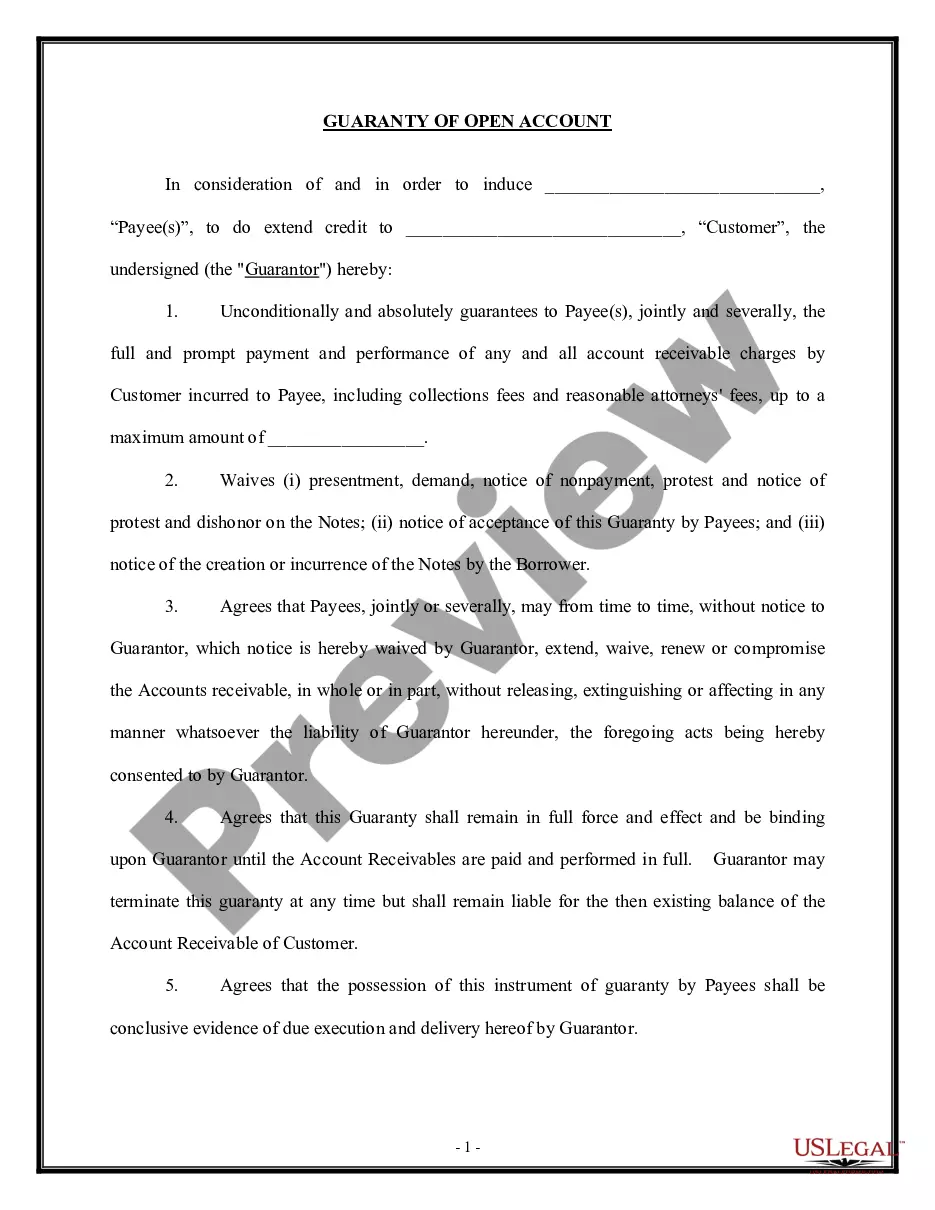

Guam Guaranty of Open Account - Alternate Form

Description

How to fill out Guaranty Of Open Account - Alternate Form?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates you can download or print.

By using the site, you may access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the Guam Guaranty of Open Account - Alternate Form in moments.

If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

When you are content with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and provide your details to create an account.

- If you are a member, Log In to download the Guam Guaranty of Open Account - Alternate Form from your US Legal Forms library.

- The Download button will be present on each form you examine.

- You can view all previously acquired forms in the My documents section of your account.

- If you are new to US Legal Forms, here are some simple steps to get started.

- Ensure you have chosen the appropriate form for your city/county.

- Click the Review button to evaluate the form's details.

Form popularity

FAQ

The FSA 50 45 5 program is a financial initiative designed to enhance the availability of credit through the Guam Guaranty of Open Account - Alternate Form. This program provides essential support to businesses in Guam by offering guarantees on open accounts, encouraging them to extend credit to their customers confidently. By participating in this program, businesses not only gain a safety net against potential losses but also foster stronger customer relationships. If you seek further clarity on this program and its benefits, USLegalForms offers easy-to-understand resources to guide you.

The correct address to mail your Guam tax return can be found on the Guam Department of Revenue and Taxation's official website. Ensure that you use the latest information, as addresses can change. Correctly mailing your return is particularly important if you are utilizing the Guam Guaranty of Open Account - Alternate Form to meet your tax obligations.

You should mail your state tax return to the specific address provided by the Department of Revenue and Taxation for your return type. This ensures that your documents reach the right destination efficiently. If you're filing using the Guam Guaranty of Open Account - Alternate Form, double-check the mailing details to avoid any issues.

Typically, residents of Guam who earn income above a certain threshold are required to file a Guam tax return. This includes individuals who receive wages, self-employment income, or other forms of revenue. If you are unsure about your filing requirements, especially regarding the Guam Guaranty of Open Account - Alternate Form, consult with a tax professional.

1 Guam is a form used for filing personal income taxes on Guam. It captures essential information about your income and tax liabilities. Understanding this form is crucial for accurate tax filing, especially when handling the Guam Guaranty of Open Account Alternate Form.

Yes, you can file your Guam tax online through the Department of Revenue and Taxation's website. This option provides a convenient way to submit your return without needing to mail paper forms. If you are using the Guam Guaranty of Open Account - Alternate Form, be sure to check for any online submission guidelines.

Guam has its own tax system, and residents typically file a Guam tax return instead of a US federal return. However, certain individuals may need to file US returns if they have specific income or circumstances. It's vital to understand the differences as you navigate your tax obligations, particularly when considering the Guam Guaranty of Open Account - Alternate Form.

The address for mailing your Guam tax return typically varies based on the type of return you are filing. You can find the specific address on the official website of the Department of Revenue and Taxation. Properly addressing your mail, especially if you are using the Guam Guaranty of Open Account - Alternate Form, will help ensure timely processing.

You should send your Guam tax return to the Department of Revenue and Taxation in Guam. The mailing address can be found on their official website. It's important to ensure that your return is sent to the correct location to avoid processing delays. For those using the Guam Guaranty of Open Account - Alternate Form, make sure to include all necessary documentation.