The Guam Agreement to Compromise Debt is a legally binding arrangement entered into by a debtor and their creditors to settle a debt at a reduced amount. This agreement allows individuals or businesses in Guam who are struggling with overwhelming debt to negotiate with their creditors and reach a compromise instead of resorting to bankruptcy. The Guam Agreement to Compromise Debt is designed to provide a fair and equitable solution for both parties involved. Debtors who qualify for this agreement may have their outstanding debts reduced significantly, allowing them to regain control of their financial situation. There are different types of Guam Agreements to Compromise Debt, depending on the specific circumstances and the parties involved. Some common types include: 1. Personal Debt Compromise: This type of agreement is applicable to individuals who have incurred excessive personal debts, such as credit card bills, medical bills, or personal loans. The debtor and their creditors negotiate a reduced payment that the debtor can afford, in exchange for settling the debt in full. 2. Business Debt Compromise: This type of agreement is tailored for businesses facing financial distress and mounting debts. It typically involves negotiations with multiple creditors, including suppliers, lenders, or service providers. By reaching a compromise, the business can restructure its debts and continue its operations. 3. Tax Debt Compromise: This particular type of Guam Agreement to Compromise Debt is designed for individuals or businesses with outstanding tax obligations to the Government of Guam. Through negotiations with the Guam Department of Revenue and Taxation, taxpayers may be able to settle their tax debt for a reduced amount, avoiding potential legal actions. 4. Mortgage Debt Compromise: In situations where homeowners in Guam are unable to make their monthly mortgage payments, a Mortgage Debt Compromise can be an option. Borrowers negotiate with the mortgage lender to reduce the outstanding loan balance or modify the terms of the loan to make it more manageable. 5. Student Loan Debt Compromise: Although student loans are generally more difficult to discharge or settle, some individuals in Guam may qualify for a compromise on their student loan debt. This involves negotiating with the loan service or lender to establish an affordable repayment plan or have a portion of the loan forgiven. It's important to note that each type of Guam Agreement to Compromise Debt has specific eligibility criteria and requirements that must be met. Seeking professional advice from a debt counselor or attorney familiar with Guam's laws and regulations is highly recommended navigating the process successfully.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Acuerdo de Compromiso de Deuda - Agreement to Compromise Debt

Description

How to fill out Guam Acuerdo De Compromiso De Deuda?

You may devote several hours online trying to find the lawful document format which fits the federal and state requirements you require. US Legal Forms gives a large number of lawful forms that are reviewed by specialists. It is possible to download or print out the Guam Agreement to Compromise Debt from your assistance.

If you have a US Legal Forms profile, it is possible to log in and then click the Obtain button. Following that, it is possible to full, modify, print out, or indicator the Guam Agreement to Compromise Debt. Every single lawful document format you purchase is the one you have eternally. To obtain another version for any bought form, proceed to the My Forms tab and then click the corresponding button.

If you use the US Legal Forms internet site the very first time, follow the easy instructions under:

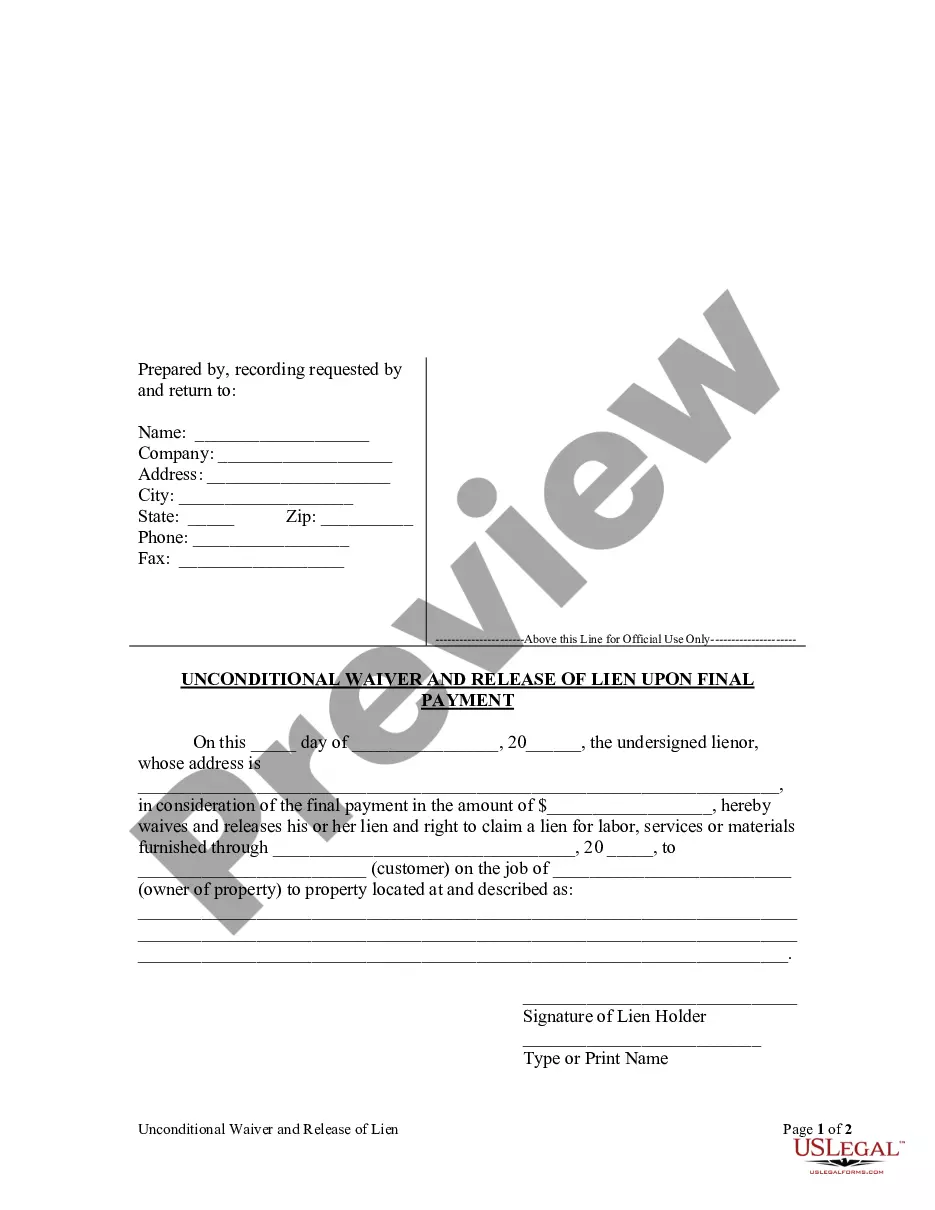

- Initial, be sure that you have chosen the best document format for your region/area that you pick. See the form explanation to ensure you have picked the correct form. If available, utilize the Review button to look with the document format as well.

- In order to find another edition of the form, utilize the Search field to discover the format that suits you and requirements.

- When you have discovered the format you want, just click Get now to move forward.

- Pick the pricing strategy you want, key in your accreditations, and register for your account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal profile to pay for the lawful form.

- Pick the file format of the document and download it for your gadget.

- Make adjustments for your document if necessary. You may full, modify and indicator and print out Guam Agreement to Compromise Debt.

Obtain and print out a large number of document themes while using US Legal Forms Internet site, which provides the biggest selection of lawful forms. Use specialist and condition-specific themes to take on your company or individual demands.