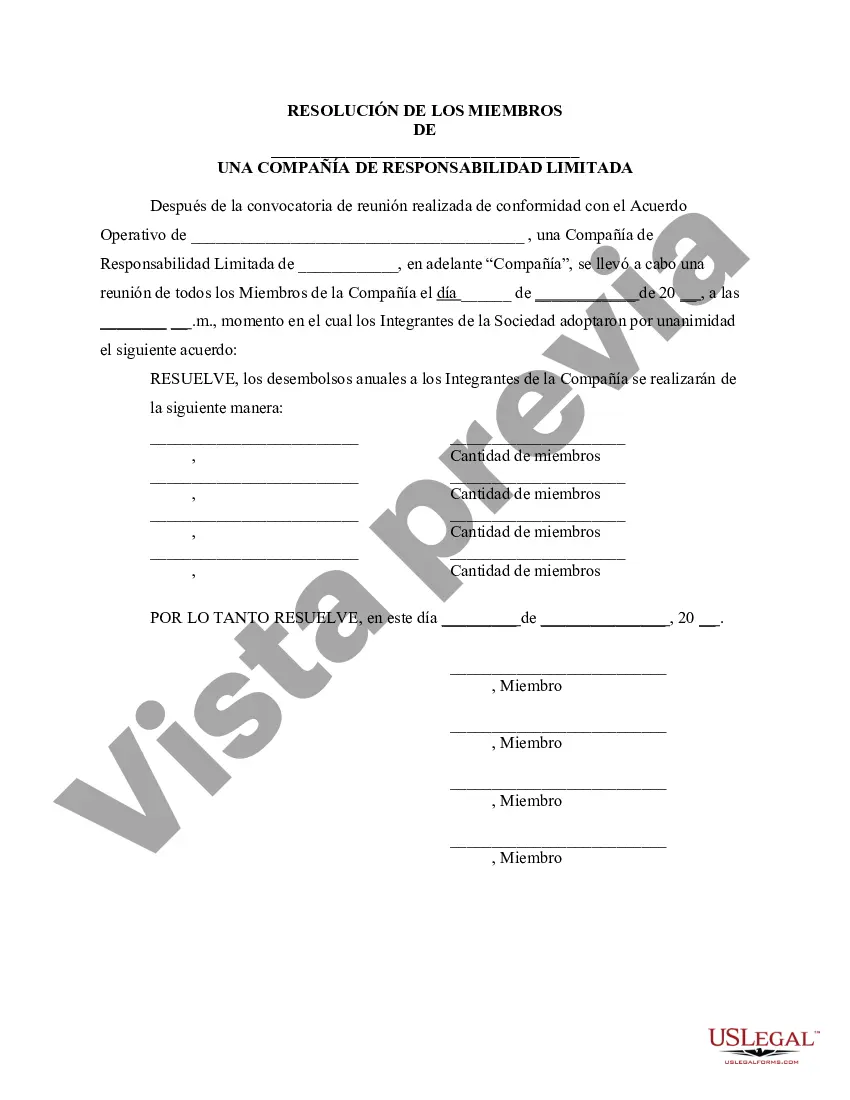

The Guam Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company is a formal document that outlines and establishes the decision regarding the distribution of profits among the members of a Limited Liability Company (LLC) based in Guam. This resolution serves as a binding agreement among LLC members to determine the specific amount of funds to be allocated to each individual member as an annual disbursement. Keywords: Guam, Resolution of Meeting, LLC Members, Specify Amount, Annual Disbursements, Company. There can be different types of Guam Resolutions of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company that organizations may adopt, depending on their specific circumstances and preferences. Some possible variations include: 1. Unanimous Consent Resolution: This type of resolution indicates that the LLC members have unanimously agreed upon a specific amount to be disbursed annually to each member. It demonstrates the complete consensus and unity among the members regarding disbursement amounts. 2. Majority Vote Resolution: In cases where all LLC members do not unanimously agree on a particular disbursement amount, a resolution with a majority vote may be adopted. This type of resolution indicates that a majority of members have agreed upon specific disbursement amounts, despite the dissenting opinions of a few members. 3. Proportional Distribution Resolution: In this resolution, the disbursement amounts are calculated based on the proportional ownership or capital contribution of each LLC member. It ensures that the distribution is fair and reflects the investments or share of each member within the company. 4. Fixed Amount Resolution: This type of resolution sets a fixed or pre-determined amount to be disbursed to each LLC member annually. It may be preferred when there is stability in the company's profits or when members desire consistent disbursements regardless of individual ownership percentages or capital contributions. 5. Performance-based Resolution: This resolution ties the annual disbursements to certain performance metrics, such as individual member contributions, achievements, or target goals. It aims to incentivize members based on their performance and create a link between rewards and company success. It is essential for LLC members to carefully consider each type of resolution and select the most suitable one for their company's specific circumstances and objectives. Furthermore, it is advisable to consult legal and financial professionals to ensure compliance with all legal requirements and to protect the best interests of the company and its members.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Resolución de la reunión de los miembros de la LLC para especificar el monto de los desembolsos anuales a los miembros de la empresa - Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

How to fill out Guam Resolución De La Reunión De Los Miembros De La LLC Para Especificar El Monto De Los Desembolsos Anuales A Los Miembros De La Empresa?

US Legal Forms - one of the largest libraries of legitimate forms in the States - provides a variety of legitimate record themes it is possible to download or printing. Using the internet site, you may get 1000s of forms for organization and person purposes, categorized by classes, suggests, or keywords.You will discover the latest variations of forms just like the Guam Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company within minutes.

If you already possess a subscription, log in and download Guam Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company through the US Legal Forms collection. The Acquire switch will show up on every single kind you see. You have access to all formerly saved forms within the My Forms tab of your respective profile.

In order to use US Legal Forms initially, allow me to share easy instructions to get you began:

- Ensure you have picked out the right kind for the metropolis/region. Click the Review switch to examine the form`s articles. Browse the kind information to ensure that you have selected the proper kind.

- When the kind does not match your needs, utilize the Lookup field at the top of the monitor to obtain the one that does.

- When you are content with the form, affirm your decision by clicking on the Get now switch. Then, opt for the rates strategy you prefer and supply your references to register for an profile.

- Process the purchase. Make use of your bank card or PayPal profile to accomplish the purchase.

- Select the file format and download the form in your system.

- Make alterations. Load, edit and printing and indication the saved Guam Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

Each and every format you included in your money lacks an expiry day and is also yours forever. So, if you would like download or printing one more duplicate, just proceed to the My Forms section and click on on the kind you want.

Get access to the Guam Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with US Legal Forms, one of the most substantial collection of legitimate record themes. Use 1000s of expert and express-certain themes that fulfill your business or person demands and needs.