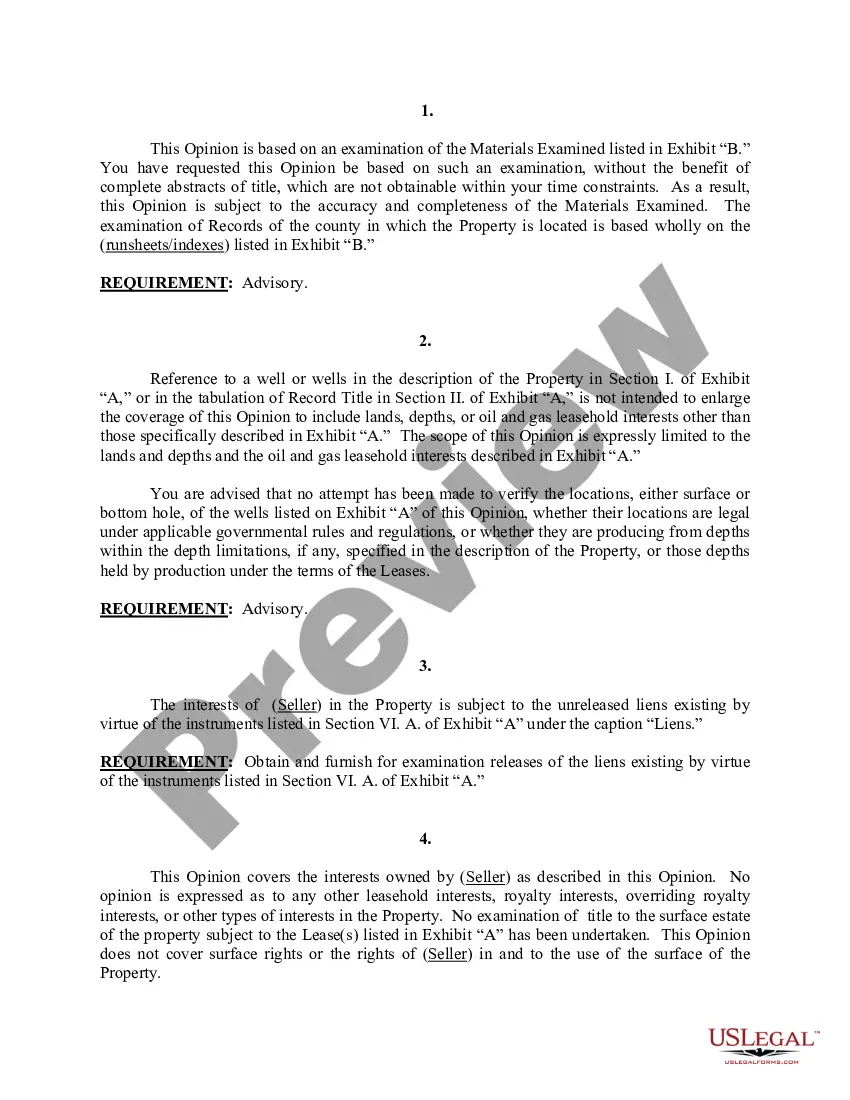

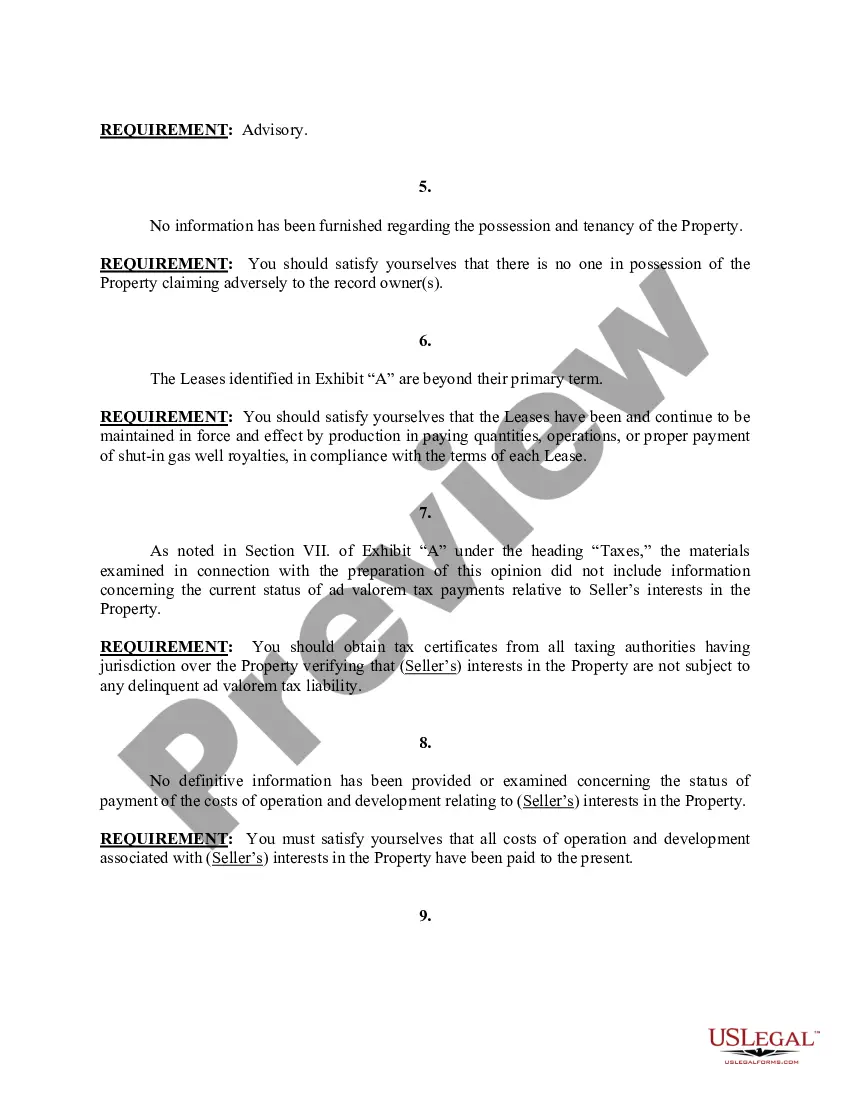

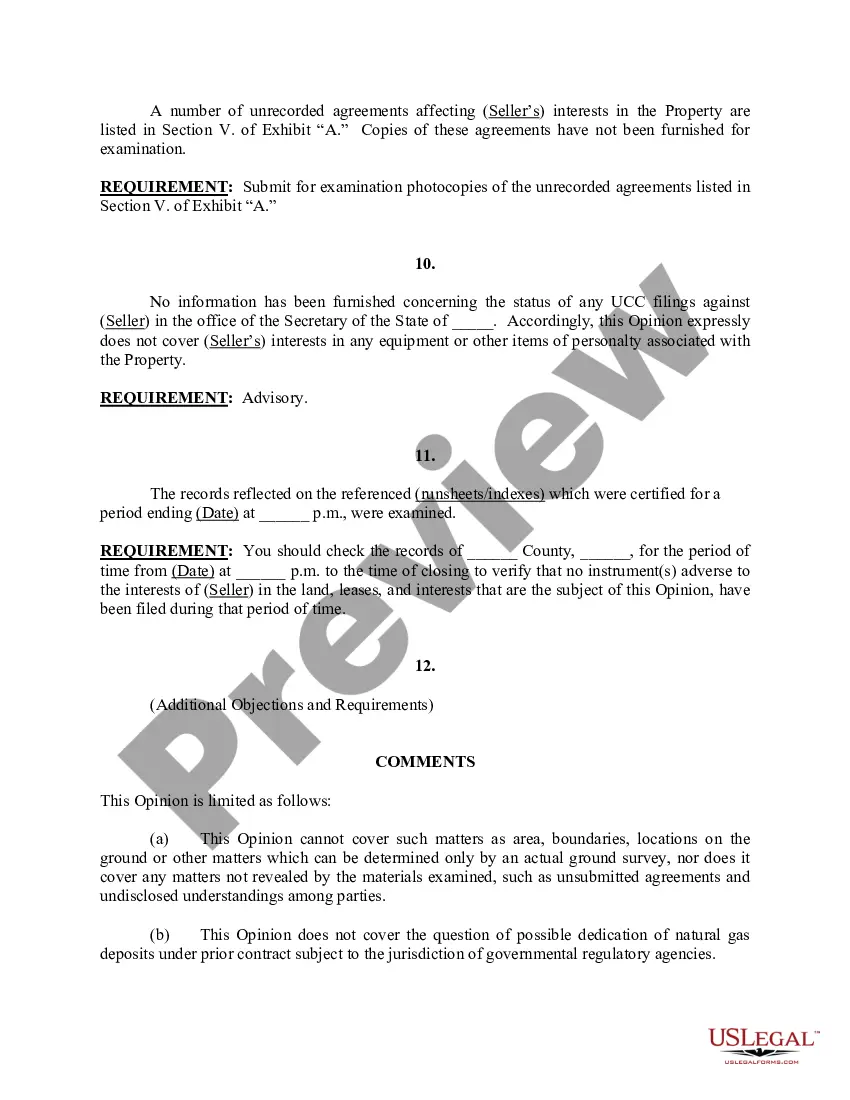

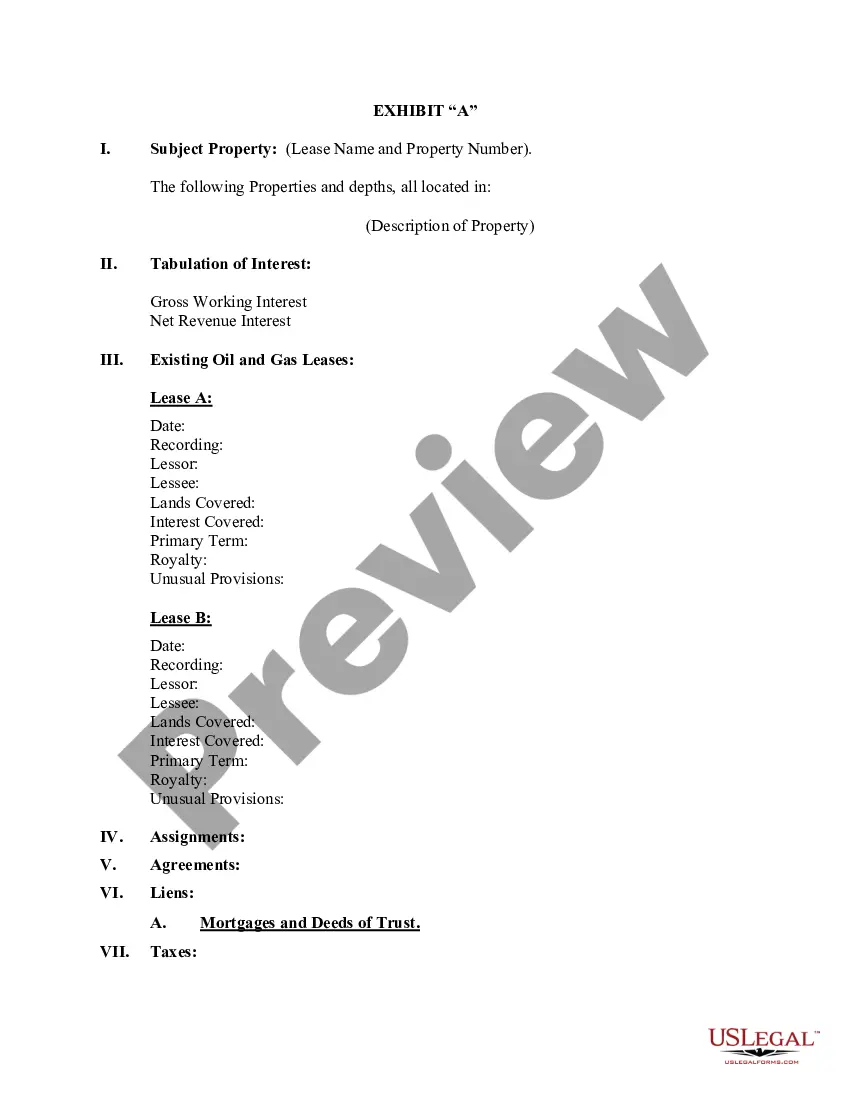

Guam Acquisition Title Opinion is a critical legal document that assesses and confirms the ownership rights of a property in Guam, a US territory located in the Western Pacific. This document is crucial during various real estate transactions, such as purchases, leases, and mortgage applications. It ensures a clear and marketable title to the property while protecting the interests of buyers and lenders. A Guam Acquisition Title Opinion encompasses a comprehensive examination of property records including deeds, mortgages, liens, judgments, tax assessments, and any other encumbrances that might affect the property's title. By thoroughly reviewing these records, the attorney or title examiner strives to identify any issues or defects in the title that could hinder the transfer or use of the property. Keywords: Guam Acquisition Title Opinion, property ownership rights, Guam, US territory, real estate transactions, purchase, lease, mortgage application, clear title, marketable title, buyer protection, lender protection, property records, deeds, mortgages, liens, judgments, tax assessments, encumbrances, title defects, transfer of property, use of property. Different types of Guam Acquisition Title Opinions may include: 1. Full Title Opinion: This type of opinion provides a detailed examination of all available property records, ensuring a thorough assessment of the title's marketability. It highlights any potential issues that require resolution before the property transfer is finalized. 2. Limited Title Opinion: In some cases, a limited opinion may be requested, focusing on specific aspects of the property's title, for instance, only analyzing recent conveyances or mortgage transactions. This opinion provides a narrower assessment but still addresses potential concerns. 3. Lender's Title Opinion: When lenders are involved in a transaction, they typically request a lender's title opinion to safeguard their financial interest in the property. This opinion specifically concentrates on any liens, encumbrances, or potential risks that could affect the lender's security. 4. Construction Loan Title Opinion: When funding a construction project in Guam, a specialized title opinion is often required. This opinion assesses the title's suitability for the construction financing, ensuring the lender's investment is adequately protected. 5. Gap Title Opinion: In situations where there is a significant time gap between the initial title search and the actual property transfer, a gap title opinion is sometimes necessary. This opinion confirms that no new issues affecting the title have arisen within the gap period. Keywords: Full Title Opinion, Limited Title Opinion, Lender's Title Opinion, Construction Loan Title Opinion, Gap Title Opinion, marketability, property transfer, conveyances, mortgage transactions, liens, encumbrances, financial interest, security, construction financing.

Guam Acquisition Title Opinion

Description

How to fill out Guam Acquisition Title Opinion?

US Legal Forms - one of the largest libraries of legal types in the States - offers an array of legal document web templates it is possible to download or print out. Making use of the website, you may get a huge number of types for enterprise and specific purposes, categorized by groups, states, or keywords.You will discover the most recent types of types such as the Guam Acquisition Title Opinion within minutes.

If you already possess a membership, log in and download Guam Acquisition Title Opinion in the US Legal Forms local library. The Obtain button can look on each form you see. You gain access to all earlier acquired types inside the My Forms tab of the accounts.

If you would like use US Legal Forms the first time, listed here are easy recommendations to help you get started out:

- Ensure you have picked the correct form for your personal town/county. Click on the Preview button to check the form`s content material. Browse the form description to actually have chosen the appropriate form.

- In case the form doesn`t satisfy your demands, use the Search area at the top of the screen to find the the one that does.

- If you are pleased with the form, confirm your decision by simply clicking the Get now button. Then, pick the costs program you prefer and offer your qualifications to sign up for the accounts.

- Approach the financial transaction. Utilize your charge card or PayPal accounts to finish the financial transaction.

- Select the file format and download the form on the gadget.

- Make alterations. Fill up, revise and print out and indicator the acquired Guam Acquisition Title Opinion.

Each web template you added to your money does not have an expiration particular date and it is the one you have for a long time. So, if you would like download or print out one more backup, just go to the My Forms area and then click on the form you want.

Get access to the Guam Acquisition Title Opinion with US Legal Forms, by far the most comprehensive local library of legal document web templates. Use a huge number of skilled and status-specific web templates that meet your small business or specific demands and demands.