Statutory Guidelines [Appendix A(2) Tres. Reg 104-1] regarding compensation for injuries or sickness under workmen's compensation acts, damages, accident or health insurance, etc. as stated in the guidelines.

Guam Compensation for Injuries or Sickness Treasury Regulation 104.1

Description

How to fill out Compensation For Injuries Or Sickness Treasury Regulation 104.1?

US Legal Forms - among the most significant libraries of authorized varieties in America - delivers a wide range of authorized document themes you can download or print. Utilizing the site, you can find a large number of varieties for organization and specific reasons, categorized by groups, claims, or key phrases.You can get the most up-to-date variations of varieties much like the Guam Compensation for Injuries or Sickness Treasury Regulation 104.1 within minutes.

If you already have a subscription, log in and download Guam Compensation for Injuries or Sickness Treasury Regulation 104.1 through the US Legal Forms catalogue. The Acquire option will show up on every form you see. You get access to all earlier acquired varieties from the My Forms tab of your accounts.

If you would like use US Legal Forms for the first time, allow me to share easy guidelines to help you get started off:

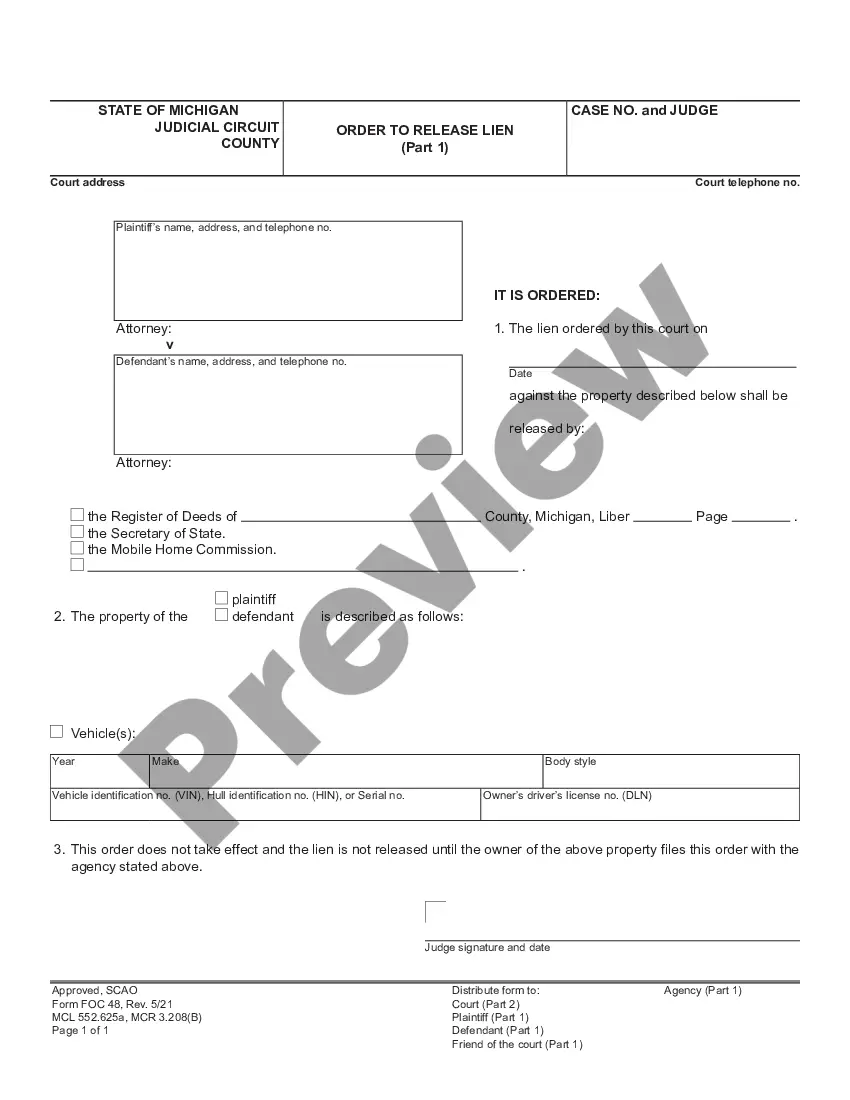

- Ensure you have selected the proper form to your city/county. Go through the Preview option to analyze the form`s information. Read the form information to actually have selected the right form.

- If the form doesn`t fit your demands, use the Search industry near the top of the display to find the one which does.

- Should you be content with the form, validate your option by clicking the Purchase now option. Then, choose the costs prepare you want and offer your references to sign up for an accounts.

- Method the transaction. Utilize your credit card or PayPal accounts to perform the transaction.

- Select the format and download the form on your own product.

- Make changes. Load, edit and print and indicator the acquired Guam Compensation for Injuries or Sickness Treasury Regulation 104.1.

Every template you included in your money lacks an expiration particular date and is also the one you have forever. So, if you would like download or print an additional version, just visit the My Forms segment and then click in the form you need.

Obtain access to the Guam Compensation for Injuries or Sickness Treasury Regulation 104.1 with US Legal Forms, one of the most extensive catalogue of authorized document themes. Use a large number of expert and status-specific themes that satisfy your business or specific needs and demands.