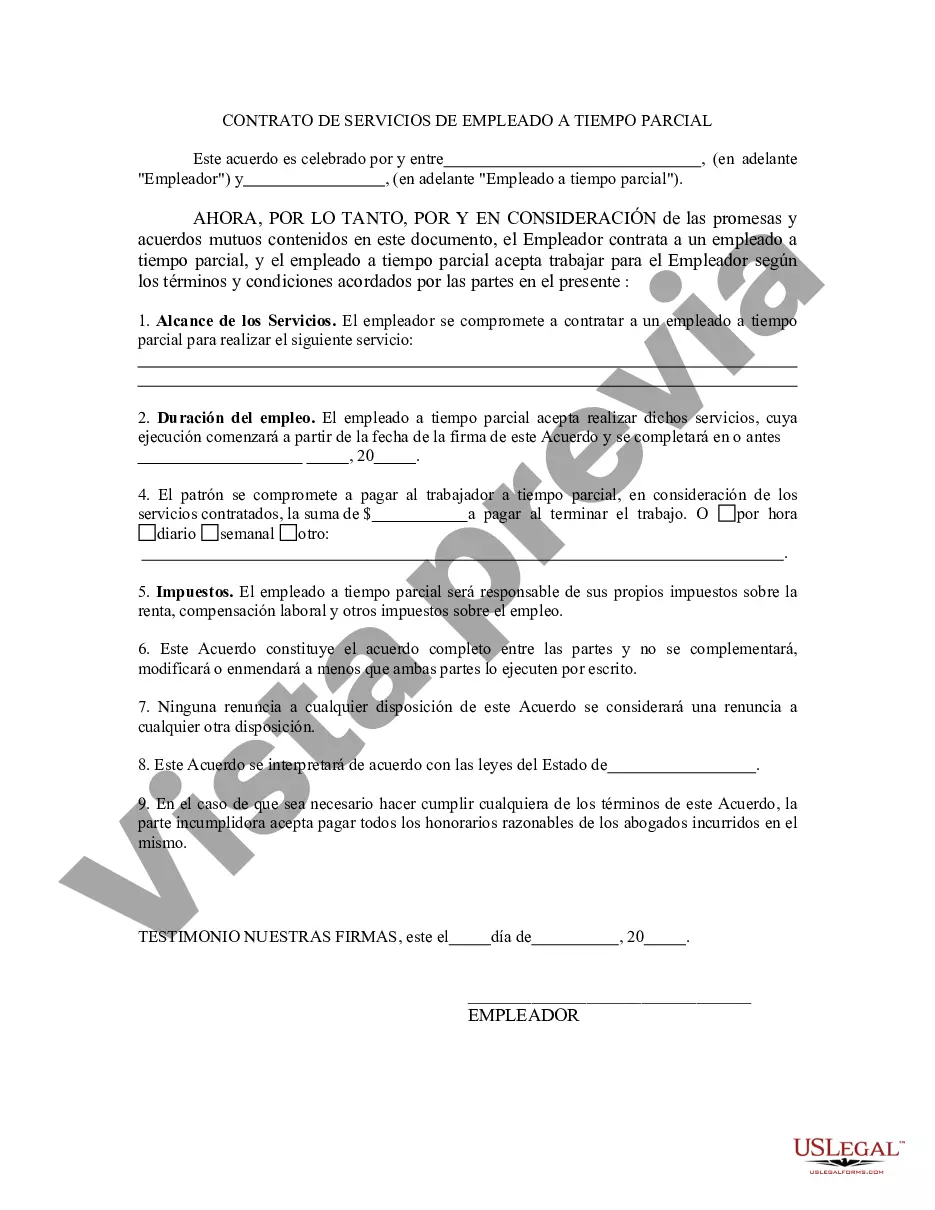

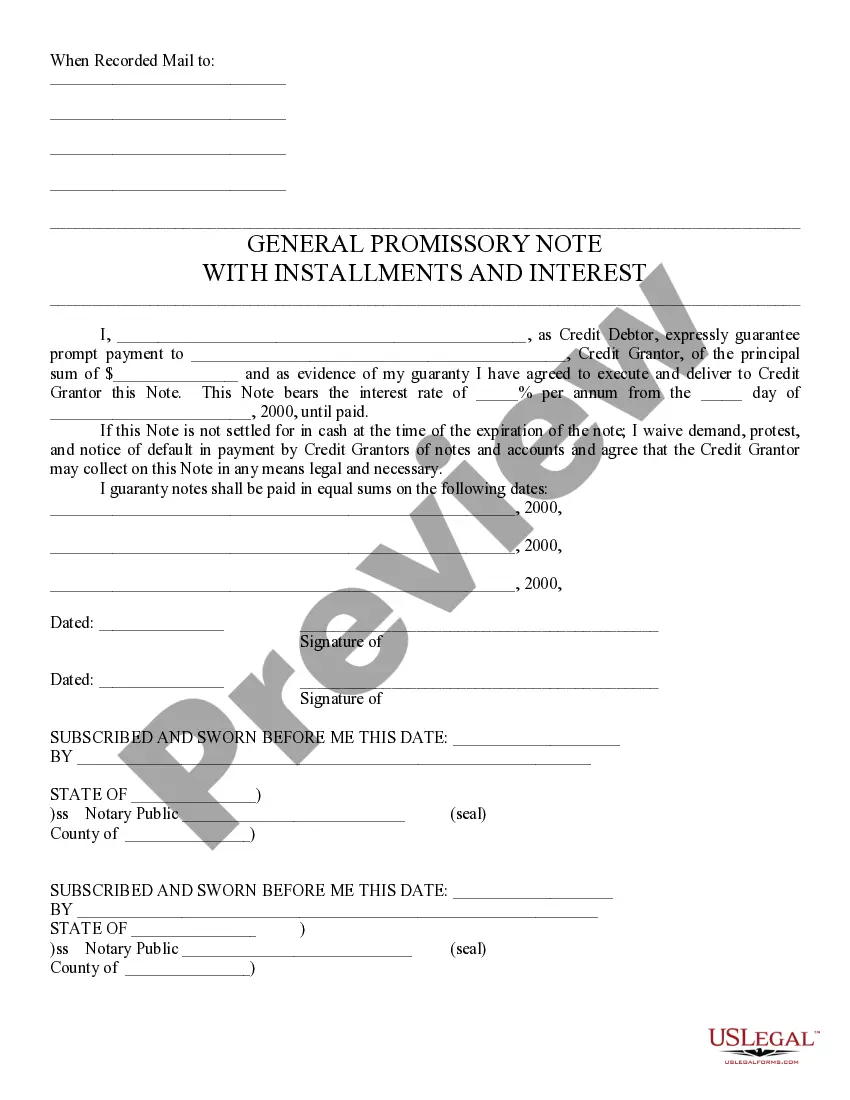

Georgia Self-Employed Part Time Employee Contract: A Comprehensive Guide Overview: A Georgia self-employed part-time employee contract is a legally binding agreement between a self-employed worker and an employer in the state of Georgia. This contract outlines the terms and conditions of the employment relationship, ensuring clarity and protection for both parties involved. It plays a crucial role in establishing the rights and responsibilities of the self-employed worker, as well as the expectations of the employer. Key Elements: 1. Parties involved: The contract clearly identifies the self-employed worker and the employer by providing their names, addresses, and contact information. 2. Scope of work: The contract should outline the specific tasks and responsibilities of the self-employed worker, ensuring both parties have a clear understanding of the work to be performed. 3. Working hours: The contract should state the agreed upon working hours, ensuring clarity on the schedule and any potential overtime requirements. 4. Remuneration: The contract should specify the agreed payment structure, whether it is an hourly rate, project-based compensation, or commission-based remuneration. It should also specify the payment frequency and any applicable taxes or deductions. 5. Duration of the contract: The contract should define the start and end dates of the employment arrangement. It may be limited to a specific project, a fixed period, or remain open-ended. 6. Termination clause: The contract should include provisions for early termination, specifying the required notice period, circumstances leading to termination, and any applicable repercussions. 7. Intellectual property rights: If the self-employed worker creates intellectual property during the course of their work, the contract should clearly outline ownership rights and any necessary usage permissions. 8. Confidentiality and non-compete agreements: The contract may include clauses prohibiting the self-employed worker from disclosing confidential information or engaging in competing activities during and after the contract's termination. 9. Dispute resolution: The contract may specify the method and jurisdiction for resolving any disputes that may arise between the parties. Different Types of Georgia Self-Employed Part-time Employee Contracts: 1. Project-based Contract: This type of contract is commonly used when engaging self-employed individuals for specific projects or short-term assignments. It defines the tasks, deadlines, and compensation associated with completing the project. 2. Fixed-term Contract: This agreement is used when engaging a self-employed worker for a defined period, such as seasonal work or temporary coverage. It specifies the start and end dates of the contract. 3. Rolling Contract: This form of contract has an indefinite duration and automatically renews until either party terminates it. It may be suitable for situations where the workload or project requirements are not well-defined or constantly change. In conclusion, a Georgia self-employed part-time employee contract is a vital document that provides a clear understanding of the terms, conditions, and expectations of the employment relationship between a self-employed worker and an employer. It ensures fairness, protection, and legal compliance for both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Georgia Contrato de Trabajador Autónomo a Tiempo Parcial - Self-Employed Part Time Employee Contract

Description

How to fill out Georgia Contrato De Trabajador Autónomo A Tiempo Parcial?

Discovering the right authorized record template might be a have difficulties. Naturally, there are a variety of layouts available online, but how would you find the authorized form you require? Use the US Legal Forms site. The service provides 1000s of layouts, such as the Georgia Self-Employed Part Time Employee Contract, that can be used for enterprise and private demands. All the kinds are inspected by professionals and fulfill state and federal needs.

In case you are already authorized, log in in your accounts and then click the Acquire option to find the Georgia Self-Employed Part Time Employee Contract. Make use of accounts to appear through the authorized kinds you possess bought in the past. Go to the My Forms tab of your accounts and get one more copy from the record you require.

In case you are a brand new end user of US Legal Forms, here are easy guidelines so that you can comply with:

- Initially, make sure you have chosen the correct form for your personal metropolis/region. It is possible to examine the shape making use of the Preview option and study the shape explanation to ensure it is the right one for you.

- In the event the form fails to fulfill your needs, take advantage of the Seach industry to get the appropriate form.

- Once you are certain the shape is acceptable, click the Purchase now option to find the form.

- Opt for the prices strategy you would like and enter the necessary details. Make your accounts and pay for the transaction using your PayPal accounts or charge card.

- Select the file file format and acquire the authorized record template in your device.

- Comprehensive, revise and print out and indicator the obtained Georgia Self-Employed Part Time Employee Contract.

US Legal Forms is the greatest library of authorized kinds for which you can discover a variety of record layouts. Use the service to acquire expertly-manufactured papers that comply with status needs.