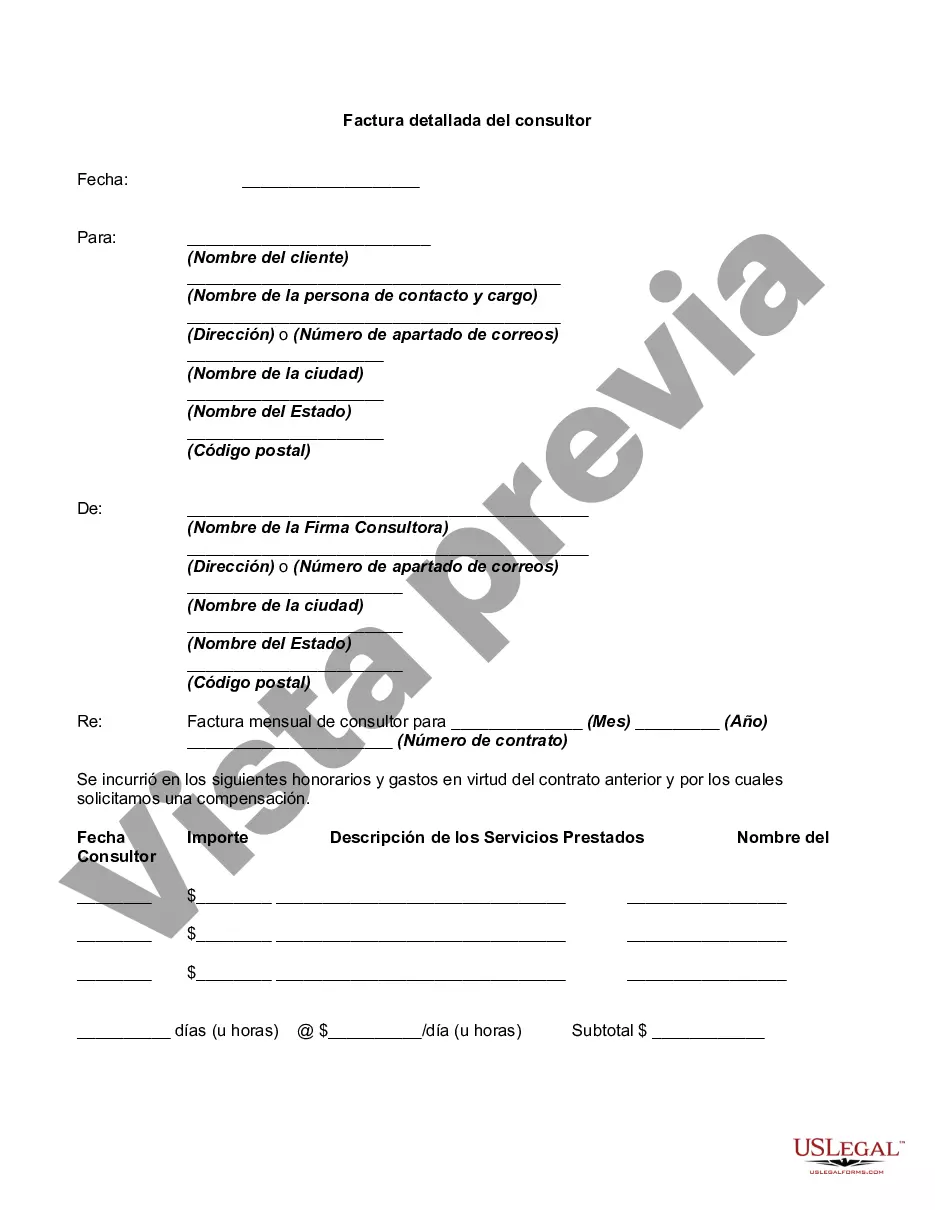

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Detailed Consultant Invoice: A Comprehensive Guide to Streamlined Business Billing Introduction to Guam: Located in the Western Pacific Ocean, Guam is an unincorporated territory of the United States. It is the largest and southernmost of the Mariana Islands, boasting a rich cultural heritage, stunning landscapes, and a booming economy. Businesses in Guam, as in any other location, often require the services of consultants to gain specialized expertise, guidance, and solutions. Consequently, it becomes essential for consultants to provide detailed invoices that accurately reflect the services rendered and enable seamless financial transactions. Overview of Guam Detailed Consultant Invoice: A Guam Detailed Consultant Invoice is a professional billing document that outlines the services provided by a consultant, including a breakdown of tasks, hours worked, expenses, and applicable taxes. This comprehensive invoice serves as a transparent record of the consultant's work, ensuring clarity and accountability in financial dealings. It provides clients with an itemized summary that enables them to understand the value they are receiving and simplifies the payment process. Key Components of a Guam Detailed Consultant Invoice: 1. Consultant Information: Start the invoice by including your company name, address, contact details, and logo for branding purposes. Also, mention the client's information, including their name, address, and contact details. 2. Invoice Number and Date: Assign a unique invoice number to each invoice for easier tracking and reference. Include the date of issue to establish the timeline of payment. 3. Description of Services: Clearly state the scope of work or services provided. Break it down into specific tasks or deliverables to provide a detailed overview. 4. Hours Worked and Rates: Itemize the number of hours spent on each task and the corresponding hourly rate. Multiply the hours worked by the respective rates to calculate the subtotals. 5. Reimbursable Expenses: If applicable, include any expenses incurred during the consultancy process. This may involve travel costs, accommodations, materials, or other additional expenses related to the project. 6. Taxes and Discounts: Calculate and include any applicable taxes, such as Guam's Business Privilege Tax (BPT). If any discounts or promotional offers apply, clearly mention them on the invoice. 7. Total Amount Due: Sum up all the subtotals, expenses, taxes, and discounts to arrive at the final amount the client needs to pay. Clearly indicate this total alongside the currency the payment should be made in. Different Types of Guam Detailed Consultant Invoices: 1. Hourly Rate Invoice: Consultants commonly invoice clients based on the number of hours spent on a project. This type of invoice includes a breakdown of tasks, hours worked, and the corresponding hourly rate. 2. Fixed Price Invoice: In cases where a consultant's services are agreed upon at a fixed price for a specific project or duration, a fixed price invoice is used. This type of invoice mentions the agreed-upon amount and may include milestone payments or due dates. 3. Retainer Invoice: A retainer invoice is used when a client pays a consultant a fixed amount upfront to secure their services for an extended period. This invoice outlines the retainer fee, any additional charges, and the duration of the retainer agreement. Conclusion: A detailed consultant invoice is a vital component of any consultancy practice, ensuring seamless financial transactions and maintaining trust and transparency between consultants and their clients. For consultants operating in Guam, creating a comprehensive invoice that accurately reflects services rendered while accounting for specific local regulations, such as the Guam Business Privilege Tax (BPT), is essential. By utilizing a Guam Detailed Consultant Invoice, consultants can streamline their billing processes and foster strong client relationships.Guam Detailed Consultant Invoice: A Comprehensive Guide to Streamlined Business Billing Introduction to Guam: Located in the Western Pacific Ocean, Guam is an unincorporated territory of the United States. It is the largest and southernmost of the Mariana Islands, boasting a rich cultural heritage, stunning landscapes, and a booming economy. Businesses in Guam, as in any other location, often require the services of consultants to gain specialized expertise, guidance, and solutions. Consequently, it becomes essential for consultants to provide detailed invoices that accurately reflect the services rendered and enable seamless financial transactions. Overview of Guam Detailed Consultant Invoice: A Guam Detailed Consultant Invoice is a professional billing document that outlines the services provided by a consultant, including a breakdown of tasks, hours worked, expenses, and applicable taxes. This comprehensive invoice serves as a transparent record of the consultant's work, ensuring clarity and accountability in financial dealings. It provides clients with an itemized summary that enables them to understand the value they are receiving and simplifies the payment process. Key Components of a Guam Detailed Consultant Invoice: 1. Consultant Information: Start the invoice by including your company name, address, contact details, and logo for branding purposes. Also, mention the client's information, including their name, address, and contact details. 2. Invoice Number and Date: Assign a unique invoice number to each invoice for easier tracking and reference. Include the date of issue to establish the timeline of payment. 3. Description of Services: Clearly state the scope of work or services provided. Break it down into specific tasks or deliverables to provide a detailed overview. 4. Hours Worked and Rates: Itemize the number of hours spent on each task and the corresponding hourly rate. Multiply the hours worked by the respective rates to calculate the subtotals. 5. Reimbursable Expenses: If applicable, include any expenses incurred during the consultancy process. This may involve travel costs, accommodations, materials, or other additional expenses related to the project. 6. Taxes and Discounts: Calculate and include any applicable taxes, such as Guam's Business Privilege Tax (BPT). If any discounts or promotional offers apply, clearly mention them on the invoice. 7. Total Amount Due: Sum up all the subtotals, expenses, taxes, and discounts to arrive at the final amount the client needs to pay. Clearly indicate this total alongside the currency the payment should be made in. Different Types of Guam Detailed Consultant Invoices: 1. Hourly Rate Invoice: Consultants commonly invoice clients based on the number of hours spent on a project. This type of invoice includes a breakdown of tasks, hours worked, and the corresponding hourly rate. 2. Fixed Price Invoice: In cases where a consultant's services are agreed upon at a fixed price for a specific project or duration, a fixed price invoice is used. This type of invoice mentions the agreed-upon amount and may include milestone payments or due dates. 3. Retainer Invoice: A retainer invoice is used when a client pays a consultant a fixed amount upfront to secure their services for an extended period. This invoice outlines the retainer fee, any additional charges, and the duration of the retainer agreement. Conclusion: A detailed consultant invoice is a vital component of any consultancy practice, ensuring seamless financial transactions and maintaining trust and transparency between consultants and their clients. For consultants operating in Guam, creating a comprehensive invoice that accurately reflects services rendered while accounting for specific local regulations, such as the Guam Business Privilege Tax (BPT), is essential. By utilizing a Guam Detailed Consultant Invoice, consultants can streamline their billing processes and foster strong client relationships.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.