A Guam Living Trust — Irrevocable is a legally binding document that allows individuals in Guam to protect and manage their assets while ensuring that their wishes are carried out after their demise. It is essential to understand the different types of Irrevocable Trusts available to residents in Guam to make informed decisions in estate planning. An Irrevocable Trust is a type of trust that cannot be modified, amended, or revoked without the consent of all beneficiaries involved. It serves as a valuable tool for individuals who are seeking asset protection, estate tax reduction, or Medicaid planning. The creation of an Irrevocable Trust involves transferring ownership of assets into the trust, effectively removing them from the granter's estate. In Guam, several variations of Irrevocable Trusts exist to suit different estate planning objectives. Some common types include: 1. Medicaid Asset Protection Trust: This trust enables individuals to protect their assets from being counted towards Medicaid eligibility while ensuring they receive necessary long-term care benefits. 2. Generation-Skipping Trust: Also known as Dynasty Trust, this type of trust allows individuals to transfer substantial wealth to future generations while minimizing estate taxes. 3. Charitable Remainder Trust: Designed for philanthropic individuals, this trust allows the granter to receive income from the assets placed within the trust while donating the remaining assets to a charitable organization after their death. 4. Special Needs Trust: This trust is set up to provide financial support and care for individuals with disabilities without jeopardizing their eligibility for government assistance programs. 5. Qualified Personnel Residence Trust: This specific trust enables individuals to transfer their primary residence or vacation home to their beneficiaries while reducing estate taxes. 6. Life Insurance Trust: By naming the trust as the owner and beneficiary of a life insurance policy, individuals can ensure the proceeds are not included in their taxable estate, providing potential estate tax savings. In conclusion, a Guam Living Trust — Irrevocable is an essential tool for estate planning, allowing individuals to protect and manage their assets while ensuring their wishes are fulfilled. The various types of Irrevocable Trusts available in Guam cater to different objectives such as asset protection, tax reduction, Medicaid planning, philanthropy, and supporting individuals with special needs. Consulting with an estate planning attorney can help individuals determine the most suitable type of Irrevocable Trust for their specific circumstances.

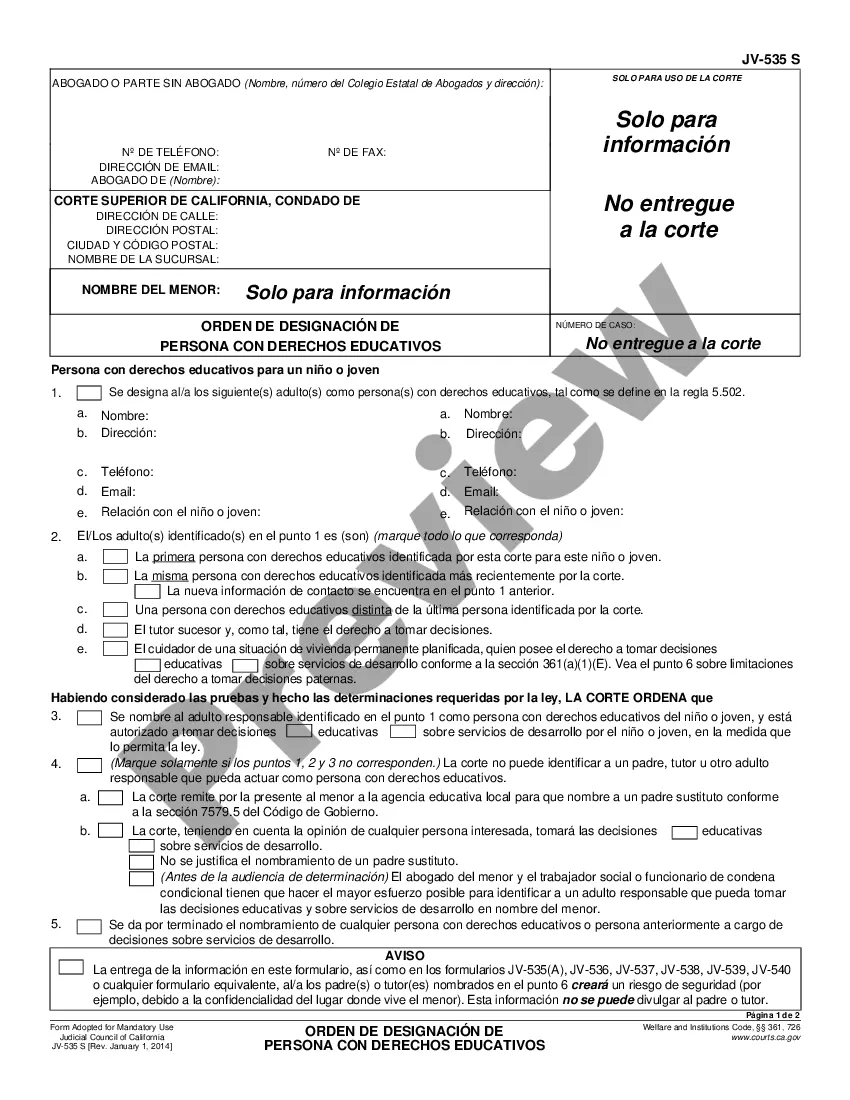

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Fideicomiso en Vida - Irrevocable - Living Trust - Irrevocable

Description

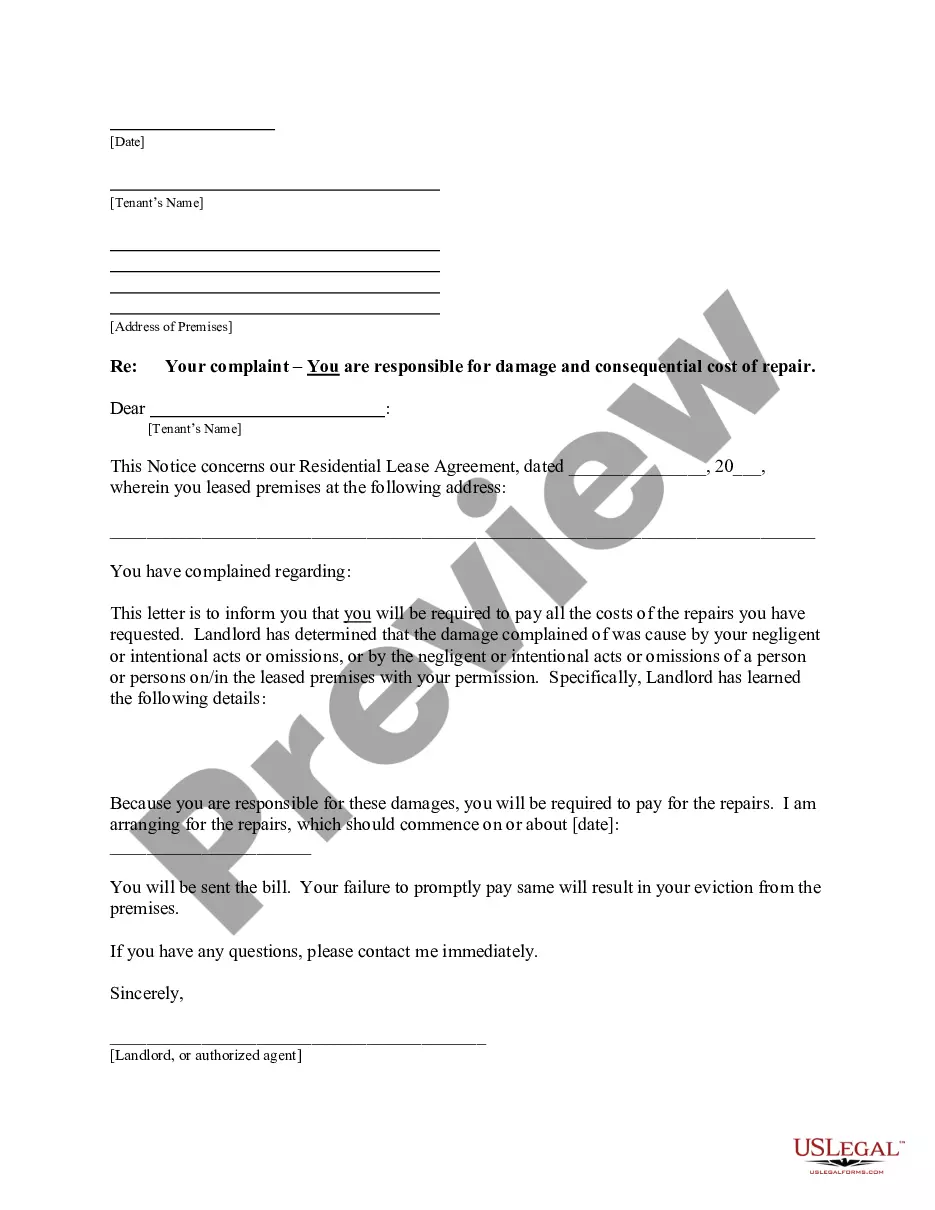

How to fill out Guam Fideicomiso En Vida - Irrevocable?

Are you in a situation where you need documents for potentially business or personal purposes almost every day.

There are many legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers numerous form templates, including the Guam Living Trust - Irrevocable, which are designed to comply with state and federal regulations.

Select the pricing plan you desire, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

Choose a convenient document format and download your copy. You can find all the document templates you've purchased in the My documents section. You can acquire another copy of Guam Living Trust - Irrevocable anytime, if needed. Just click the relevant form to download or print the document template. Use US Legal Forms, the most comprehensive collection of legal forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that you can utilize for various purposes. Create your account on US Legal Forms and start making your life simpler.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Guam Living Trust - Irrevocable template.

- If you do not possess an account and wish to begin using US Legal Forms, follow these instructions.

- Locate the form you require and ensure it is for the correct state/region.

- Utilize the Review button to examine the document.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, make use of the Search field to find the form that meets your needs and requirements.

- Once you identify the correct form, click on Buy now.

Form popularity

FAQ

Property tax in Guam is based on the assessed value of the property and is generally lower compared to the continental United States. The local government assesses residential and commercial properties to determine tax amounts. By establishing a Guam Living Trust - Irrevocable, property owners can effectively manage their estate and potentially reduce tax liabilities.

Yes, a living trust can be classified as an irrevocable trust. Once established, an irrevocable Guam Living Trust cannot be modified or revoked by the grantor. This characteristic provides significant benefits, including potential asset protection and tax advantages. Many individuals find this type of trust beneficial for long-term estate planning.

Inheritance law in Guam typically follows the principles of community property and equitable distribution. When a person passes away, their assets will be distributed according to state statutes or a will. Understanding these laws is crucial for estate planning. Utilizing a Guam Living Trust - Irrevocable can be an effective tool to ensure your wishes are honored.

To make a Guam Living Trust - Irrevocable, you must declare your intent in the trust documents and meet specific legal requirements. This includes drafting the trust in a way that clearly states it cannot be altered or terminated once created. Legal guidance is crucial to ensure compliance with local laws and to make the process seamless. USLegalForms can provide the necessary resources and documents to help you achieve this.

One downside of a Guam Living Trust - Irrevocable is the loss of control over the assets you've entrusted to the trust. Once the trust is established, you cannot modify or dissolve it without legal intervention, which can lead to complications. Additionally, irrevocable trusts may have tax implications that require careful planning. Always consult with a professional to weigh the pros and cons.

Yes, you can create a Guam Living Trust - Irrevocable by yourself, but it may be challenging. It's important to understand the legal implications and ensure all requirements are met. Without professional guidance, you might overlook critical details, potentially invalidating the trust. Consider using legal services, such as USLegalForms, to simplify the process.

The major disadvantage of a trust, particularly a Guam Living Trust - Irrevocable, is the lack of flexibility after its creation. Once established, the terms cannot typically be altered, which means that circumstances around asset distribution must be carefully considered beforehand. This can lead to challenges if future needs arise, so thoughtful planning is essential.

Placing assets in a trust can be a strategic move for your parents, especially to protect wealth and ensure a smooth transfer to heirs. A Guam Living Trust - Irrevocable helps manage and distribute assets according to their wishes while potentially reducing tax burdens. It's wise to discuss this option with a legal professional to assess their specific situation.

Filling out an irrevocable trust involves several key steps, starting with choosing a trustworthy trustee. You'll need to identify the assets being transferred and clearly outline the beneficiaries in the trust documents. Utilizing a service like uslegalforms can simplify this process by providing tools and resources designed for creating a Guam Living Trust - Irrevocable effectively.

Trust funds can present several risks if not managed properly. The primary concern involves tax implications and the potential for disputes among beneficiaries. A Guam Living Trust - Irrevocable minimizes some risks but doesn't eliminate them entirely, so careful planning and ongoing management are crucial for safeguarding your assets.

Interesting Questions

More info

Forms Sources.