Cash flow is the movement of cash into or out of a business, project, or financial product. It is usually measured during a specified, finite period of time. Measurement of cash flow can be used for calculating other parameters that give information on a company's value and situation. Cash flow can e.g. be used for calculating parameters:

To determine a project's rate of return or value. The time of cash flows into and out of projects are used as inputs in financial models such as internal rate of return and net present value.

To determine problems with a business's liquidity. Being profitable does not necessarily mean being liquid. A company can fail because of a shortage of cash even while profitable.

As an alternative measure of a business's profits when it is believed that accrual accounting concepts do not represent economic realities. For example, a company may be notionally profitable but generating little operational cash (as may be the case for a company that barters its products rather than selling for cash). In such a case, the company may be deriving additional operating cash by issuing shares or raising additional debt finance.

Cash flow can be used to evaluate the 'quality' of income generated by accrual accounting. When net income is composed of large non-cash items it is considered low quality.

To evaluate the risks within a financial product, e.g. matching cash requirements, evaluating default risk, re-investment requirements, etc.

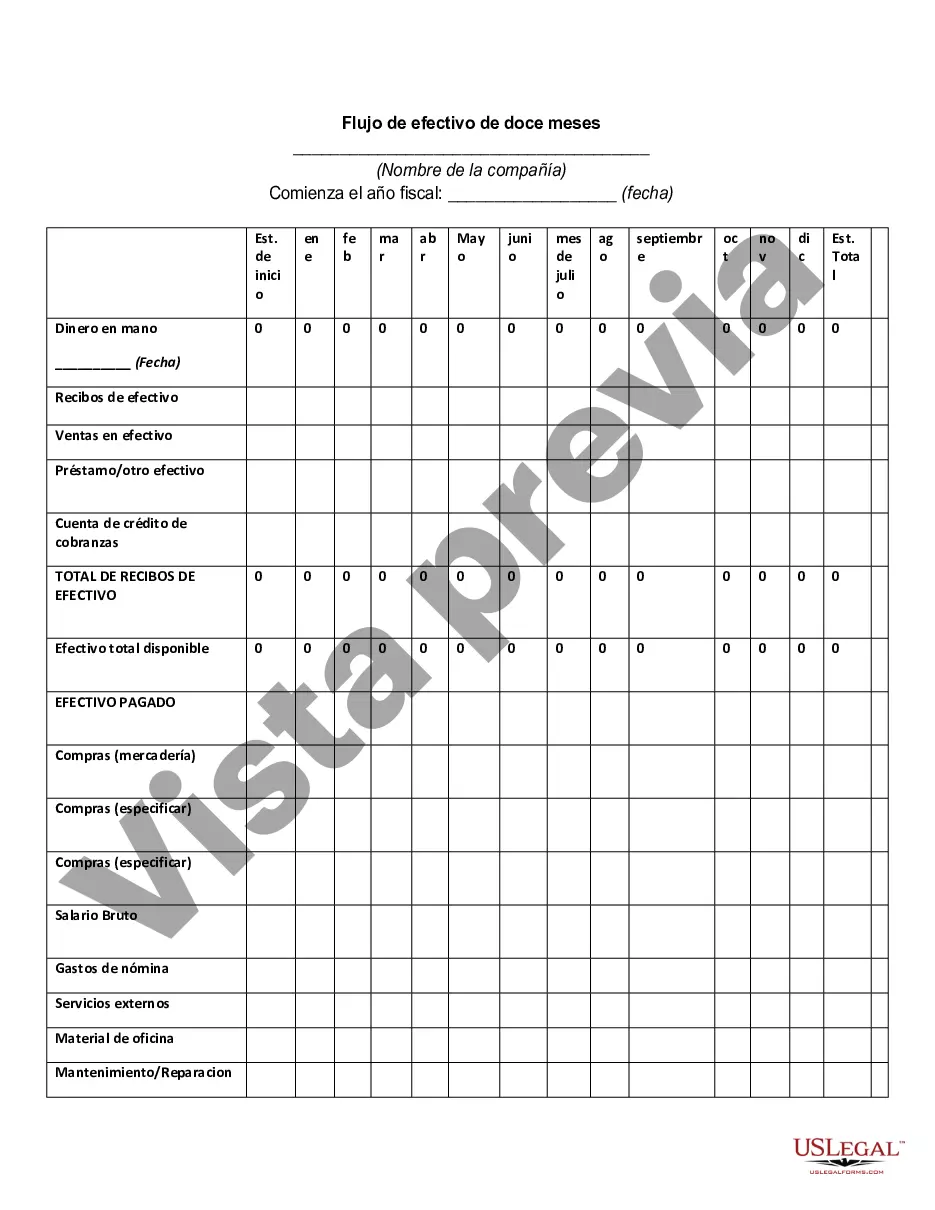

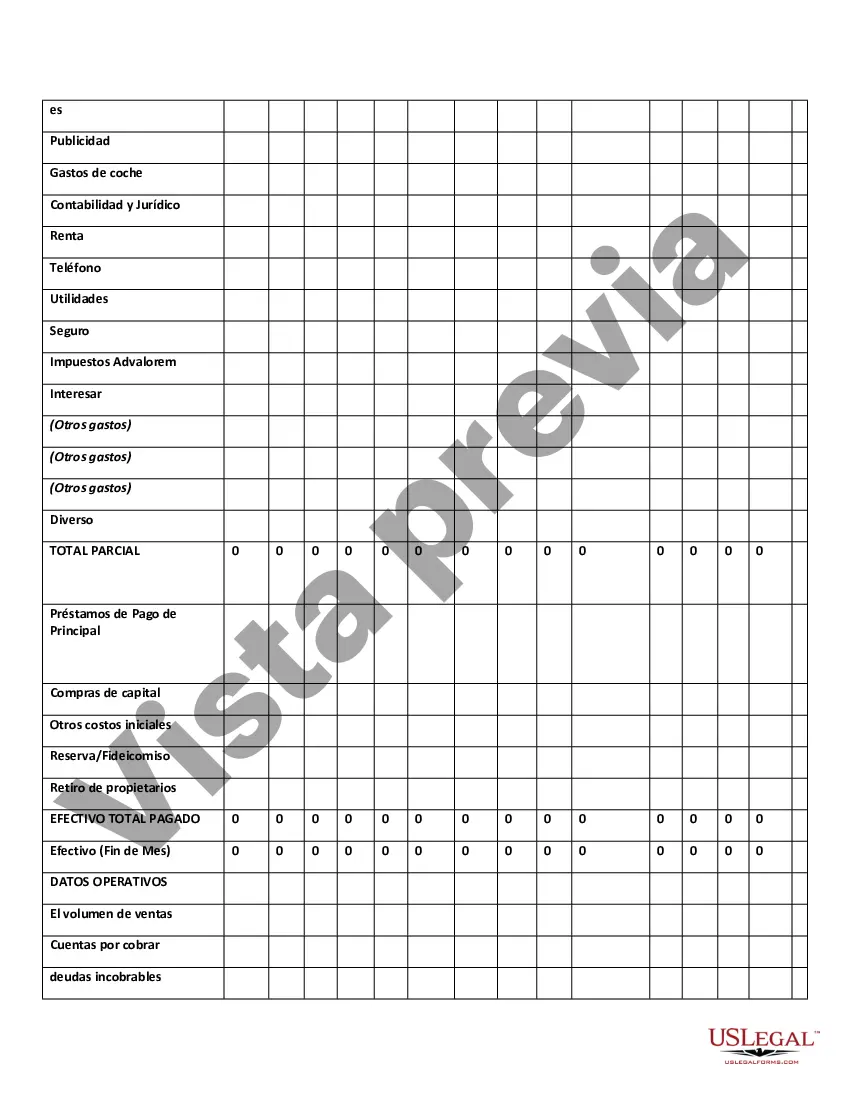

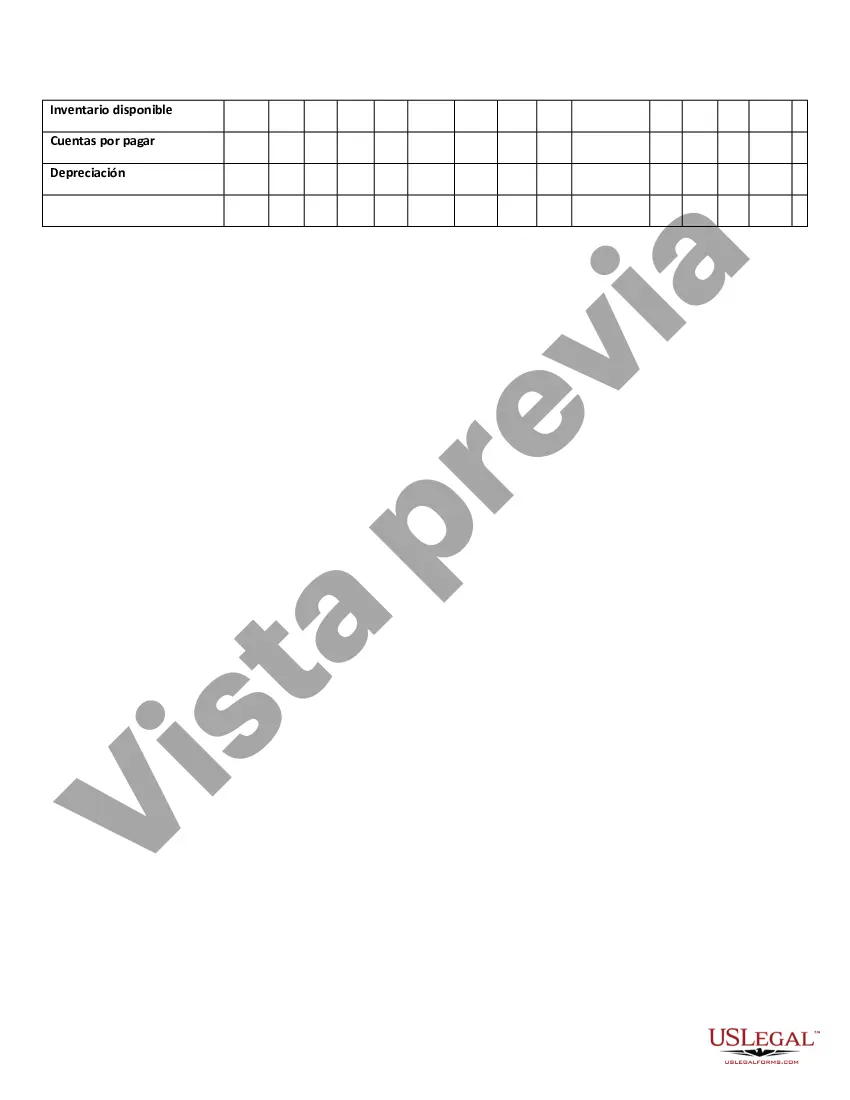

Guam Twelve-Month Cash Flow refers to a financial statement that provides a comprehensive breakdown of the inflows and outflows of cash over a twelve-month period in the context of Guam. It entails tracking the movement of money into and out of a business, organization, or individual located in Guam over a year. Understanding the Guam Twelve-Month Cash Flow is essential for financial planning and decision-making, as it helps evaluate the overall financial health and stability of an entity in Guam. This detailed analysis helps in identifying cash surpluses or deficits, enabling strategic allocation of resources and ensuring efficient cash management. Several types of Guam Twelve-Month Cash Flow statements exist, each catering to specific entities: 1. Personal Cash Flow: This type of statement focuses on analyzing an individual's cash inflows and outflows in Guam over twelve months. It includes monthly income from various sources, such as employment, investments, and business activities, along with expenses like rent, utilities, loans, and discretionary spending. 2. Business Cash Flow: A business-specific cash flow statement in Guam outlines the cash movements of a company over a twelve-month period. It incorporates income from sales, investments, and financing, along with expenses like salaries, inventory, rent, utilities, marketing, loan repayments, and taxes. This statement assists in assessing a business's liquidity, profitability, and ability to meet financial obligations. 3. Non-Profit Organization Cash Flow: Non-profit organizations in Guam also prepare cash flow statements to monitor their cash inflows and outflows. This statement highlights donations, grants, membership fees, program revenues, and expenses related to their mission or cause. It helps non-profits manage cash effectively, ensuring funds are allocated appropriately to carry out their activities. 4. Government Cash Flow: Governments in Guam generate cash flow statements to monitor public fund movements. It encompasses revenue sources like taxes, fees, fines, and grants, as well as expenditures such as salaries, infrastructure development, welfare programs, and debt servicing. These statements aid in maintaining financial transparency and accountability in the public sector. By analyzing Guam Twelve-Month Cash Flow statements, individuals, businesses, non-profit organizations, and governments can gain valuable insights into their financial position, make informed decisions, plan for future growth, and identify areas for improvement. Efficient cash flow management is essential for achieving financial stability, sustainability, and overall success in Guam's diverse economic landscape.Guam Twelve-Month Cash Flow refers to a financial statement that provides a comprehensive breakdown of the inflows and outflows of cash over a twelve-month period in the context of Guam. It entails tracking the movement of money into and out of a business, organization, or individual located in Guam over a year. Understanding the Guam Twelve-Month Cash Flow is essential for financial planning and decision-making, as it helps evaluate the overall financial health and stability of an entity in Guam. This detailed analysis helps in identifying cash surpluses or deficits, enabling strategic allocation of resources and ensuring efficient cash management. Several types of Guam Twelve-Month Cash Flow statements exist, each catering to specific entities: 1. Personal Cash Flow: This type of statement focuses on analyzing an individual's cash inflows and outflows in Guam over twelve months. It includes monthly income from various sources, such as employment, investments, and business activities, along with expenses like rent, utilities, loans, and discretionary spending. 2. Business Cash Flow: A business-specific cash flow statement in Guam outlines the cash movements of a company over a twelve-month period. It incorporates income from sales, investments, and financing, along with expenses like salaries, inventory, rent, utilities, marketing, loan repayments, and taxes. This statement assists in assessing a business's liquidity, profitability, and ability to meet financial obligations. 3. Non-Profit Organization Cash Flow: Non-profit organizations in Guam also prepare cash flow statements to monitor their cash inflows and outflows. This statement highlights donations, grants, membership fees, program revenues, and expenses related to their mission or cause. It helps non-profits manage cash effectively, ensuring funds are allocated appropriately to carry out their activities. 4. Government Cash Flow: Governments in Guam generate cash flow statements to monitor public fund movements. It encompasses revenue sources like taxes, fees, fines, and grants, as well as expenditures such as salaries, infrastructure development, welfare programs, and debt servicing. These statements aid in maintaining financial transparency and accountability in the public sector. By analyzing Guam Twelve-Month Cash Flow statements, individuals, businesses, non-profit organizations, and governments can gain valuable insights into their financial position, make informed decisions, plan for future growth, and identify areas for improvement. Efficient cash flow management is essential for achieving financial stability, sustainability, and overall success in Guam's diverse economic landscape.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.