Guam Sample Letter Transmitting UCC-1 Forms for a Loan Closing

Description

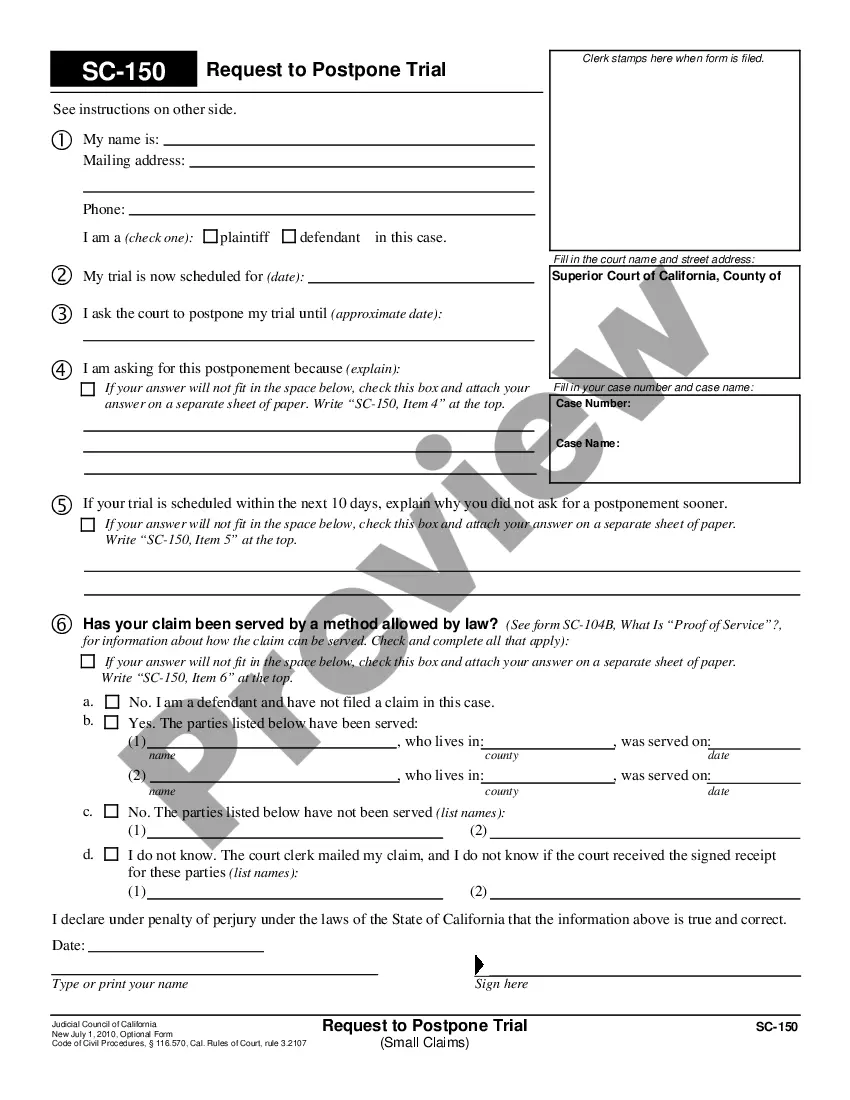

How to fill out Sample Letter Transmitting UCC-1 Forms For A Loan Closing?

If you want to compile, acquire, or create authorized document formats, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and user-friendly search tool to secure the documents you require.

Various templates for commercial and personal purposes are organized by categories and claims, or keywords.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of your legal template and download it to your device.

- Utilize US Legal Forms to secure the Guam Sample Letter Transmitting UCC-1 Forms for a Loan Closing in just a few clicks.

- If you are a current US Legal Forms user, Log In to your account and click the Download button to acquire the Guam Sample Letter Transmitting UCC-1 Forms for a Loan Closing.

- Additionally, you can access forms previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, consult the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview function to review the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the page to find alternative templates of your legal form.

- Step 4. After locating the required form, click on the Purchase now button. Choose your preferred pricing option and enter your information to register for the account.

Form popularity

FAQ

(b) An EFS may be filed electronically provided a State allows electronic filing of financing statements without the signature of the debtor under applicable State law under provisions of the Uniform Commercial Code or may be a paper document.

When the debtor has satisfied all amounts owed to the lender, a UCC-3 termination statement (now called a UCC termination statement) is routinely filed to terminate the security interest perfected by the UCC-1 financing statement.

If the debtor is bound by a security agreement, authorization to file a financing statement is implied. If the debtor is not bound (or not yet bound) by the security agreement, the debtor must authenticate the financing statement.

A4. For UCC and EFS, a termination creates a public record that a loan was repaid, a lien was removed, or some other obligation was met. The records will remain in our system until two years after they lapse.

Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

If you ever find yourself in that frustrating situation the answer is: Yes, you can, providing there is no existing obligation to the lender. This is provided for in Section 9-513 of the Uniform Commercial Code.

The secured party has 20 days to either terminate the filing or send a termination statement to the debtor that the debtor can then file. If this does not happen within the 20-day time frame, the debtor may file a UCC-3 termination statement.

Visit your secretary of state's office. To do so you will generally need to make a trip in person down to your secretary of state's office. Once there, you will be able to swear under oath that you've satisfied the debt in full and wish to request for the UCC-1 filing to be removed.

No signatures are required if included they will be redacted. No SSN or TIN numbers required if included they will be redacted. Debtor and Secured Party may not appear to be the same.

Addresses. Technically, a correct address is not required for a financing statement to be effective. However, a filing office can (and usually will) reject financing statement without addresses for the Debtor or the Secured Party as allowed under Section 9-516(b)(4) and (5).