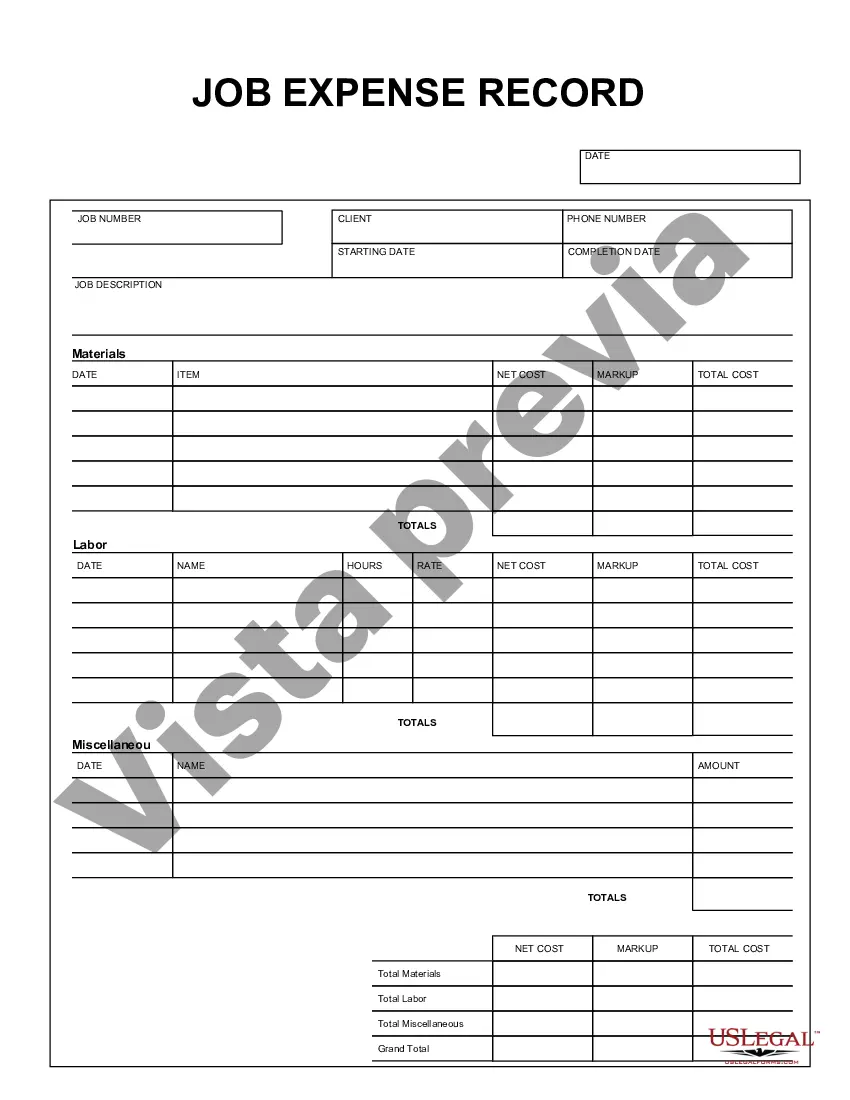

Guam Job Expense Record, as the name suggests, is a comprehensive system used for tracking and documenting job-related expenses in Guam. It is a crucial tool for both employees and employers to keep a detailed record of expenses incurred during work-related activities. This record helps individuals or businesses in managing their finances effectively, as well as providing accurate information for tax deductions or reimbursements. The Guam Job Expense Record serves as a consolidated document that chronologically captures various job-related expenses. It ensures transparency and accountability in the financial aspects of work operations. Here are some relevant keywords that further describe the Guam Job Expense Record and its distinct types: 1. Guam Job Expense Record Form: This refers to a standardized document or form designed specifically for recording job expenses in Guam. It typically includes fields or sections to record details such as date, purpose of the expense, amount spent, and supporting documentation. 2. Employee Expense Record: This type of Guam Job Expense Record focuses on documenting expenses incurred by employees during their work-related activities. It covers expenses like travel, meals, accommodation, transportation, and other necessary costs. Employee Expense Records are often used to claim reimbursements or as evidence for tax deductions. 3. Self-Employed Expense Record: Self-employed individuals in Guam also maintain a specific type of Job Expense Record to keep track of their business-related spending. This record includes expenses like office supplies, equipment, marketing, utilities, and professional services. Self-employed individuals use this detailed record to accurately calculate their business deductions and report their income while filing taxes. 4. Contractor Job Expense Record: Contractors operating in Guam utilize a separate Job Expense Record to document and track expenses directly related to their contract jobs. These expenses can encompass materials, subcontractor costs, permits, licenses, insurance, and any other expenses directly related to the contracted work. 5. Small Business Expense Record: Small business owners in Guam maintain a comprehensive Job Expense Record to monitor and manage all business-related expenses. It involves recording expenses such as rent, utilities, inventory, salaries, marketing, office supplies, equipment, and maintenance costs. This record enables small business owners to analyze expenses, control costs, and plan their finances effectively. In conclusion, the Guam Job Expense Record is an essential tool for individuals, employees, contractors, self-employed individuals, and small businesses to document and track job-related expenses. It ensures accurate financial management, facilitates tax deductions, supports reimbursement claims, and allows for better control over expenses. By utilizing various types of Guam Job Expense Records, individuals and businesses can maintain clarity and transparency in their financial transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Guam Registro De Gastos De Trabajo?

US Legal Forms - one of the most significant libraries of legal kinds in the States - provides a wide range of legal papers templates it is possible to down load or printing. Using the site, you may get a large number of kinds for business and person reasons, sorted by types, suggests, or search phrases.You will find the newest models of kinds just like the Guam Job Expense Record within minutes.

If you have a subscription, log in and down load Guam Job Expense Record in the US Legal Forms catalogue. The Obtain button can look on every single kind you view. You get access to all previously saved kinds inside the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, listed below are easy instructions to help you started:

- Be sure you have chosen the best kind for your personal metropolis/county. Select the Preview button to examine the form`s information. See the kind explanation to actually have chosen the right kind.

- In case the kind doesn`t satisfy your needs, make use of the Lookup industry near the top of the monitor to discover the the one that does.

- If you are happy with the form, affirm your option by clicking the Buy now button. Then, opt for the pricing program you favor and supply your credentials to register for the profile.

- Approach the financial transaction. Use your bank card or PayPal profile to perform the financial transaction.

- Choose the structure and down load the form on the product.

- Make modifications. Fill out, revise and printing and indicator the saved Guam Job Expense Record.

Every single web template you included in your account does not have an expiry time and is also your own property eternally. So, if you would like down load or printing one more backup, just go to the My Forms portion and then click about the kind you want.

Obtain access to the Guam Job Expense Record with US Legal Forms, the most considerable catalogue of legal papers templates. Use a large number of expert and status-distinct templates that meet up with your business or person requirements and needs.