Guam Promissory Note in Connection with Sale of Motor Vehicle

Description

A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

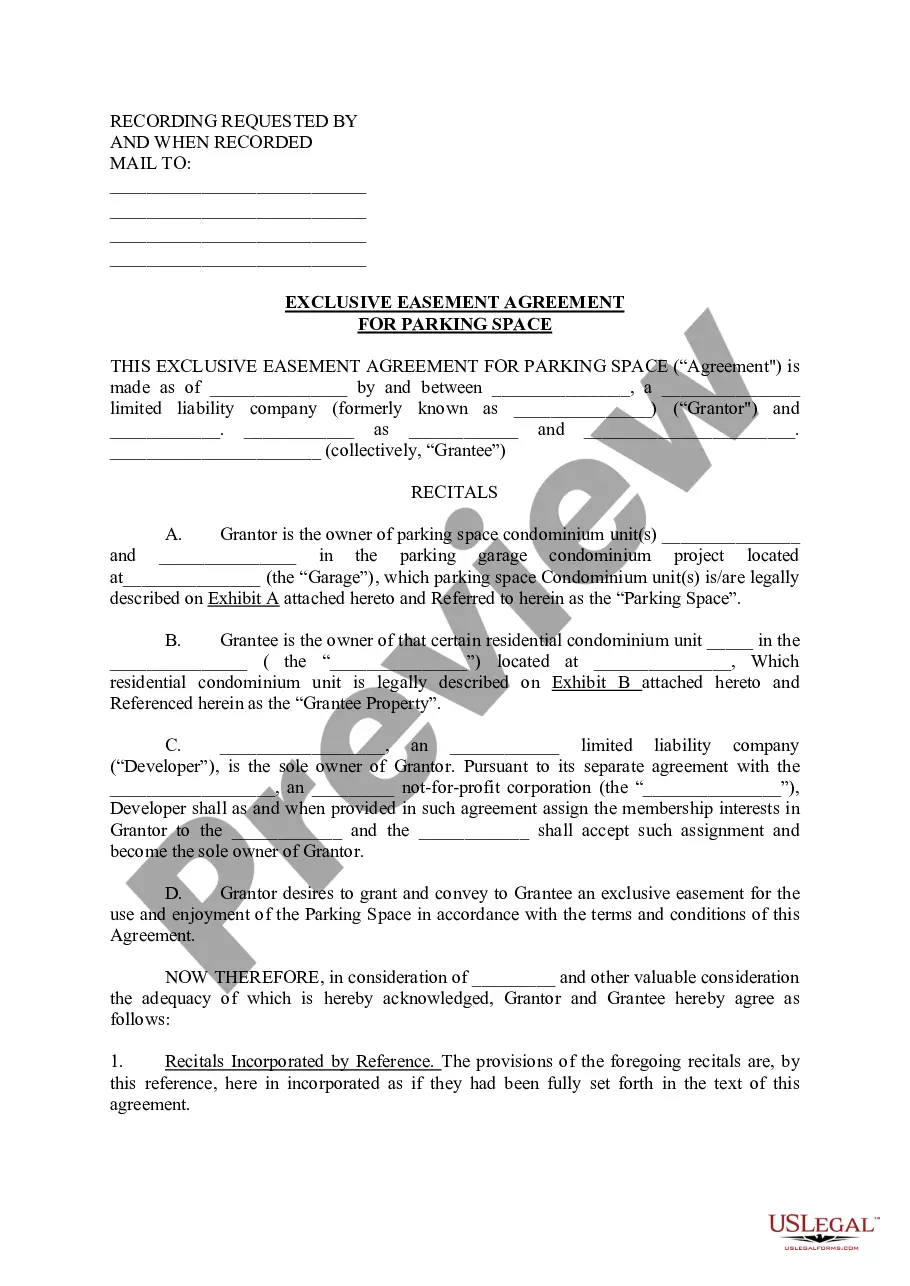

How to fill out Promissory Note In Connection With Sale Of Motor Vehicle?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a vast selection of legal document formats that you can download or print.

By using the website, you can access thousands of templates for business and personal purposes, categorized by types, states, or keywords.

You can obtain the latest editions of documents such as the Guam Promissory Note related to the Sale of Motor Vehicle in just moments.

Check the form description to ensure you have chosen the right one.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have an account, Log In and download the Guam Promissory Note related to the Sale of Motor Vehicle from the US Legal Forms library.

- The Download button appears on every document you view.

- You can access all previously purchased forms in the My documents section of your account.

- If you're new to US Legal Forms, here are some basic steps to get you started.

- Ensure you have selected the correct form for your area/county.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

Yes, promissory notes can hold up in court when they are properly drafted and executed. In the context of a Guam Promissory Note in Connection with Sale of Motor Vehicle, having a clear agreement can help both parties enforce their rights. Courts generally recognize these documents as valid evidence of a debt. It is crucial to ensure that all terms are outlined clearly to avoid disputes.

To write a contract agreement for payment, start by clearly stating the parties involved and the terms of payment. Include the amount due, payment method, and any due dates. If applicable, you can reference a Guam Promissory Note in Connection with Sale of Motor Vehicle to outline the repayment schedule or conditions related to vehicle sales.

To secure a Guam Promissory Note in Connection with Sale of Motor Vehicle with real estate, you can create a mortgage or deed of trust. This agreement uses the real estate as collateral, allowing the lender to recover the owed amount in case of default. For assistance in drafting these documents, consider using platforms like USLegalForms.

Generally, a Guam Promissory Note in Connection with Sale of Motor Vehicle does not require registration to be enforceable. However, certain situations may necessitate recording the note to protect against third-party claims. It’s advisable to consult local regulations or a legal professional to ensure compliance.

Several factors can void a Guam Promissory Note in Connection with Sale of Motor Vehicle. For instance, if the note is obtained through fraud, misrepresentation, or undue influence, it loses its validity. Additionally, if the signer lacks the mental capacity to understand the agreement, this can also void the note.

When you sell a Guam Promissory Note in Connection with Sale of Motor Vehicle, ownership transfers through endorsement. The current holder must sign the note, indicating their intent to transfer interest to the purchaser. This action makes the buyer the new owner, which is crucial for enforcing the payment terms.

A promissory note is a legally binding document, making it enforceable in a court of law if it meets certain criteria, such as clarity in terms and both parties' signatures. If you properly draft your Guam Promissory Note in Connection with Sale of Motor Vehicle with precise terms, it can serve as strong evidence in case of disputes. By utilizing platforms like US Legal Forms, you can ensure your note meets legal standards and safeguards your interests.