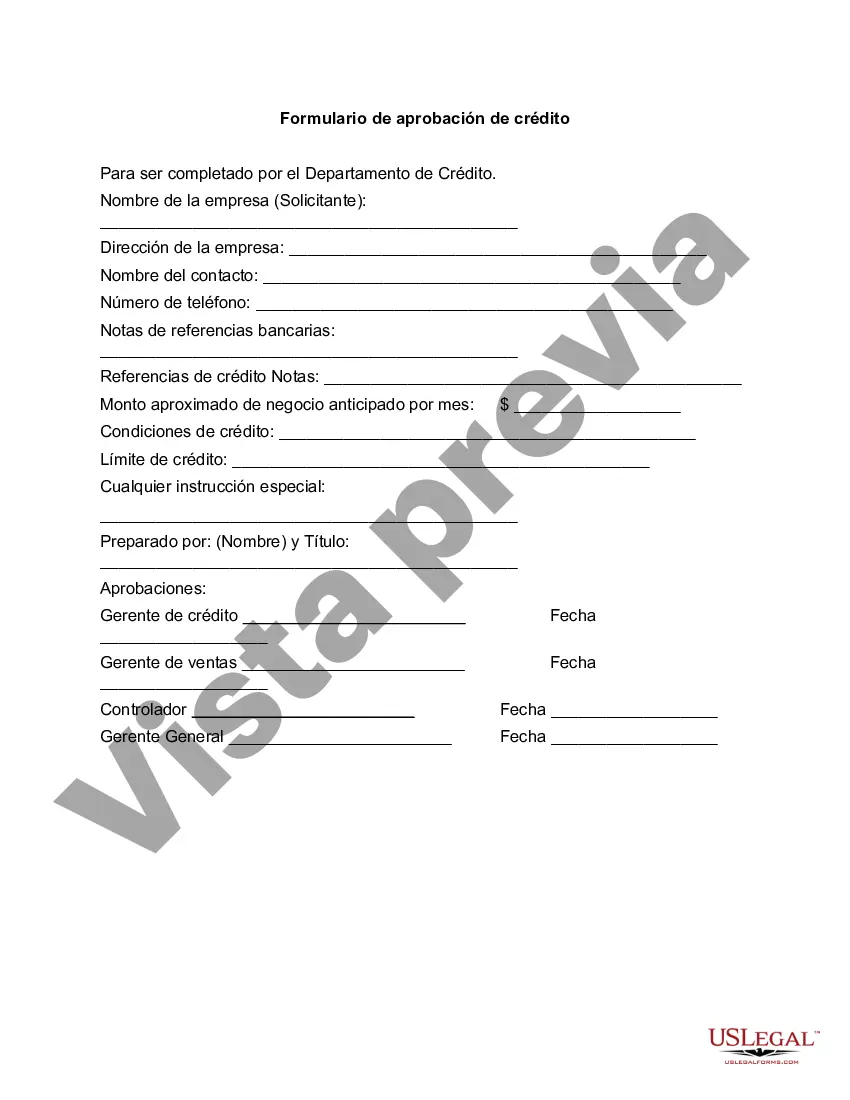

Title: Guam Credit Approval Form: A Comprehensive Overview of Types and Key Features Introduction: The Guam Credit Approval Form is a crucial document that serves as the foundation for credit evaluation and approval processes. This detailed description will shed light on the purpose, significance, and types of credit approval forms commonly used in Guam, along with relevant keywords to facilitate understanding. 1. Purpose of the Guam Credit Approval Form: The Guam Credit Approval Form is designed to assess an individual or business's creditworthiness and determine their eligibility for credit services. This form is pivotal for financial institutions, lenders, or credit providers to make informed decisions regarding extending credit facilities. 2. Key Features of the Guam Credit Approval Form: i. Personal Information: Collects essential personal details of the applicant, including name, contact information, social security number, employment status, and residential address. ii. Income Details: Requires the applicant to disclose income sources, employment history, and current salary information to evaluate their ability to repay the credit. iii. Financial Obligations: Inquires about existing loans, credit card debts, mortgages, or other financial obligations to assess the applicant's overall debt burden and repayment capacity. iv. Credit History: Asks for authorization to pull credit reports from relevant credit bureaus to review past payment history, credit utilization, and any prior delinquencies. v. Collateral Evaluation: In case a secured loan is being sought, this section focuses on documenting and evaluating the collateral being offered as security against credit approval. 3. Types of Guam Credit Approval Forms: i. Personal Credit Approval Form: This form is predominantly used for individuals seeking personal loans, credit cards, or financing options for personal expenses. It focuses on personal financial information, credit history, and income details. ii. Business Credit Approval Form: This variant of the form is tailored for entities seeking credit facilities for business purposes, such as startup funding, expansion, or operational finance. It emphasizes business financials, tax information, and credit references. iii. Mortgage Credit Approval Form: Specifically designed to evaluate an applicant's eligibility for home loans or mortgages, this form includes additional sections regarding property details, estimated appraisals, and insurance requirements. iv. Vehicle Loan Credit Approval Form: As the name suggests, this form is exclusively intended for individuals looking to finance their vehicle purchases. It typically includes sections for vehicle details, insurance information, and estimated running costs. Keywords: Guam Credit Approval Form, creditworthiness assessment, eligibility, financial institutions, lenders, personal information, income details, financial obligations, credit history, collateral evaluation, personal credit approval form, business credit approval form, mortgage credit approval form, vehicle loan credit approval form. Conclusion: Understanding the Guam Credit Approval Form and its different types enables individuals and businesses to navigate the credit evaluation process effectively. By meticulously completing the relevant sections of these forms, applicants can enhance their chances of credit approval and secure desired financial assistance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out Guam Formulario De Aprobación De Crédito?

Are you inside a position that you require paperwork for both enterprise or specific functions nearly every day time? There are a variety of authorized record layouts accessible on the Internet, but locating ones you can trust isn`t straightforward. US Legal Forms provides a huge number of kind layouts, such as the Guam Credit Approval Form, that are published to satisfy federal and state specifications.

Should you be currently informed about US Legal Forms website and have a merchant account, merely log in. After that, you can obtain the Guam Credit Approval Form template.

If you do not offer an accounts and wish to start using US Legal Forms, adopt these measures:

- Get the kind you want and make sure it is for the correct town/county.

- Use the Preview key to check the shape.

- Look at the information to ensure that you have selected the correct kind.

- In the event the kind isn`t what you`re searching for, take advantage of the Look for area to find the kind that meets your needs and specifications.

- When you get the correct kind, simply click Get now.

- Choose the costs strategy you need, complete the necessary info to make your bank account, and purchase an order utilizing your PayPal or bank card.

- Select a handy document format and obtain your version.

Find every one of the record layouts you might have bought in the My Forms food list. You can obtain a further version of Guam Credit Approval Form anytime, if required. Just select the necessary kind to obtain or print out the record template.

Use US Legal Forms, one of the most comprehensive assortment of authorized varieties, to save lots of efforts and stay away from blunders. The support provides appropriately manufactured authorized record layouts which can be used for a variety of functions. Generate a merchant account on US Legal Forms and initiate making your lifestyle easier.