Title: Exploring Guam: A Detailed Description and Variations of Letters to Creditors Requesting Temporary Payment Reduction Introduction: Guam, an enchanting U.S. territory located in the Western Pacific Ocean, offers visitors a unique blend of breathtaking landscapes, rich culture, and significant historical sites. In this article, we will provide a comprehensive description of Guam and delve into the various types of letters one can use to request a temporary payment reduction from creditors. 1. Discovering Guam: Guam, often referred to as "Where America's Day Begins," is a tropical paradise famous for its pristine sandy beaches, crystal-clear waters, and vibrant coral reefs. As the largest island in Micronesia, Guam boasts a diverse ecosystem, with lush jungles, limestone cliffs, and fascinating wildlife. Visitors can explore historical treasures like Fort Questran Señora de la Soledad, delve into the indigenous Chamorro culture, and indulge in a wide array of water sports. 2. Understanding the Guam Letter to Creditor: A Guam Letter to Creditor Requesting a Temporary Payment Reduction is a formal communication sent by individuals facing financial hardships due to unforeseen circumstances. This letter aims to propose an arrangement with the creditor to reduce monthly payment obligations temporarily, allowing the individual to overcome immediate financial challenges while maintaining a positive credit history. 3. Key Elements of a Guam Letter to Creditor: i. Contact Information: Begin by including your full name, address, contact number, and email address to ensure accurate correspondence. ii. Creditor Details: Clearly state the creditor's name, address, and any relevant account or reference numbers. iii. Explanation of Financial Hardship: Articulate your current financial situation, including the reasons for the temporary payment reduction request, such as job loss, medical emergency, or unexpected expenses tied to Guam's high cost of living. iv. Proposed Temporary Payment Arrangement: Suggest a reduced payment amount or alternative payment plan that aligns with your current financial situation, demonstrating your commitment to resolving the financial situation responsibly. v. Supporting Documentation: Attach relevant supporting documents, such as medical reports, termination letters, or financial statements, as evidence of the hardship faced. vi. Assurance of Timely Communication: Express willingness to provide updates on the situation and assure the creditor of your intention to resume regular payments once your financial situation improves. 4. Types of Guam Letters to Creditor: i. Guam Letter to Mortgage Creditor Requesting a Temporary Payment Reduction ii. Guam Letter to Credit Card Company Requesting a Temporary Payment Reduction iii. Guam Letter to Auto Loan Creditor Requesting a Temporary Payment Reduction iv. Guam Letter to Student Loan Creditor Requesting a Temporary Payment Reduction v. Guam Letter to Personal Loan Creditor Requesting a Temporary Payment Reduction Conclusion: Guam is a captivating destination offering a plethora of recreational activities, historical landmarks, and natural wonders. When faced with temporary financial hardships, utilizing a Guam Letter to Creditor Requesting a Temporary Payment Reduction can be an effective way to navigate through challenging times while maintaining a positive credit history. Utilize the aforementioned types of letters specific to your creditor to address your financial concerns in the most appropriate manner.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Carta al acreedor solicitando una reducción de pago temporal - Letter to Creditor Requesting a Temporary Payment Reduction

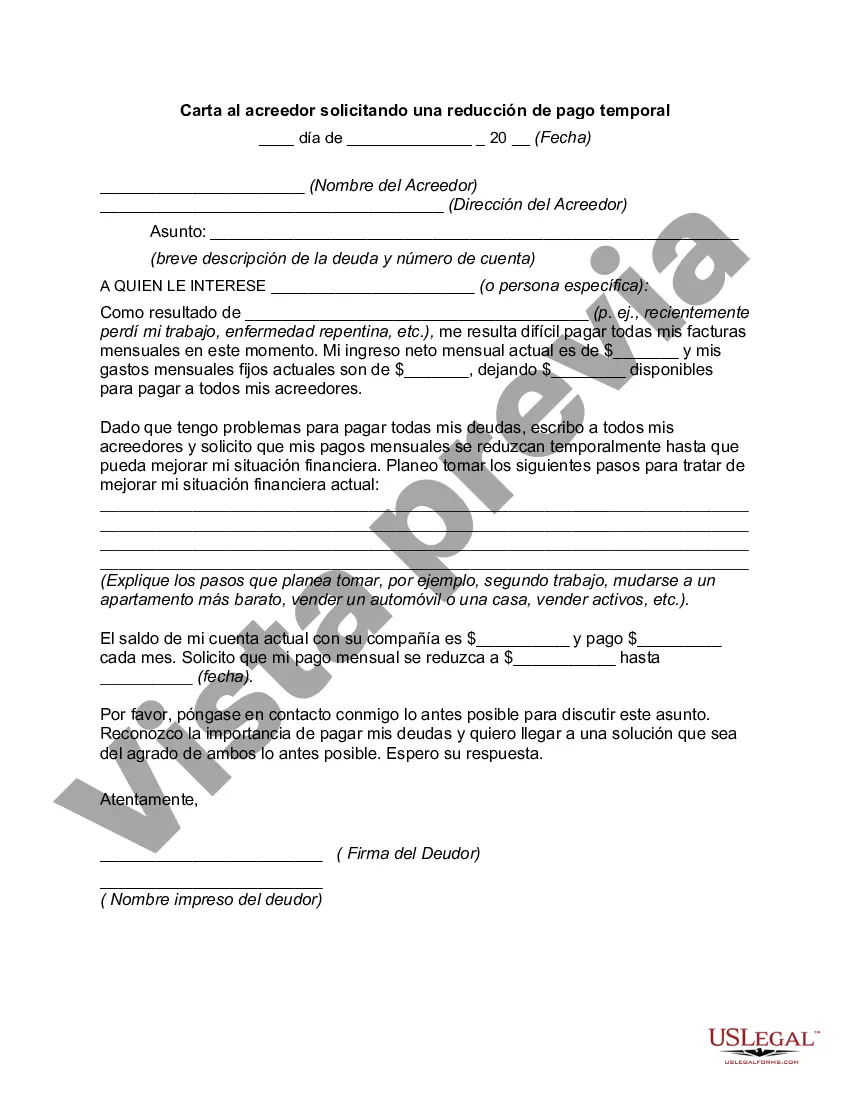

Description

How to fill out Guam Carta Al Acreedor Solicitando Una Reducción De Pago Temporal?

You can spend several hours on-line attempting to find the legitimate document web template that suits the federal and state specifications you will need. US Legal Forms gives a huge number of legitimate forms that are reviewed by pros. It is simple to acquire or print out the Guam Letter to Creditor Requesting a Temporary Payment Reduction from my service.

If you already possess a US Legal Forms profile, you may log in and click the Down load switch. After that, you may comprehensive, revise, print out, or indication the Guam Letter to Creditor Requesting a Temporary Payment Reduction. Each and every legitimate document web template you acquire is your own forever. To get one more backup for any bought develop, go to the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms internet site initially, adhere to the simple guidelines beneath:

- Initially, make certain you have chosen the right document web template for your region/area that you pick. Look at the develop description to ensure you have chosen the right develop. If readily available, take advantage of the Review switch to search from the document web template as well.

- If you would like get one more model of your develop, take advantage of the Search field to get the web template that meets your requirements and specifications.

- Once you have located the web template you need, click on Acquire now to continue.

- Select the rates plan you need, key in your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You can utilize your bank card or PayPal profile to cover the legitimate develop.

- Select the file format of your document and acquire it to the gadget.

- Make adjustments to the document if possible. You can comprehensive, revise and indication and print out Guam Letter to Creditor Requesting a Temporary Payment Reduction.

Down load and print out a huge number of document layouts using the US Legal Forms site, that provides the most important assortment of legitimate forms. Use expert and express-specific layouts to tackle your business or specific requirements.