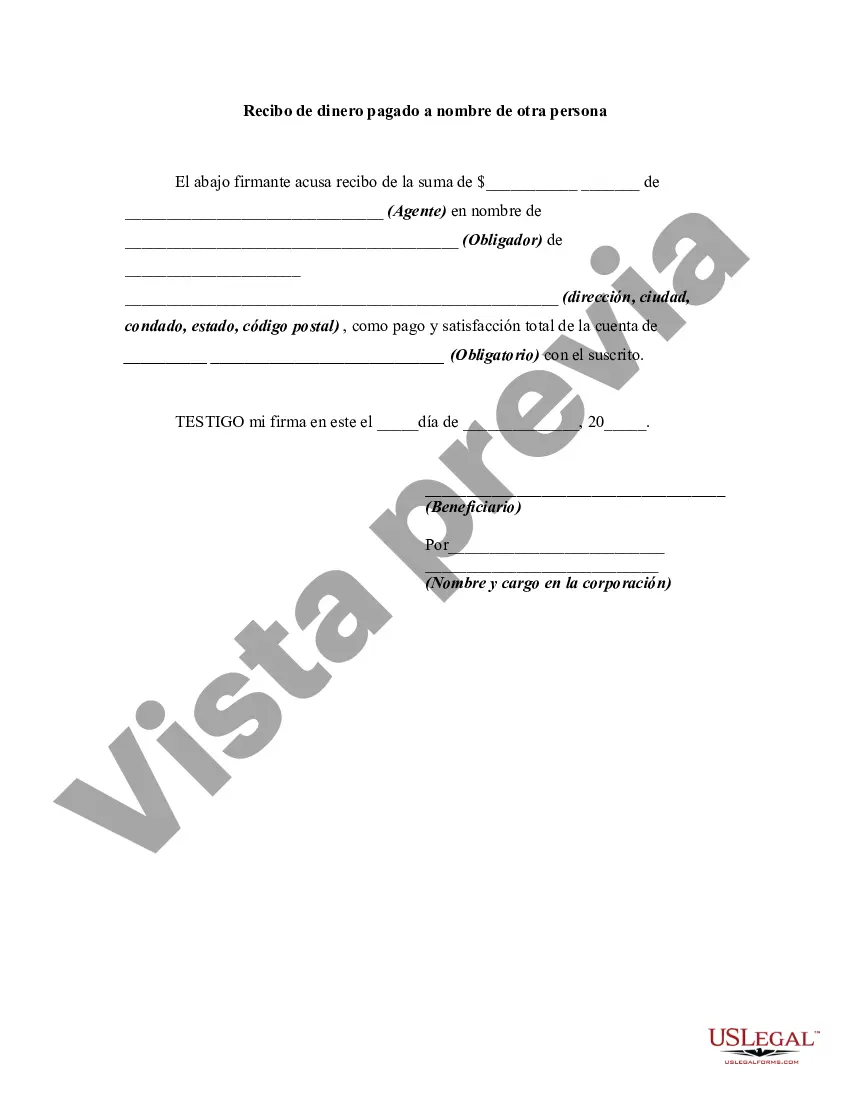

Title: Understanding Guam Receipt for Money Paid on Behalf of Another Person Introduction: A Guam Receipt for Money Paid on Behalf of Another Person serves as a formal document to acknowledge and record monetary transactions where one party makes a payment on behalf of someone else in the U.S. territory of Guam. This article will provide a detailed description of what a Guam Receipt for Money Paid on Behalf of Another Person entails, its importance, and potential variations or types. Key terms: Guam, receipt, money paid, behalf of another person 1. Understanding Guam Receipt for Money Paid on Behalf of Another Person: A Guam Receipt for Money Paid on Behalf of Another Person is a legal document that outlines the details of a financial transaction where a party (payer) makes a payment using their own funds for the benefit of another individual or entity (payee). This receipt serves as evidence of the payment made and creates a record for future reference. 2. Importance of Guam Receipt for Money Paid on Behalf of Another Person: a. Documentation: It ensures that monetary transactions involving third-party payments are properly documented, reducing misunderstandings or disputes in the future. b. Accountability: The receipt helps establish a clear audit trail, demonstrating who made the payment on behalf of the other party. c. Legal Protection: In case of any legal issues or disputes, the Guam Receipt presents evidence of the parties' financial obligations and responsibilities. 3. Details included in a Guam Receipt for Money Paid on Behalf of Another Person: a. Date: The date when the payment was made. b. Parties Involved: Name and contact details of both the payer and the payee. c. Payment Amount: The exact amount of money paid on behalf of the other person. d. Payment Purpose: A clear description of the purpose for which the payment was made. e. Payment Method: The mode of payment used, such as cash, check, electronic transfer, etc. f. Signatures: Both the payer and the payee, or their authorized representatives, should sign the receipt. 4. Variations or Types of Guam Receipt for Money Paid on Behalf of Another Person: a. Personal Expenses: Receipts for payments made by individuals on behalf of family members, friends, or acquaintances for personal expenses like medical bills, education, or utilities. b. Business Transactions: Receipts generated when a person pays for goods, services, or debts on behalf of a business partner, colleague, or employer. c. Legal Matters: Receipts relevant to attorney fees, court costs, or bail payments made on behalf of another person involved in legal proceedings. Conclusion: A Guam Receipt for Money Paid on Behalf of Another Person is a crucial document that provides an official record of financial transactions where one party pays on behalf of someone else. It ensures transparency, accountability, and legal protection for both parties involved. Understanding the necessary details and varying types of these receipts allows for accurate record-keeping and efficient financial management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Recibo de dinero pagado a nombre de otra persona - Receipt for Money Paid on Behalf of Another Person

Description

How to fill out Guam Recibo De Dinero Pagado A Nombre De Otra Persona?

If you want to comprehensive, down load, or print authorized record themes, use US Legal Forms, the biggest collection of authorized forms, that can be found on the web. Use the site`s easy and convenient look for to discover the documents you require. Numerous themes for enterprise and specific purposes are categorized by types and suggests, or key phrases. Use US Legal Forms to discover the Guam Receipt for Money Paid on Behalf of Another Person in just a few clicks.

Should you be already a US Legal Forms buyer, log in to the account and click on the Acquire switch to obtain the Guam Receipt for Money Paid on Behalf of Another Person. You can also access forms you previously saved from the My Forms tab of the account.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for that right area/nation.

- Step 2. Use the Preview choice to look through the form`s content. Never neglect to read through the explanation.

- Step 3. Should you be not satisfied with all the type, use the Look for area near the top of the monitor to find other variations from the authorized type design.

- Step 4. After you have located the shape you require, select the Purchase now switch. Opt for the prices strategy you like and add your qualifications to register for an account.

- Step 5. Procedure the deal. You can use your credit card or PayPal account to perform the deal.

- Step 6. Pick the structure from the authorized type and down load it on your own system.

- Step 7. Full, revise and print or indication the Guam Receipt for Money Paid on Behalf of Another Person.

Each and every authorized record design you buy is your own for a long time. You possess acces to each and every type you saved inside your acccount. Click on the My Forms segment and select a type to print or down load yet again.

Remain competitive and down load, and print the Guam Receipt for Money Paid on Behalf of Another Person with US Legal Forms. There are millions of professional and state-certain forms you may use to your enterprise or specific requires.