This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

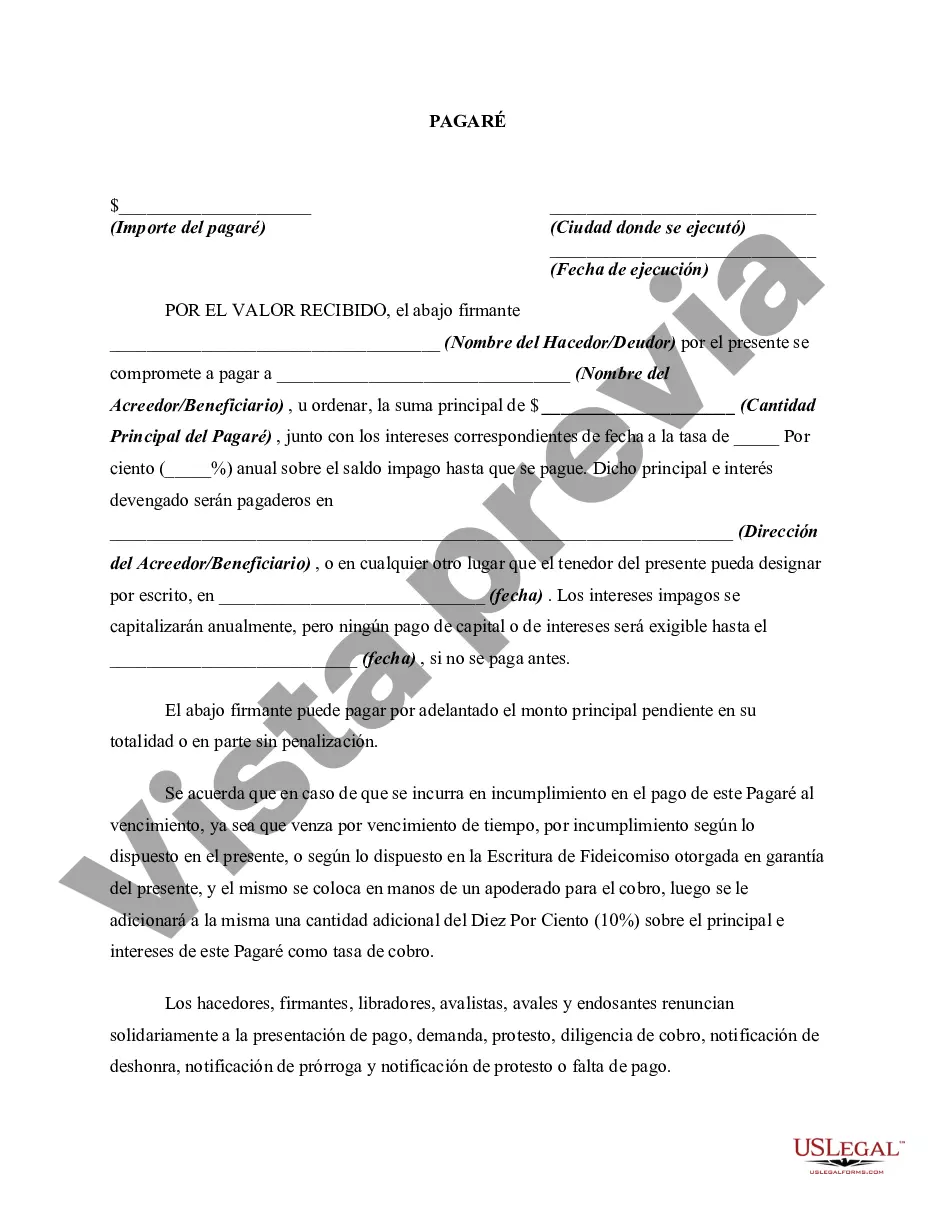

A Guam Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding agreement that outlines the terms and conditions of a loan between a lender and a borrower in Guam. This type of promissory note is specifically designed to delay the repayment of the principal amount until the specified maturity date while accruing interest annually on a compounded basis. With this type of promissory note, the borrower is not required to make any periodic payments towards the loan until the agreed-upon maturity date, which gives them more flexibility in managing their finances. Additionally, the interest on the loan is compounded annually, meaning that it accumulates and adds to the original principal amount on a yearly basis. This can result in a higher repayment amount at the end of the loan term. The Guam Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually can vary in terms of loan amount, interest rate, maturity date, and other specific provisions based on the agreement between the lender and borrower. It is important for both parties to carefully review and understand all the terms and conditions outlined in the promissory note before signing to ensure clarity and mutual agreement. Different types or variations of Guam Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually may include: 1. Fixed-Rate Promissory Note: This type of promissory note features a predetermined fixed interest rate which remains unchanged throughout the loan term. 2. Variable-Rate Promissory Note: With this variation, the interest rate may fluctuate periodically, typically based on an underlying benchmark such as the Guam Prime Rate or another reference rate. 3. Secured Promissory Note: This type of promissory note includes collateral offered by the borrower to secure the loan. In the event of default, the lender can seize and sell the collateral to recover the outstanding amount. 4. Unsecured Promissory Note: Unlike the secured promissory note, this variation does not require collateral. The lender relies solely on the borrower's creditworthiness for repayment. 5. Convertible Promissory Note: This type of note allows the lender to convert some or all of the outstanding amount into equity in the borrower's business, usually at predetermined terms and conditions. 6. Balloon Promissory Note: In this variation, the borrower makes fixed payments towards the interest during the loan term, and the entire principal amount is due at the maturity date. Compound interest may still apply. 7. Subordinated Promissory Note: Often used in conjunction with other loans or debt obligations, this note specifies that the lender's claim to repayment holds a lower priority compared to other lenders in case of default. It is essential for borrowers and lenders in Guam to consult with legal professionals specializing in promissory notes and understand the local laws and regulations to ensure compliance and protection of their respective rights.A Guam Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a legally binding agreement that outlines the terms and conditions of a loan between a lender and a borrower in Guam. This type of promissory note is specifically designed to delay the repayment of the principal amount until the specified maturity date while accruing interest annually on a compounded basis. With this type of promissory note, the borrower is not required to make any periodic payments towards the loan until the agreed-upon maturity date, which gives them more flexibility in managing their finances. Additionally, the interest on the loan is compounded annually, meaning that it accumulates and adds to the original principal amount on a yearly basis. This can result in a higher repayment amount at the end of the loan term. The Guam Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually can vary in terms of loan amount, interest rate, maturity date, and other specific provisions based on the agreement between the lender and borrower. It is important for both parties to carefully review and understand all the terms and conditions outlined in the promissory note before signing to ensure clarity and mutual agreement. Different types or variations of Guam Promissory Notes with no Payment Due Until Maturity and Interest to Compound Annually may include: 1. Fixed-Rate Promissory Note: This type of promissory note features a predetermined fixed interest rate which remains unchanged throughout the loan term. 2. Variable-Rate Promissory Note: With this variation, the interest rate may fluctuate periodically, typically based on an underlying benchmark such as the Guam Prime Rate or another reference rate. 3. Secured Promissory Note: This type of promissory note includes collateral offered by the borrower to secure the loan. In the event of default, the lender can seize and sell the collateral to recover the outstanding amount. 4. Unsecured Promissory Note: Unlike the secured promissory note, this variation does not require collateral. The lender relies solely on the borrower's creditworthiness for repayment. 5. Convertible Promissory Note: This type of note allows the lender to convert some or all of the outstanding amount into equity in the borrower's business, usually at predetermined terms and conditions. 6. Balloon Promissory Note: In this variation, the borrower makes fixed payments towards the interest during the loan term, and the entire principal amount is due at the maturity date. Compound interest may still apply. 7. Subordinated Promissory Note: Often used in conjunction with other loans or debt obligations, this note specifies that the lender's claim to repayment holds a lower priority compared to other lenders in case of default. It is essential for borrowers and lenders in Guam to consult with legal professionals specializing in promissory notes and understand the local laws and regulations to ensure compliance and protection of their respective rights.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.