Title: Guam Simple Promissory Note for School: Definition, Types, and Important Considerations Description: If you are considering borrowing money for educational purposes in Guam, understanding what a Guam Simple Promissory Note for School entails is vital. This detailed description will provide insights into the key elements, importance, and types of such promissory notes available in Guam. Guam Simple Promissory Note for School serves as a legally binding agreement between a borrower and a lender, typically pertaining to education-related expenses. It outlines the terms and conditions governing the loan, including the principal amount borrowed, the interest rate, repayment schedule, and any additional terms agreed upon. Types of Guam Simple Promissory Note for School: 1. Standard Fixed-Term Promissory Note: — This type of promissory note establishes a fixed repayment term, usually ranging from months to years. It outlines the predetermined number of installments to be paid and the frequency of payments. The interest rate remains fixed throughout the repayment term. 2. Adjustable Rate Promissory Note: — This type of promissory note allows for variable interest rates over the repayment period. The interest rate adjusts periodically according to predetermined factors such as market rates, ensuring flexibility for both the borrower and lender. 3. Parent-Student Loan Agreement: — In this type of promissory note, parents act as the primary borrowers, assuming responsibility for their child's education expenses. The agreement often includes provisions allowing the student to assume the debt after graduation or upon reaching a certain income threshold. 4. Graduate Student Promissory Note: — Specifically designed for postgraduate students, this type of promissory note caters to the unique needs of individuals pursuing higher education. It may offer flexible repayment options based on the student's expected future income. Important Considerations for a Guam Simple Promissory Note for School: 1. Interest Rates: — Familiarize yourself with the interest rate charged on the loan. Ensure it aligns with your financial capabilities, as it affects the overall repayment amount. 2. Repayment Term: — Consider the length of time required to repay the loan. Shorter terms often involve higher monthly payments, but lead to less interest paid overall, while longer terms offer lower monthly obligations but result in more interest paid. 3. Late Payment and Default Clauses: — Understand the consequences of missed or late payments, as well as the conditions under which default occurs. Being aware of penalties, fees, or potential legal actions can help prevent unfavorable circumstances. 4. Loan Forgiveness or Deferment Options: — Investigate if the promissory note includes provisions for loan forgiveness, deferment, or alternative payment arrangements in case of financial hardship or unforeseen circumstances. By comprehending the different types and considerations related to a Guam Simple Promissory Note for School, you can make informed decisions, ensuring financial responsibility during your educational journey in Guam. Remember, seeking guidance from financial advisors or legal professionals can provide additional clarity and ensure the best possible outcome for your situation.

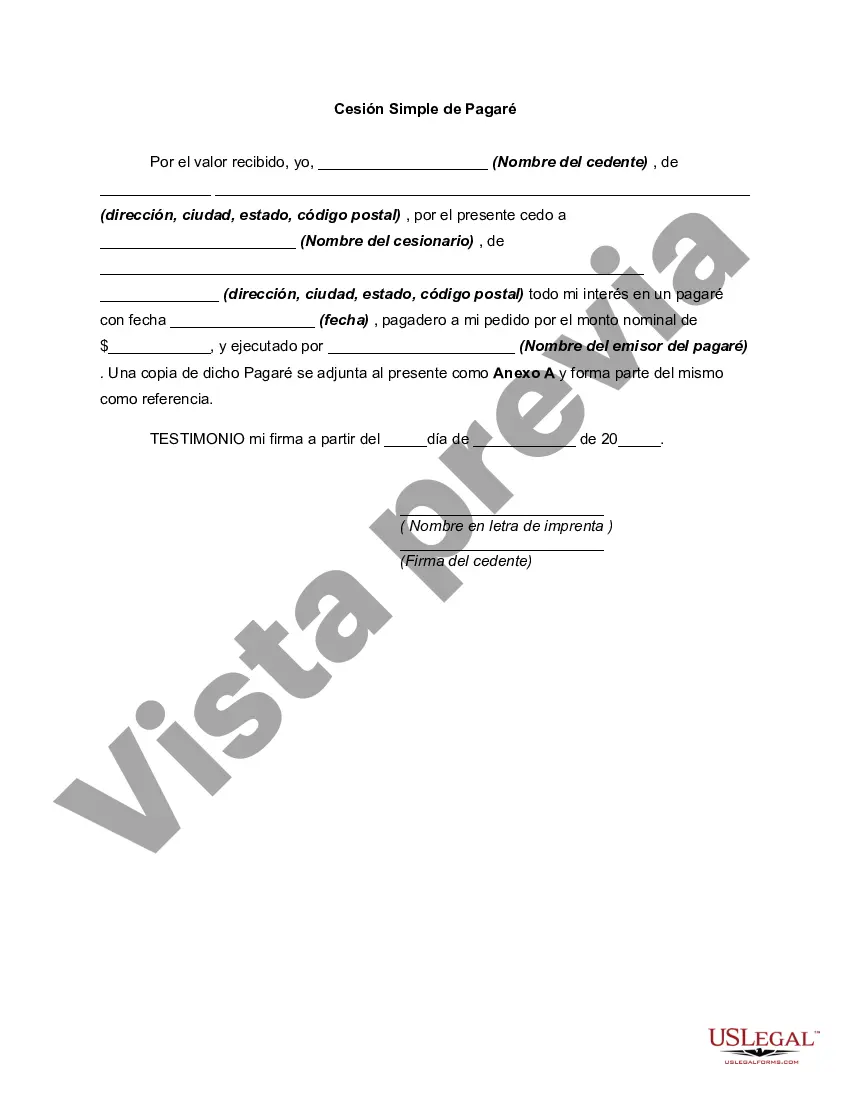

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Pagaré simple para la escuela - Simple Promissory Note for School

Description

How to fill out Guam Pagaré Simple Para La Escuela?

If you want to comprehensive, download, or printing lawful document themes, use US Legal Forms, the biggest variety of lawful types, that can be found on the web. Use the site`s easy and practical look for to get the documents you require. Various themes for business and specific functions are categorized by types and claims, or keywords. Use US Legal Forms to get the Guam Simple Promissory Note for School within a few click throughs.

When you are currently a US Legal Forms customer, log in in your account and then click the Acquire key to get the Guam Simple Promissory Note for School. You can also entry types you previously delivered electronically within the My Forms tab of the account.

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Ensure you have selected the form for that appropriate city/land.

- Step 2. Take advantage of the Preview method to look over the form`s information. Never overlook to see the information.

- Step 3. When you are not happy with the form, make use of the Lookup field at the top of the monitor to get other versions of your lawful form template.

- Step 4. Upon having identified the form you require, select the Get now key. Opt for the costs prepare you choose and add your references to sign up on an account.

- Step 5. Method the financial transaction. You can utilize your charge card or PayPal account to perform the financial transaction.

- Step 6. Choose the format of your lawful form and download it on your own system.

- Step 7. Total, modify and printing or signal the Guam Simple Promissory Note for School.

Every single lawful document template you buy is the one you have for a long time. You possess acces to each and every form you delivered electronically within your acccount. Go through the My Forms portion and select a form to printing or download once more.

Contend and download, and printing the Guam Simple Promissory Note for School with US Legal Forms. There are millions of professional and condition-specific types you may use for your business or specific requirements.