A Guam Qualified Personnel Residence Trust (PRT) One Term Holder is a specific type of trust created under Guam law that allows individuals to transfer their primary residence or vacation home into a trust while retaining the right to live in the property for a predetermined term. The PRT One Term Holder is a popular estate planning strategy for individuals who wish to reduce their estate tax liability, protect their assets, and avoid probate. The primary purpose of a Guam PRT One Term Holder is to transfer the ownership of a residence to the trust, thereby removing it from the individual's taxable estate. This allows the individual to potentially reduce their estate tax burden upon their death. The individual can designate themselves as the One Term Holder, meaning that they have the right to live in the residence for a specific term, typically between 10 and 20 years. During this term, the individual continues to be responsible for the expenses related to the residence, such as property taxes, insurance, and maintenance. At the end of the term, the residence passes to the remainder beneficiaries named in the trust. The remainder beneficiaries are usually the individual's children or other family members. By transferring the property to the trust, the individual can effectively freeze the value of the property at the time of the transfer for estate tax purposes. This can be particularly advantageous if the value of the property appreciates significantly during the term of the trust. There are different types of Guam Parts, including the Granter PRT and the Non-Grantor PRT. The Granter PRT allows the individual to retain certain control over the trust, such as the ability to change the terms or revoke the trust entirely. The Non-Grantor PRT, on the other hand, provides no such control to the individual and is often used when there is a desire to fully remove the property from the taxable estate. Using a Guam PRT One Term Holder can offer numerous benefits to individuals, including potential estate tax savings, asset protection, avoidance of probate, and preservation of family wealth. However, it is essential to consult with an experienced estate planning attorney to fully understand the implications and requirements of creating a Guam PRT One Term Holder and to ensure it aligns with your specific circumstances and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Titular calificado de fideicomiso de residencia personal de un plazo - Qualified Personal Residence Trust One Term Holder

Description

How to fill out Guam Titular Calificado De Fideicomiso De Residencia Personal De Un Plazo?

If you need to full, acquire, or print out authorized file layouts, use US Legal Forms, the greatest collection of authorized types, that can be found online. Take advantage of the site`s simple and easy practical research to find the paperwork you will need. Various layouts for enterprise and individual reasons are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to find the Guam Qualified Personal Residence Trust One Term Holder with a handful of click throughs.

If you are presently a US Legal Forms customer, log in in your accounts and click the Download button to find the Guam Qualified Personal Residence Trust One Term Holder. You can also entry types you previously delivered electronically from the My Forms tab of the accounts.

If you use US Legal Forms the very first time, refer to the instructions beneath:

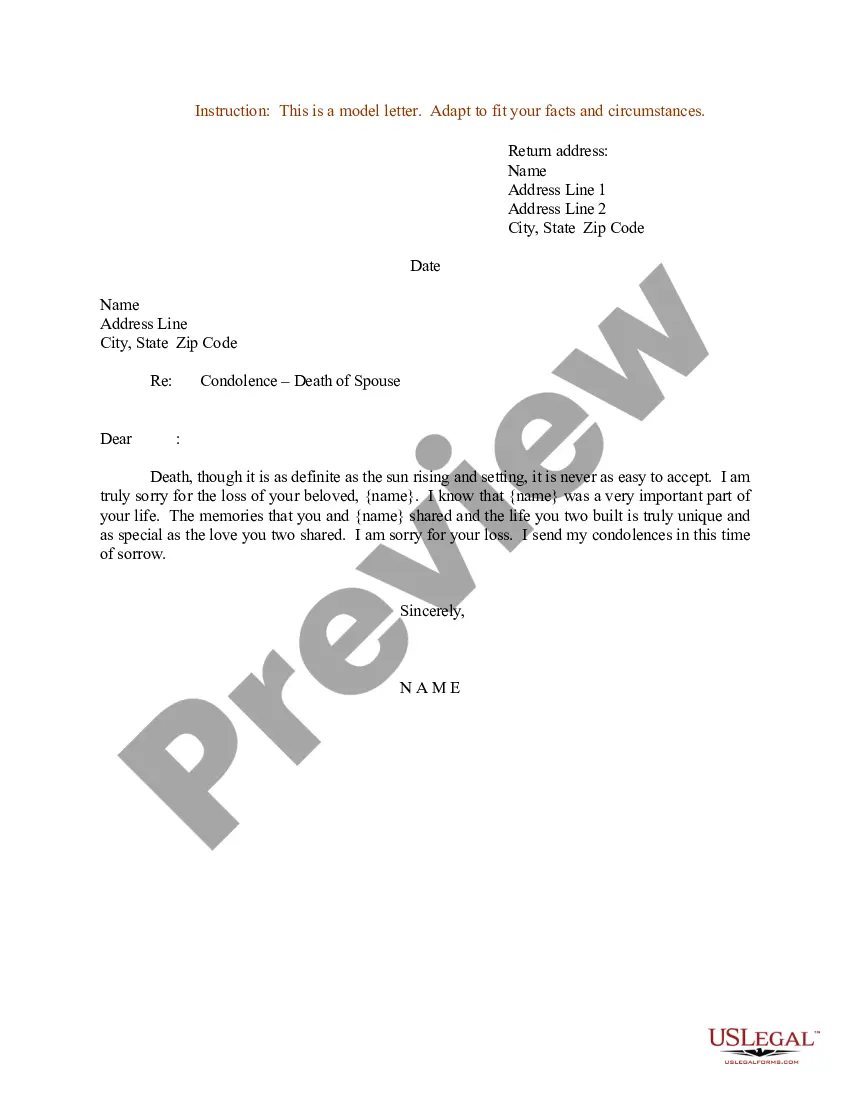

- Step 1. Ensure you have selected the form to the right city/country.

- Step 2. Use the Preview solution to check out the form`s information. Do not neglect to read through the explanation.

- Step 3. If you are unsatisfied with all the kind, make use of the Search field on top of the screen to find other versions from the authorized kind web template.

- Step 4. After you have identified the form you will need, select the Purchase now button. Pick the pricing program you like and include your qualifications to sign up on an accounts.

- Step 5. Approach the financial transaction. You should use your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Pick the file format from the authorized kind and acquire it on your product.

- Step 7. Complete, edit and print out or signal the Guam Qualified Personal Residence Trust One Term Holder.

Each and every authorized file web template you acquire is the one you have forever. You may have acces to every kind you delivered electronically in your acccount. Select the My Forms segment and decide on a kind to print out or acquire yet again.

Be competitive and acquire, and print out the Guam Qualified Personal Residence Trust One Term Holder with US Legal Forms. There are thousands of specialist and express-distinct types you can use for the enterprise or individual demands.