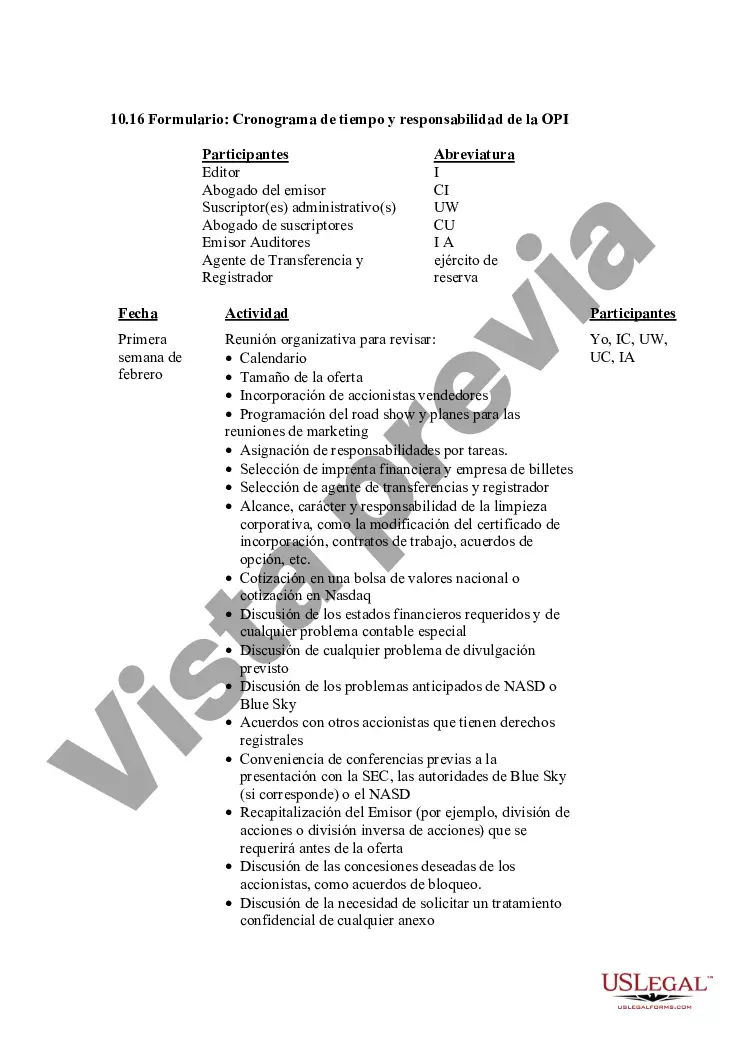

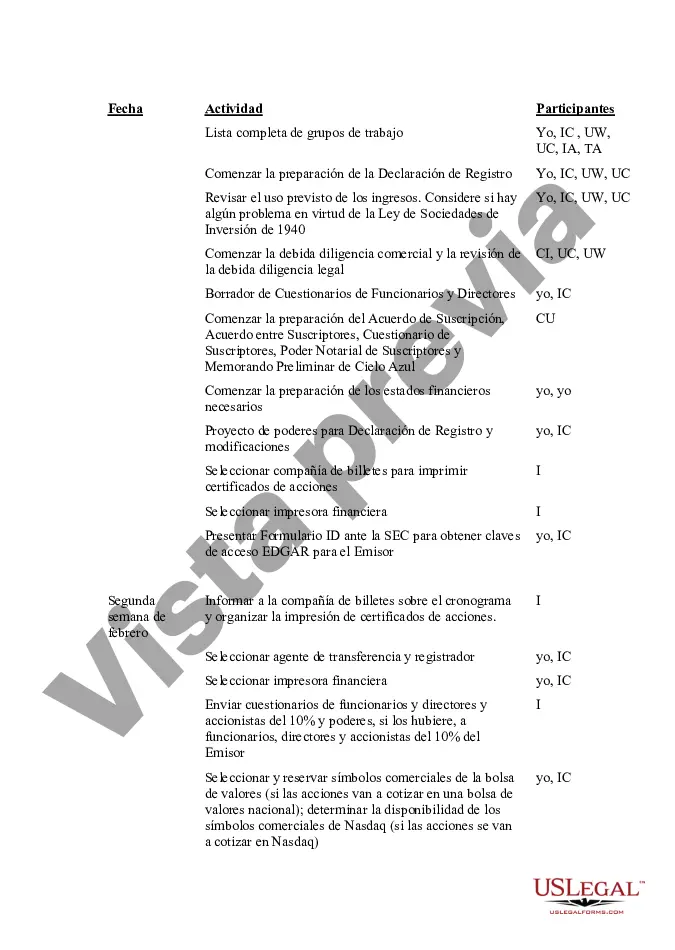

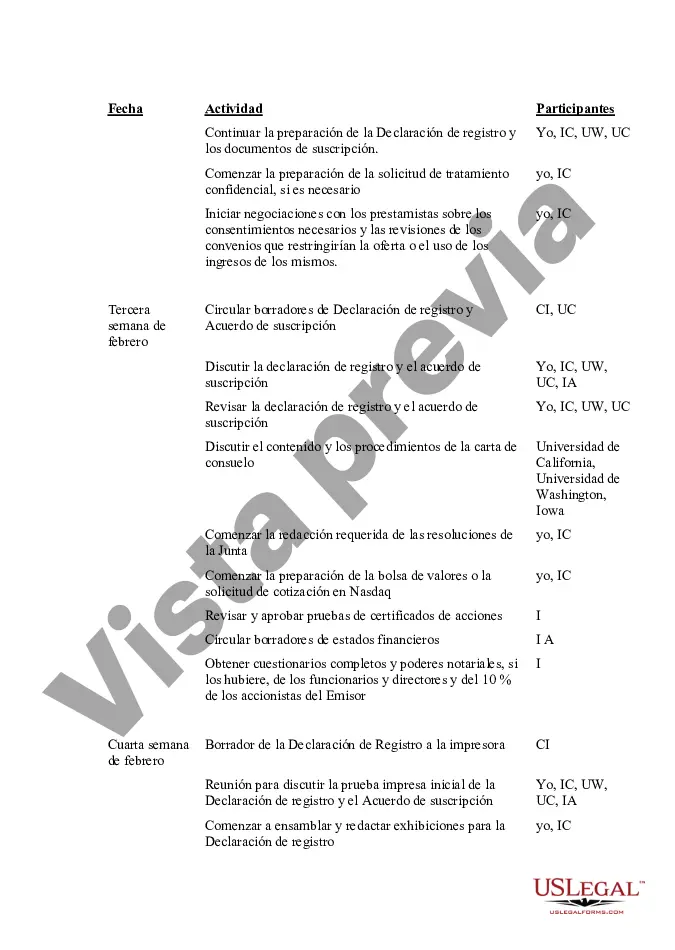

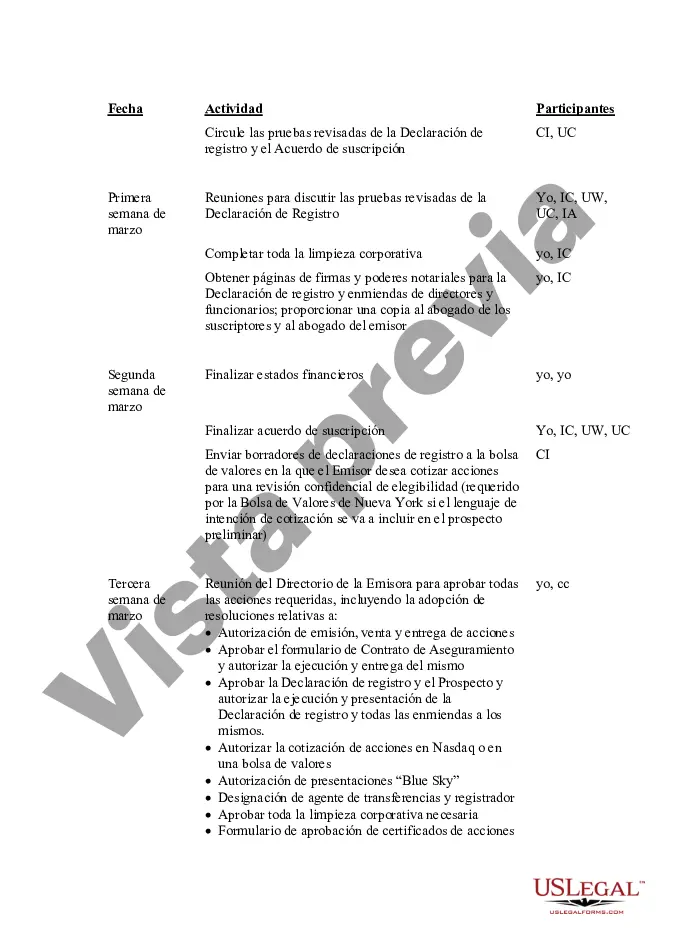

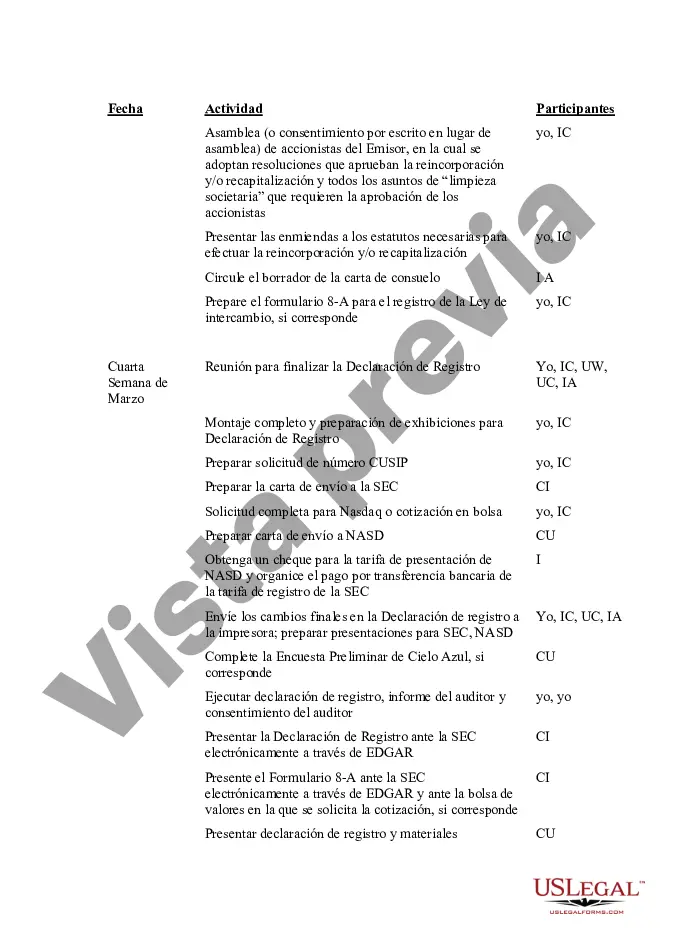

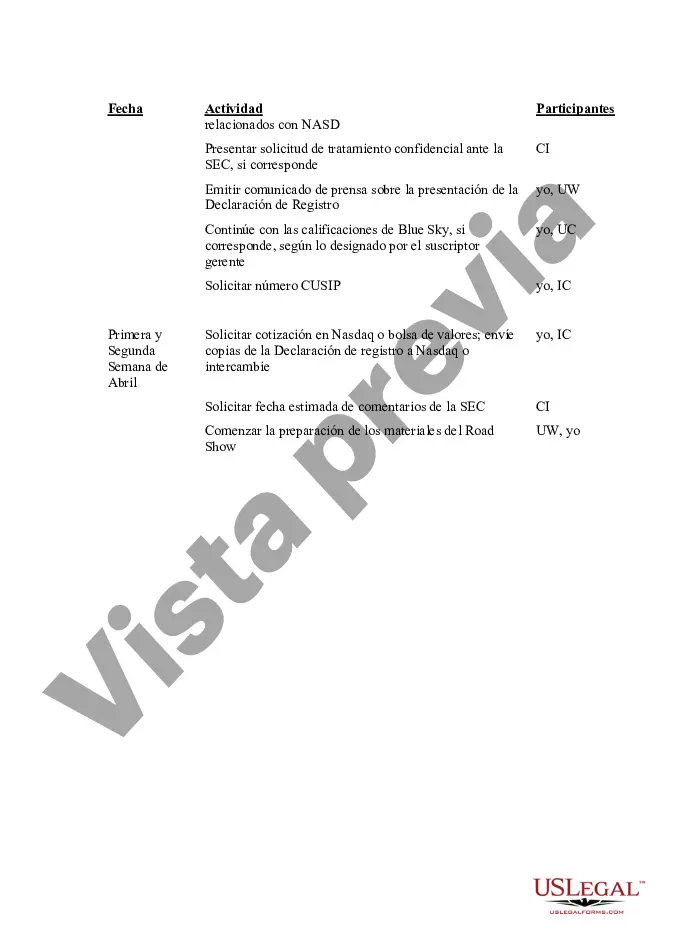

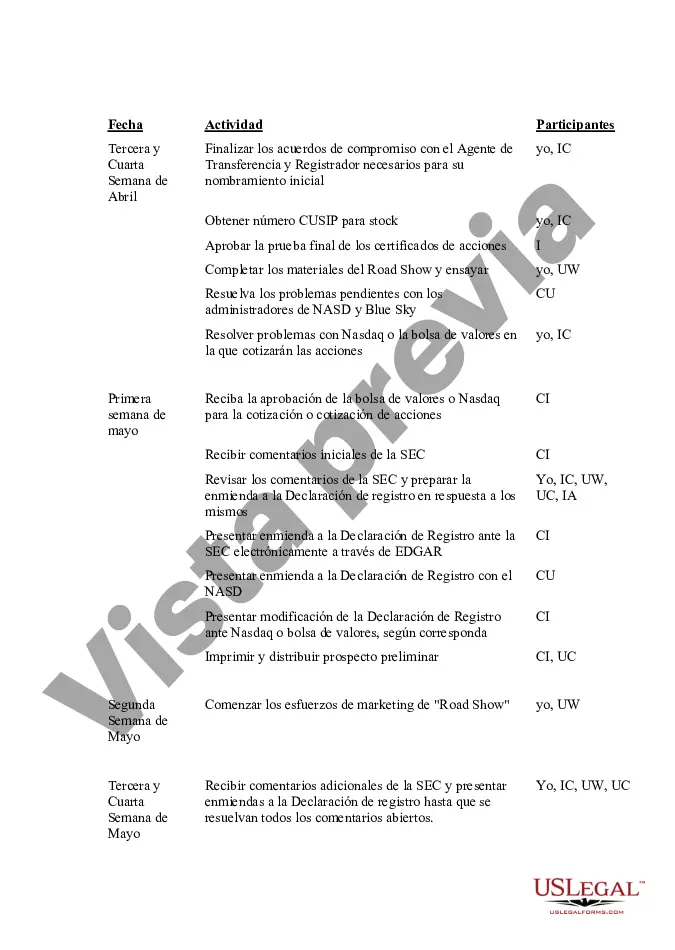

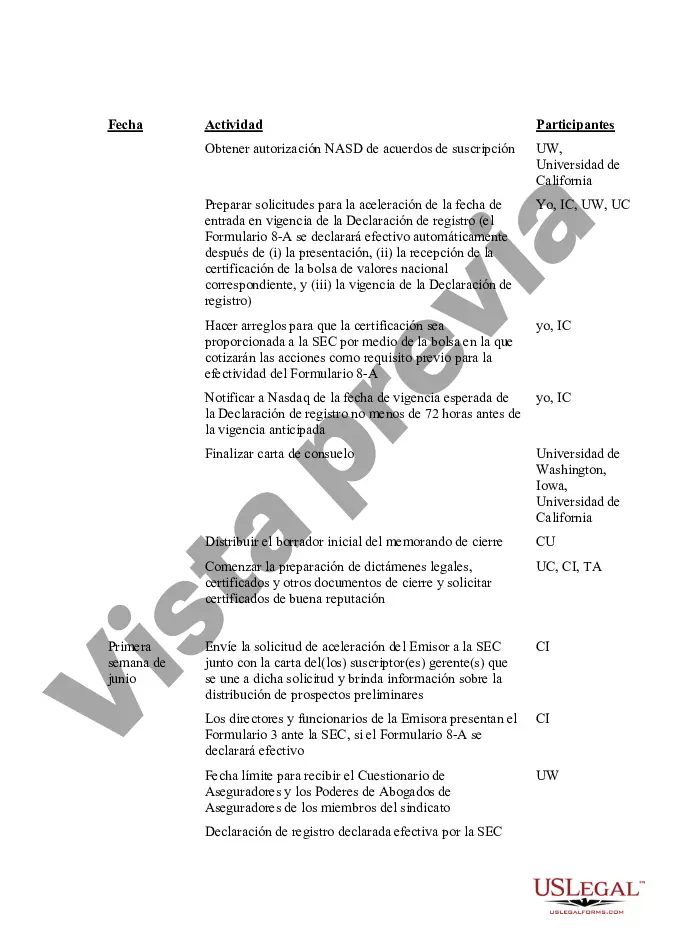

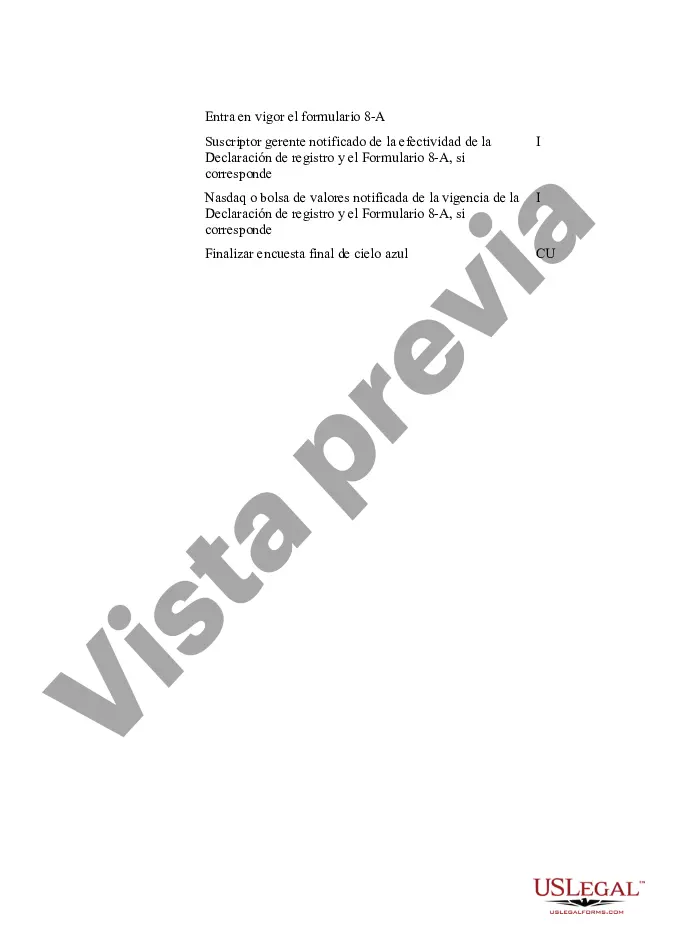

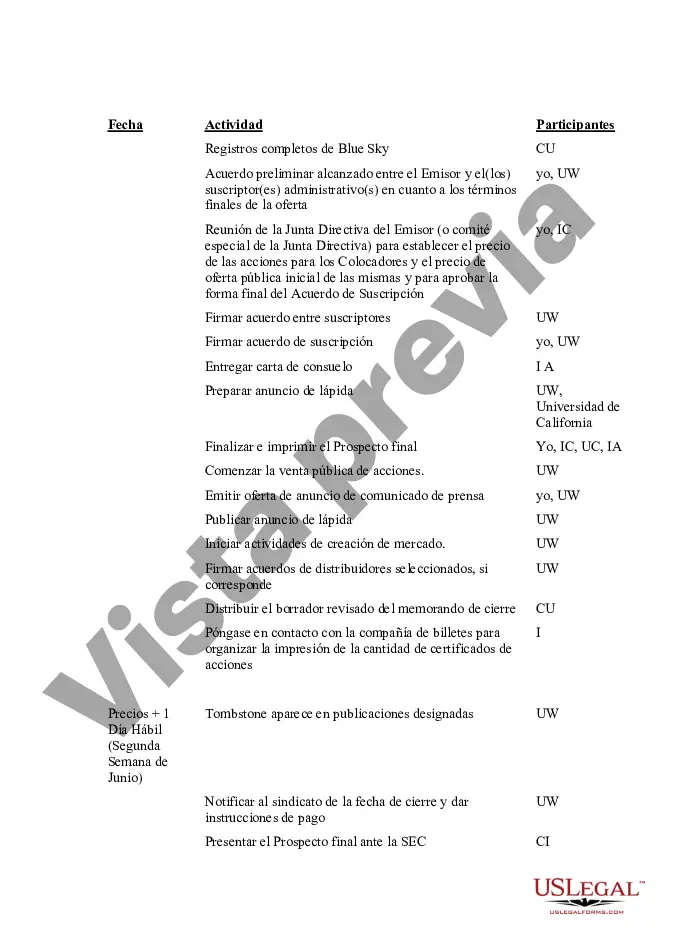

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

Georgia IPO Time and Responsibility Schedule is a crucial aspect of any Initial Public Offering (IPO) process. The schedule outlines the specific timeline and responsibilities associated with an IPO in the state of Georgia. This comprehensive guide ensures that all parties involved in the IPO are aware of their roles and deadlines, promoting a smooth and efficient transition to becoming a publicly traded company. The Georgia IPO Time and Responsibility Schedule typically consists of various key stages, each with its own set of specific tasks and deadlines. These stages may include: 1. pre-IPO Planning: This phase involves evaluating the company's readiness for going public. It encompasses tasks such as conducting internal assessments, engaging legal and financial advisors, and setting overall objectives for the IPO. 2. Financial Audit and Reporting: As part of the IPO process, the company needs to ensure its financial statements are accurate and comply with regulations. This stage involves conducting a thorough audit, preparing financial statements, and coordinating with external auditors to ensure compliance. 3. Due Diligence: This stage involves a comprehensive review of the company's operations, financials, legal matters, and potential risks. The management team and advisors collaborate to gather all necessary documentation, including contracts, patents, licenses, and any pending litigation. 4. SEC Registration and Filings: To become a publicly traded company, registration with the Securities and Exchange Commission (SEC) is mandatory. This stage involves preparing and filing the necessary registration statement, including drafting the prospectus, financial statements, and other required disclosures. 5. Roadshow and Investor Relations: At this stage, the company organizes roadshows where it presents its business model, financials, strategies, and growth potential to potential investors. The management team, with assistance from investment banks, works on creating presentations, scheduling meetings, and communicating effectively with prospective shareholders. 6. Pricing and Allocation: Once the roadshow is complete, the company and its underwriters determine the IPO price and allocation of shares among investors. Careful analysis is conducted to ensure that the pricing is attractive and reflects market demand while aligning with the company's valuation. 7. Listing and Trading: After finalizing the offering price and allocation, the IPO shares are listed on the stock exchange. This stage involves facilitating the share transfer process, coordinating with stock exchanges, and complying with listing requirements. The Georgia IPO Time and Responsibility Schedule is not limited to one specific type. However, it may vary depending on the type of IPO undertaken, such as a traditional IPO, direct listing, or special-purpose acquisition company (SPAC) merger. Each type has its unique set of rules and requirements, necessitating a tailored schedule for successful completion. In conclusion, the Georgia IPO Time and Responsibility Schedule is a comprehensive guide that outlines the timeline and responsibilities associated with an IPO in Georgia. It encompasses various stages, including pre-IPO planning, financial audit and reporting, due diligence, SEC registration and filings, roadshow and investor relations, pricing and allocation, and listing and trading. Adhering to this schedule is vital to ensure a smooth and successful transition to becoming a publicly traded company in Georgia.Georgia IPO Time and Responsibility Schedule is a crucial aspect of any Initial Public Offering (IPO) process. The schedule outlines the specific timeline and responsibilities associated with an IPO in the state of Georgia. This comprehensive guide ensures that all parties involved in the IPO are aware of their roles and deadlines, promoting a smooth and efficient transition to becoming a publicly traded company. The Georgia IPO Time and Responsibility Schedule typically consists of various key stages, each with its own set of specific tasks and deadlines. These stages may include: 1. pre-IPO Planning: This phase involves evaluating the company's readiness for going public. It encompasses tasks such as conducting internal assessments, engaging legal and financial advisors, and setting overall objectives for the IPO. 2. Financial Audit and Reporting: As part of the IPO process, the company needs to ensure its financial statements are accurate and comply with regulations. This stage involves conducting a thorough audit, preparing financial statements, and coordinating with external auditors to ensure compliance. 3. Due Diligence: This stage involves a comprehensive review of the company's operations, financials, legal matters, and potential risks. The management team and advisors collaborate to gather all necessary documentation, including contracts, patents, licenses, and any pending litigation. 4. SEC Registration and Filings: To become a publicly traded company, registration with the Securities and Exchange Commission (SEC) is mandatory. This stage involves preparing and filing the necessary registration statement, including drafting the prospectus, financial statements, and other required disclosures. 5. Roadshow and Investor Relations: At this stage, the company organizes roadshows where it presents its business model, financials, strategies, and growth potential to potential investors. The management team, with assistance from investment banks, works on creating presentations, scheduling meetings, and communicating effectively with prospective shareholders. 6. Pricing and Allocation: Once the roadshow is complete, the company and its underwriters determine the IPO price and allocation of shares among investors. Careful analysis is conducted to ensure that the pricing is attractive and reflects market demand while aligning with the company's valuation. 7. Listing and Trading: After finalizing the offering price and allocation, the IPO shares are listed on the stock exchange. This stage involves facilitating the share transfer process, coordinating with stock exchanges, and complying with listing requirements. The Georgia IPO Time and Responsibility Schedule is not limited to one specific type. However, it may vary depending on the type of IPO undertaken, such as a traditional IPO, direct listing, or special-purpose acquisition company (SPAC) merger. Each type has its unique set of rules and requirements, necessitating a tailored schedule for successful completion. In conclusion, the Georgia IPO Time and Responsibility Schedule is a comprehensive guide that outlines the timeline and responsibilities associated with an IPO in Georgia. It encompasses various stages, including pre-IPO planning, financial audit and reporting, due diligence, SEC registration and filings, roadshow and investor relations, pricing and allocation, and listing and trading. Adhering to this schedule is vital to ensure a smooth and successful transition to becoming a publicly traded company in Georgia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.