Guam Guaranty without Pledged Collateral

Description

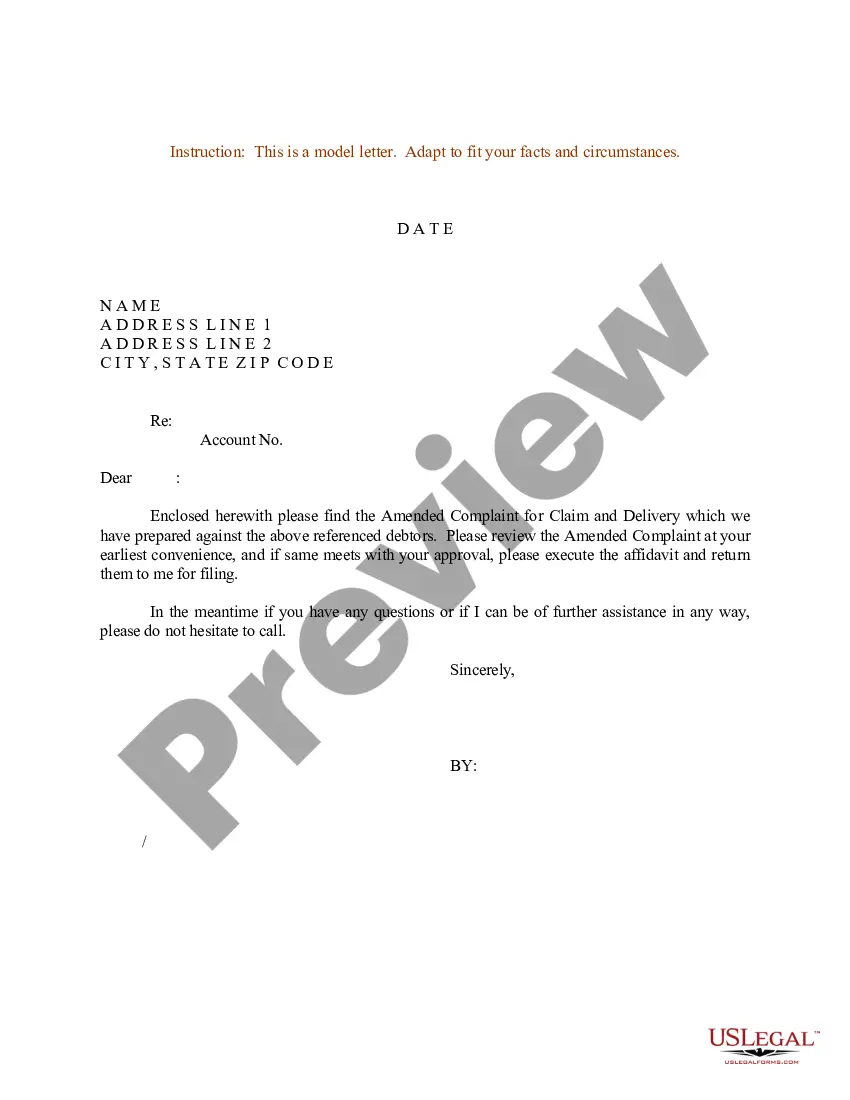

How to fill out Guaranty Without Pledged Collateral?

US Legal Forms - one of the largest collections of valid templates in the United States - provides a vast selection of legitimate document designs you can download or create.

Using the website, you can find thousands of templates for business and personal purposes, organized by types, states, or keywords. You can access the latest templates such as the Guam Guaranty without Pledged Collateral in a matter of minutes.

If you currently hold a subscription, Log In to obtain the Guam Guaranty without Pledged Collateral from the US Legal Forms library. The Download button will appear on each template you view. You can find all previously downloaded templates in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the payment.

Select the format and download the template to your device. Make modifications. Complete, edit, print, and sign the downloaded Guam Guaranty without Pledged Collateral. Each template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the template you require. Access the Guam Guaranty without Pledged Collateral through US Legal Forms, the most extensive library of valid document designs. Utilize thousands of professional and state-specific templates that meet your business or personal needs and criteria.

- Ensure you have chosen the correct template for your city/county.

- Click the Review button to check the content of the form.

- Examine the template details to confirm you have selected the right template.

- If the template does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

Secured loans require that you offer up something you own of value as collateral in case you can't pay back your loan, whereas unsecured loans allow you borrow the money outright (after the lender considers your financials).

Pledge TypesActive Pledge. Active pledge is defined as a pledge that is active, regardless if it has a payment schedule or not.Annual Fund Pledge.Conditional Pledge.Open Pledge.Pledge Intention.Straight Pledge.Will Commitment.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

A personal guarantee, almost by definition, is unsecured, which means it is an amount not tied to any specific asset such as a residence. By making a guarantee, however, you are are putting yourself - and your assets - on the hook, by acting as the loan's cosigner.

The Guarantor undertakes to pay compensation up to a certain amount to the Beneficiary in case the Applicant/Instructing Party fails to deliver the goods or to carry out certain work. This type of Guarantee is often issued for 5-10% of the contract value, although the percentage varies case by case.

A secured personal loan is backed by collateral. If the borrower defaults, the lender can collect the collateral. For this reason, secured loans tend to offer better rates than unsecured loans.

Guarantee vs collateral what's the difference? A personal guarantee is a signed document that promises to repay back a loan in the event that your business defaults. Collateral is a good or an owned asset that you use toward loan security in the event that your business defaults.

The guarantor guarantees a loan by pledging their assets as collateral. A guarantor alternatively describes someone who verifies the identity of an individual attempting to land a job or secure a passport. Unlike a co-signer, a guarantor has no claim to the asset purchased by the borrower.

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

When used as a verb, to agree to pay another person's debt or perform another person's duty, if that person fails to come through. As a noun, the written document in which this assurance is made.