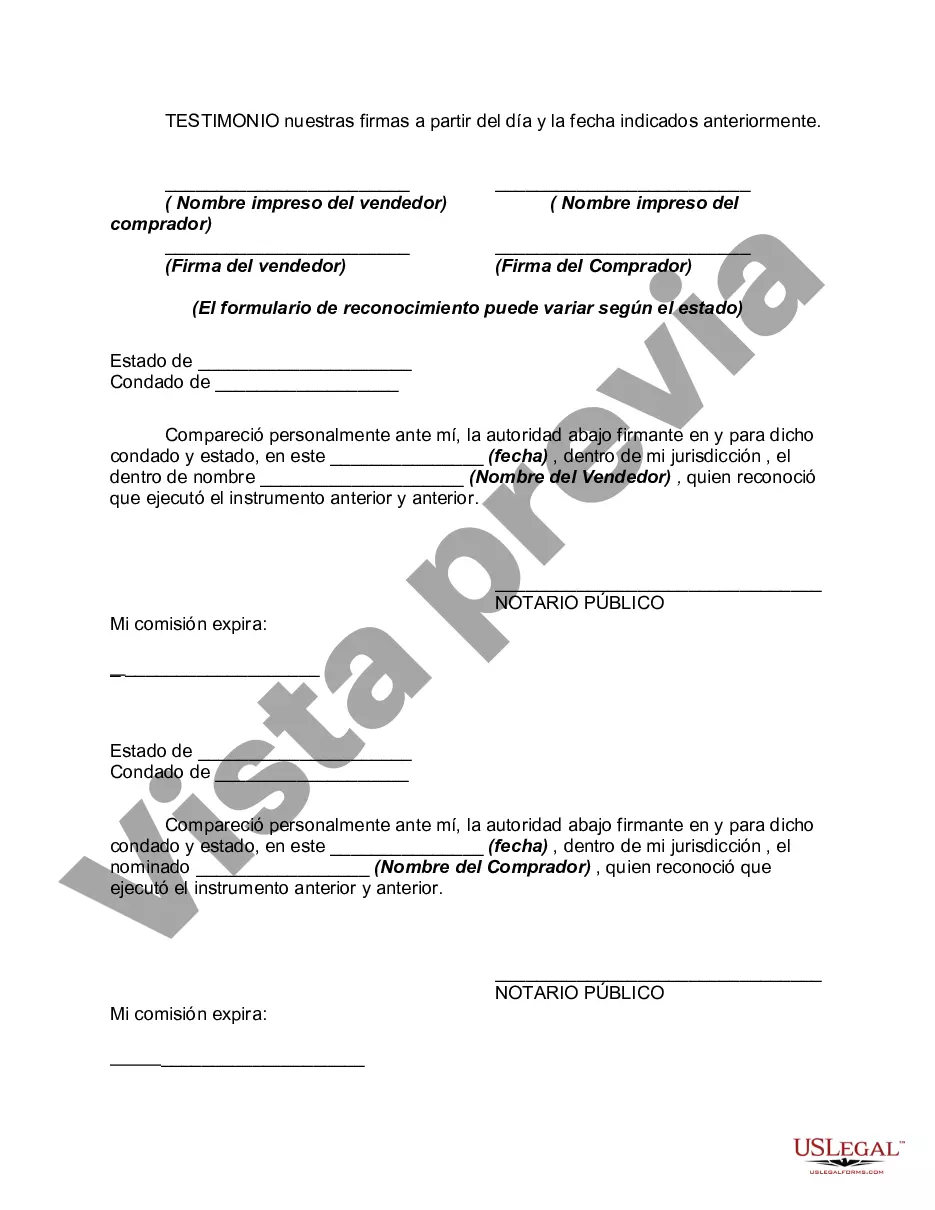

A Guam Contract for the Sale of Motor Vehicle — Owner Financed with Provisions for Note and Security Agreement is a legal document that outlines the terms and conditions of a vehicle sale where the owner acts as the financier. This type of agreement is commonly used when the seller agrees to finance the purchase of a motor vehicle by the buyer, rather than relying on a traditional bank or lending institution. The Guam Contract for the Sale of Motor Vehicle — Owner Financed with Provisions for Note and Security Agreement includes several key provisions to protect both parties involved in the transaction. These provisions ensure that the terms of the agreement are clear and enforceable. Some relevant keywords related to this type of contract are: 1. Motor Vehicle Sale: This refers to the transaction between the seller and the buyer where a motor vehicle is being sold. 2. Owner Financing: This highlights the specific financing arrangement in which the seller provides the financing for the purchase directly to the buyer. 3. Note: This refers to the written agreement that outlines the terms and conditions of the financing agreement, including the repayment schedule, interest rate, and any additional charges. 4. Security Agreement: This is a legally binding document that outlines the collateral or security provided by the buyer to the seller to secure the loan. 5. Repayment Schedule: This specifies how the buyer will make payments to the seller, including the frequency, amount, and due dates. 6. Interest Rate: The interest rate determines the cost of borrowing and is usually agreed upon by both parties. 7. Collateral: This refers to any assets or property owned by the buyer that are pledged as security for the loan. 8. Default: This outlines the consequences if the buyer fails to make payments or violates any terms of the agreement. Different types of Guam Contracts for the Sale of Motor Vehicle — Owner Financed with Provisions for Note and Security Agreement may vary based on specific clauses or additional provisions. Some variations could include special conditions for late payments, penalties for early repayment, or clauses related to insurance coverage. It is essential to carefully review the specific terms and provisions of any contract before entering into such an agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Contrato de Venta de Vehículo Automotor - Dueño Financiado con Provisiones para Nota y Contrato de Garantía - Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement

Description

How to fill out Guam Contrato De Venta De Vehículo Automotor - Dueño Financiado Con Provisiones Para Nota Y Contrato De Garantía?

You are able to devote hrs online searching for the authorized file format that fits the state and federal demands you want. US Legal Forms gives thousands of authorized kinds which can be reviewed by experts. It is possible to obtain or produce the Guam Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement from our assistance.

If you already possess a US Legal Forms accounts, you can log in and click on the Down load key. Afterward, you can full, revise, produce, or signal the Guam Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement. Each authorized file format you buy is yours for a long time. To acquire another backup associated with a purchased kind, check out the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms internet site the first time, stick to the basic instructions below:

- Initially, ensure that you have selected the right file format to the region/area that you pick. Look at the kind description to make sure you have picked out the appropriate kind. If accessible, use the Preview key to appear with the file format too.

- If you would like get another variation in the kind, use the Lookup industry to find the format that suits you and demands.

- Once you have found the format you desire, just click Purchase now to proceed.

- Pick the costs plan you desire, type in your qualifications, and sign up for a free account on US Legal Forms.

- Total the deal. You can utilize your Visa or Mastercard or PayPal accounts to cover the authorized kind.

- Pick the format in the file and obtain it to your product.

- Make alterations to your file if necessary. You are able to full, revise and signal and produce Guam Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement.

Down load and produce thousands of file themes using the US Legal Forms website, that provides the most important assortment of authorized kinds. Use expert and state-specific themes to tackle your small business or personal needs.