Guam Aging Accounts Payable

Description

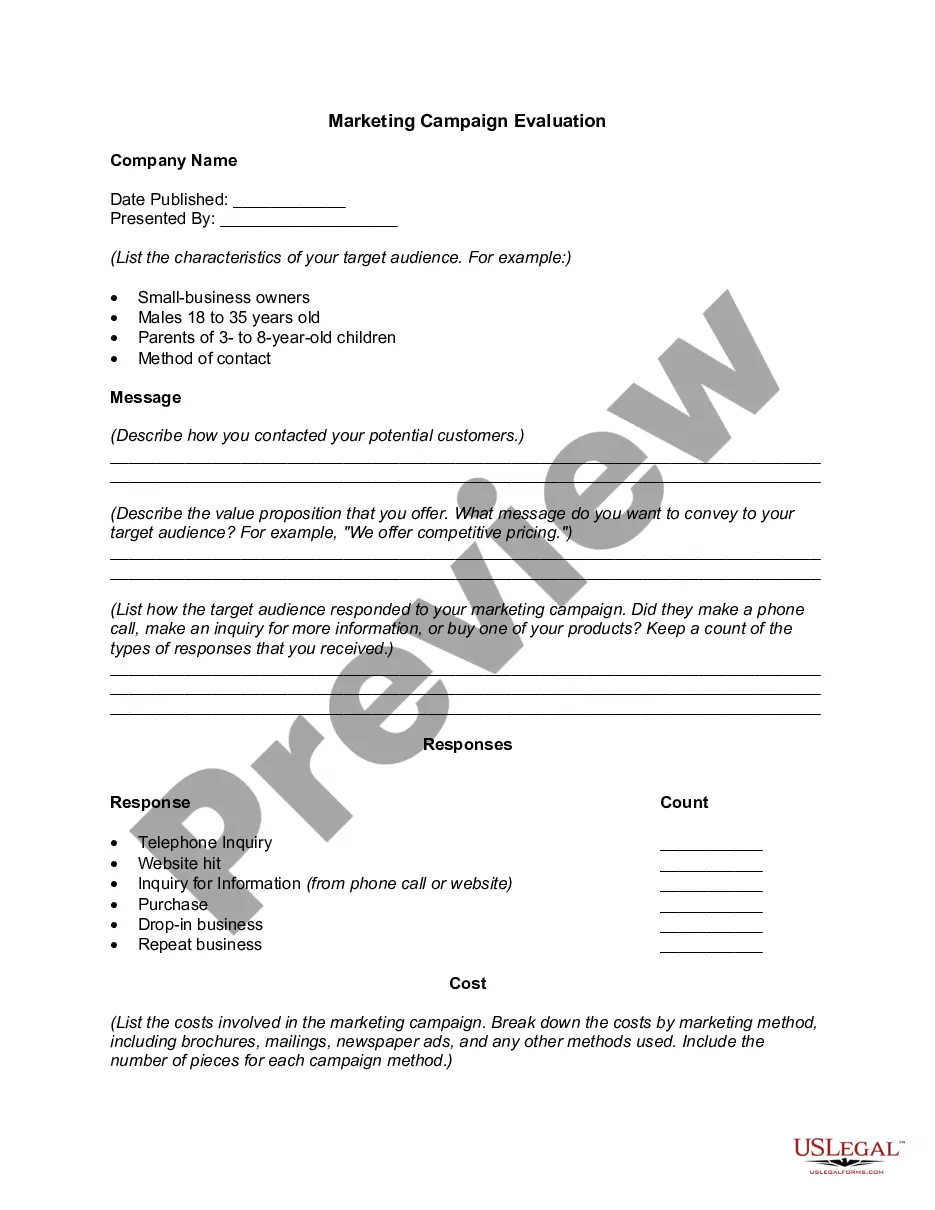

How to fill out Aging Accounts Payable?

US Legal Forms - one of the largest collections of authorized templates in the United States - offers a vast array of legal document formats that you can download or print.

By using the site, you will find thousands of forms for both business and personal use, organized by categories, states, or keywords. You can locate the latest versions of forms such as the Guam Aging Accounts Payable in moments.

If you already have an account, sign in and download the Guam Aging Accounts Payable from the US Legal Forms library. The Download button will be visible on every form you browse.

Complete the transaction. Use your credit card or PayPal to finalize the purchase.

Select the format and download the form to your device. Make changes. Fill out, edit, and print and sign the downloaded Guam Aging Accounts Payable.

Every template you add to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you want.

Access the Guam Aging Accounts Payable with US Legal Forms, the most extensive collection of legal document formats. Utilize thousands of professional and state-specific templates that fit your business or personal needs.

- To use US Legal Forms for the first time, here are simple steps to get started.

- Make sure you've selected the correct form for your city/state.

- Click the Review button to examine the form's content.

- Read the form description to confirm you've chosen the right one.

- If the form isn't suitable for your needs, use the Search box at the top of the screen to find one that is.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Next, choose your payment plan and provide your credentials to register for an account.

Form popularity

FAQ

You have accounts receivables if you extend credit to customers (e.g., you invoice a customer and they pay you at a later date). The aging of accounts receivable refers to the number of days an invoice is past due.

An accounts payable aging summary report shows the balances you owe to others. The report helps you organize and visualize the amounts you owe. Typically, an aging of accounts payable includes: Vendor names. How much you owe each vendor.

AP Aging ReportsGo to Reports on the top menu.Choose Vendors and Payables.Select A/P Aging Detail.Tick the Customize Report tab.In the Dates field choose Custom.Enter the date for April in the From and To field.Tap OK.16-Feb-2021

To prepare accounts receivable aging report, sort the unpaid invoices of a business with the number of days outstanding. This report displays the amount of money owed to you by your customers for good and services purchased.

When you pay off an invoice, remove the current or past due amount from your report. For example, say you paid off the $100 invoice that's 61 90 days past due for Vendor 3. After you pay Vendor 3 the $100, make sure you change the 61 90 days column to say $0.

An aging schedule is an accounting table that shows a company's accounts receivables, ordered by their due dates. Often created by accounting software, an aging schedule can help a company see if its customers are paying on time.

Simply put, accounts payable aging reports gives you an overview of what your business owes for supplies, inventory, and services. A quick glance at this report reveals the identities of your creditors, how much money is owed to each creditor and how long that money has been owed.

The Accounts Payable Aging Report lists vendors to which you owe money in the rows. The columns separate your bills by how many days they are overdue, with the first column being bills that are not overdue, and the fifth column being bills that are more than 90 days overdue.

The intent of the report is to give the user a visual aid in determining which invoices are overdue for payment. It is especially useful when a business is short on cash, and so needs to monitor which payables are not being paid on time.