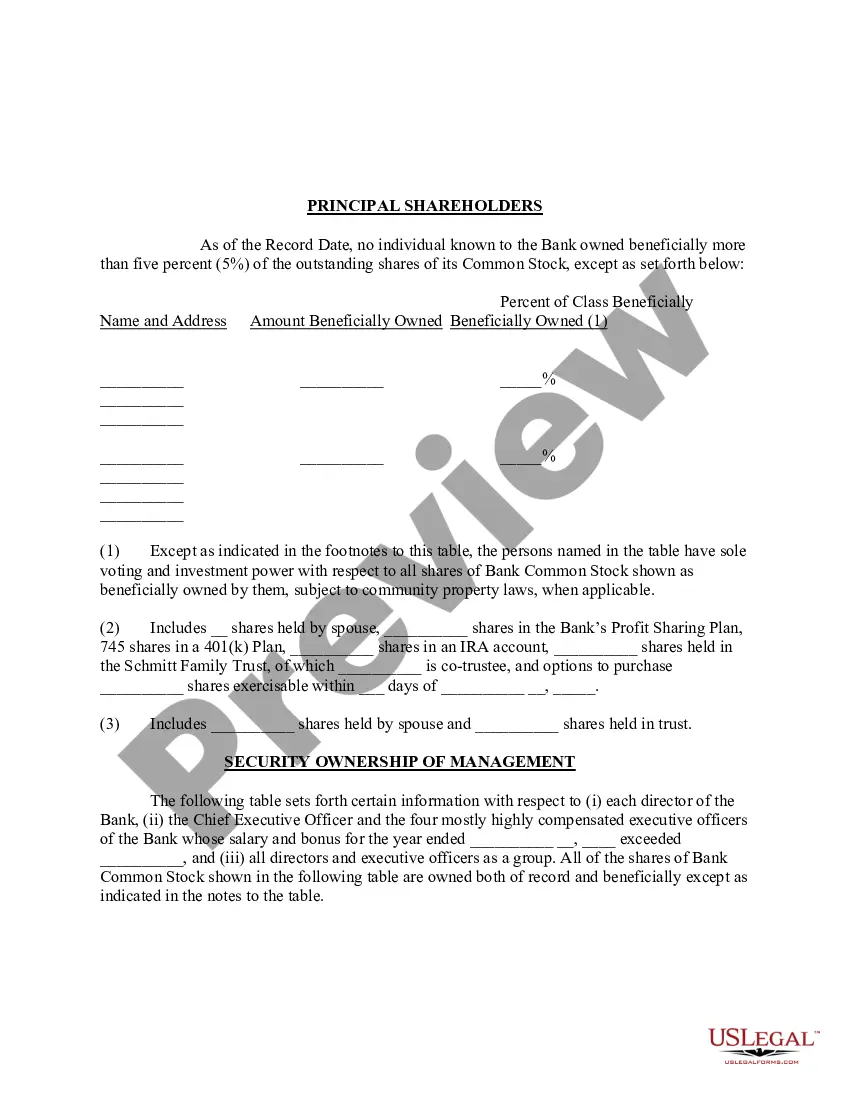

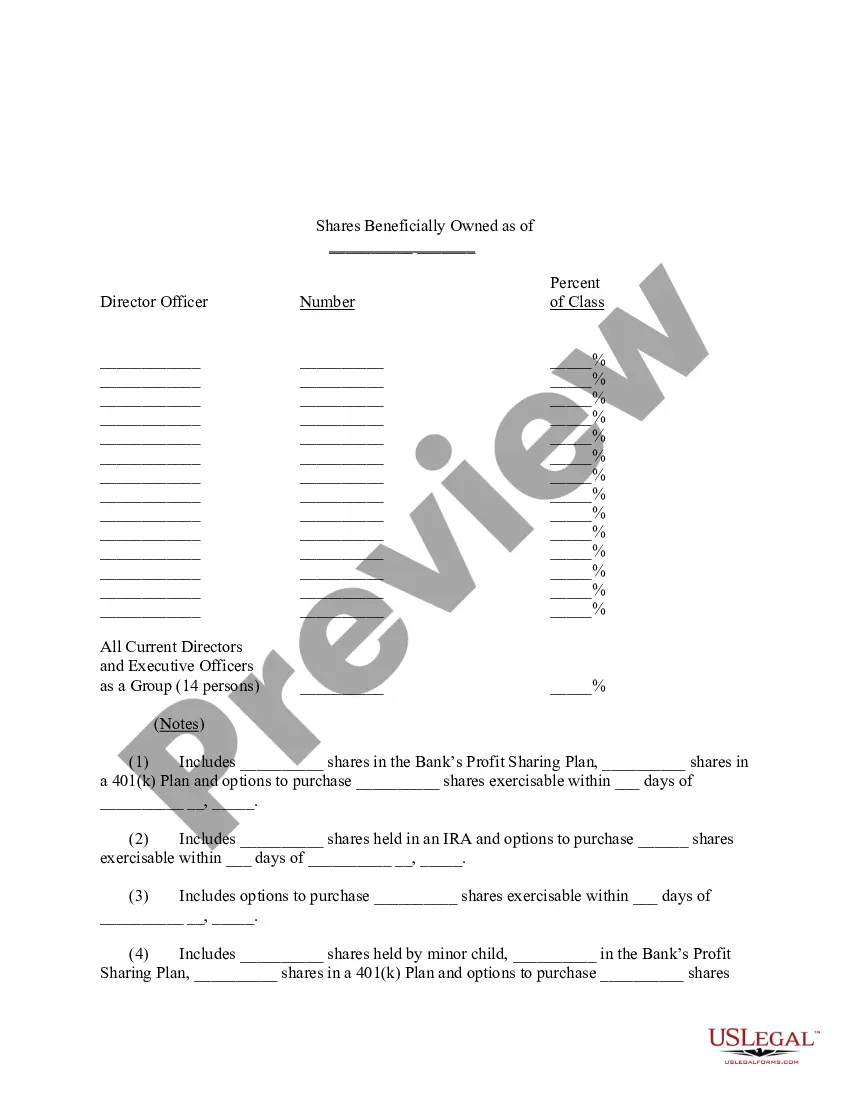

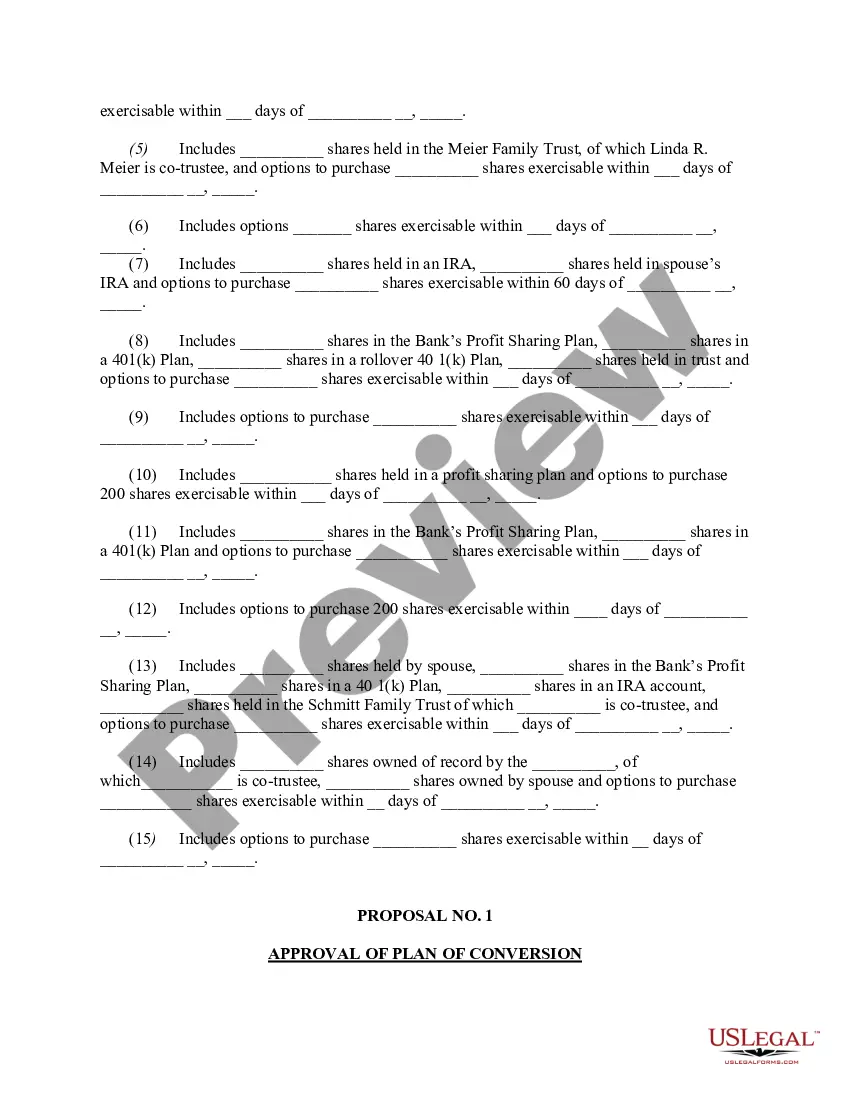

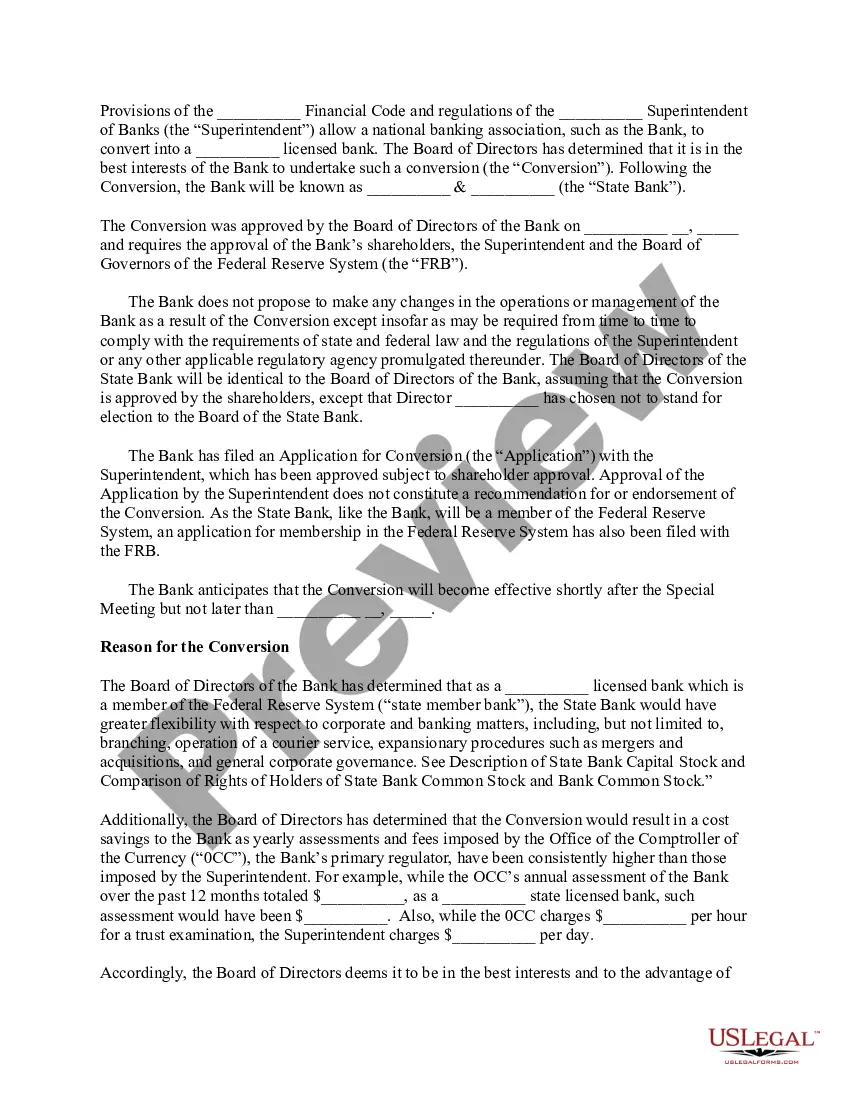

A Guam Proxy Statement is a document prepared by University National Bank and Trust Co. (UNIT) for its shareholders, providing them with detailed information about corporate governance matters and proposing resolutions that require their votes. The proxy statement serves as a communication medium between the company's management and its shareholders, ensuring transparency and accountability in decision-making processes. Keywords: 1. Guam Proxy Statement: A document prepared by University National Bank and Trust Co. for shareholders in Guam. 2. University National Bank and Trust Co.: A financial institution that operates in Guam. 3. Shareholders: Individuals or entities who own shares in University National Bank and Trust Co. 4. Corporate governance: The system of rules, practices, and processes used by a company to direct and control its operations. 5. Resolutions: Proposals that need shareholders' votes to make decisions on major corporate actions. 6. Transparency: The quality of being open, honest, and clear in business practices. 7. Accountability: The obligation of individuals or organizations to take responsibility for their actions and decisions. 8. Decision-making processes: The methods and procedures used to make choices and reach conclusions. 9. Communication: The exchange of information between University National Bank and Trust Co.'s management and shareholders. 10. Financial institution: A company that offers financial services such as banking, investment, and trust services. Different types of Guam Proxy Statements issued by University National Bank and Trust Co. may include: 1. Annual Proxy Statement: Prepared and distributed to shareholders annually, providing information about upcoming decisions, corporate governance practices, and resolutions to be voted on during the annual general meeting. 2. Special Proxy Statement: Issued when there are significant corporate events or proposals, such as mergers, acquisitions, or changes in corporate structure, requiring shareholders' approval. 3. Proxy Statement Supplement: A supplementary document issued when there are updates or additional information regarding previously issued proxy statements. 4. Proxy Statement Notice: A preliminary document that announces the upcoming release of a proxy statement and provides shareholders with relevant details, including meeting dates, voting procedures, and deadlines. 5. Proxy Card: An accompanying document that shareholders receive with the proxy statement, allowing them to vote on proposed resolutions by marking their preferences and returning the card to the company. It is important for University National Bank and Trust Co. to provide clear and comprehensive proxy statements to ensure that shareholders are well-informed and can make informed decisions about the company's future. These statements play a crucial role in fostering transparency, accountability, and effective communication between the bank's management and its stakeholders in Guam.

Guam Proxy Statement - University National Bank and Trust Co.

Description

How to fill out Proxy Statement - University National Bank And Trust Co.?

Choosing the best lawful record web template can be quite a struggle. Needless to say, there are a lot of web templates available on the Internet, but how do you obtain the lawful form you want? Take advantage of the US Legal Forms website. The support delivers a large number of web templates, including the Guam Proxy Statement - University National Bank and Trust Co., that can be used for enterprise and personal requires. All the forms are examined by experts and meet federal and state needs.

Should you be already registered, log in to your profile and click the Download switch to get the Guam Proxy Statement - University National Bank and Trust Co.. Utilize your profile to look through the lawful forms you have bought earlier. Go to the My Forms tab of your own profile and have yet another duplicate of your record you want.

Should you be a whole new user of US Legal Forms, here are simple directions for you to follow:

- Initial, ensure you have chosen the correct form for the town/state. It is possible to check out the form while using Review switch and look at the form outline to make certain this is the right one for you.

- In case the form fails to meet your requirements, take advantage of the Seach discipline to obtain the correct form.

- Once you are sure that the form is proper, click the Get now switch to get the form.

- Opt for the pricing prepare you want and enter in the necessary information and facts. Create your profile and purchase your order with your PayPal profile or credit card.

- Select the submit format and acquire the lawful record web template to your product.

- Total, edit and produce and signal the attained Guam Proxy Statement - University National Bank and Trust Co..

US Legal Forms is definitely the biggest catalogue of lawful forms where you can find different record web templates. Take advantage of the company to acquire expertly-created papers that follow state needs.

Form popularity

FAQ

A document sent to shareholders letting them know when and where a shareholders' meeting is taking place and detailing the matters to be voted upon at the meeting. You can attend the meeting and vote in person or cast a proxy vote.

Proxy statements are documents that the Securities and Exchange Commission requires companies to give to shareholders so they can weigh in on important company issues. Proxy statements offer shareholders information about changes on the board and other important decisions the board needs to make.

Proxy Statements The proxy documents provide shareholders with the information necessary to make informed votes on issues important to the company's performance. A Proxy statement offers shareholders and prospective investors insight into a company's governance and management operations.

Filling out a voting proxy form is necessary in order to be able to have someone vote on your behalf in an election or referendum. Proxy voting, the act of having some else vote on your behalf, is often allowed in specific circumstances.