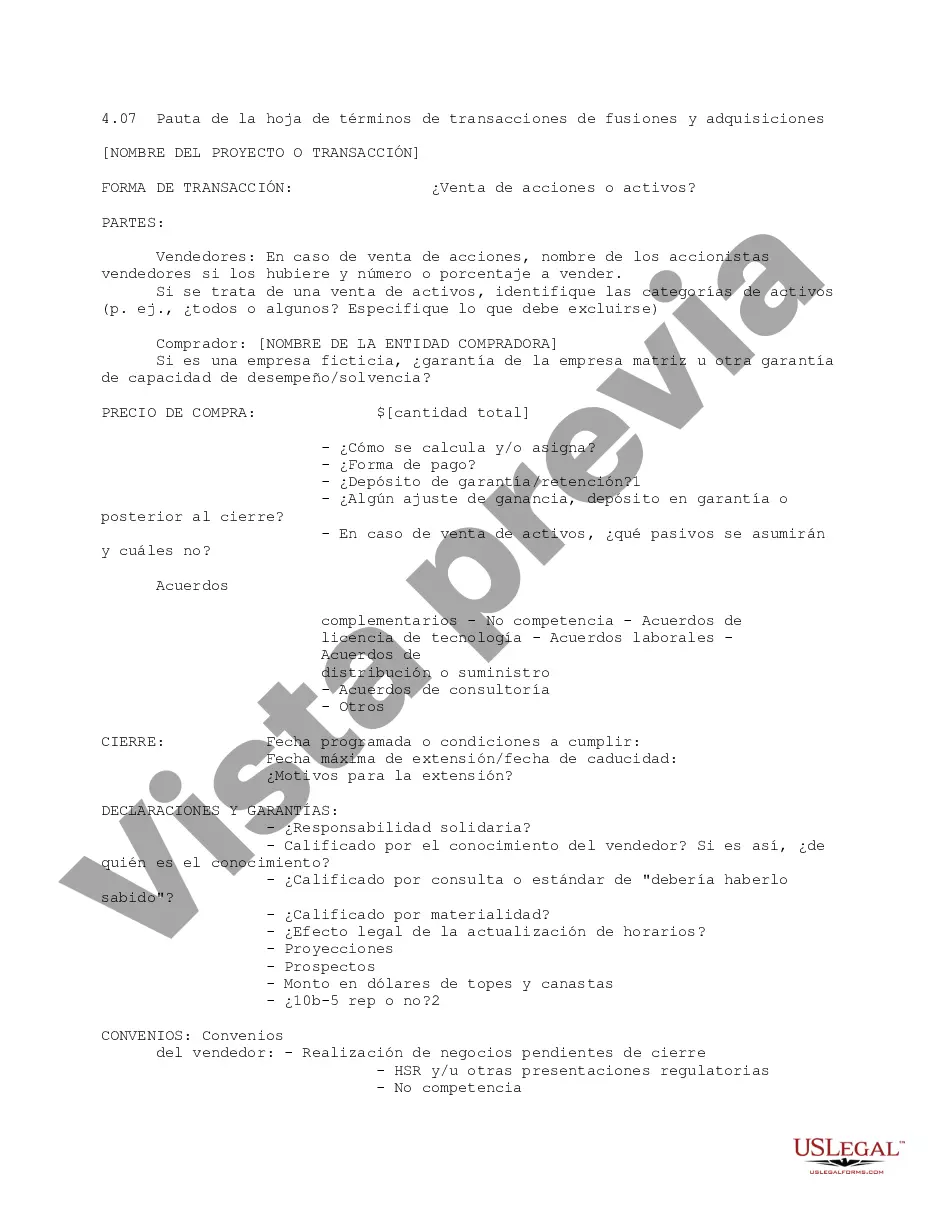

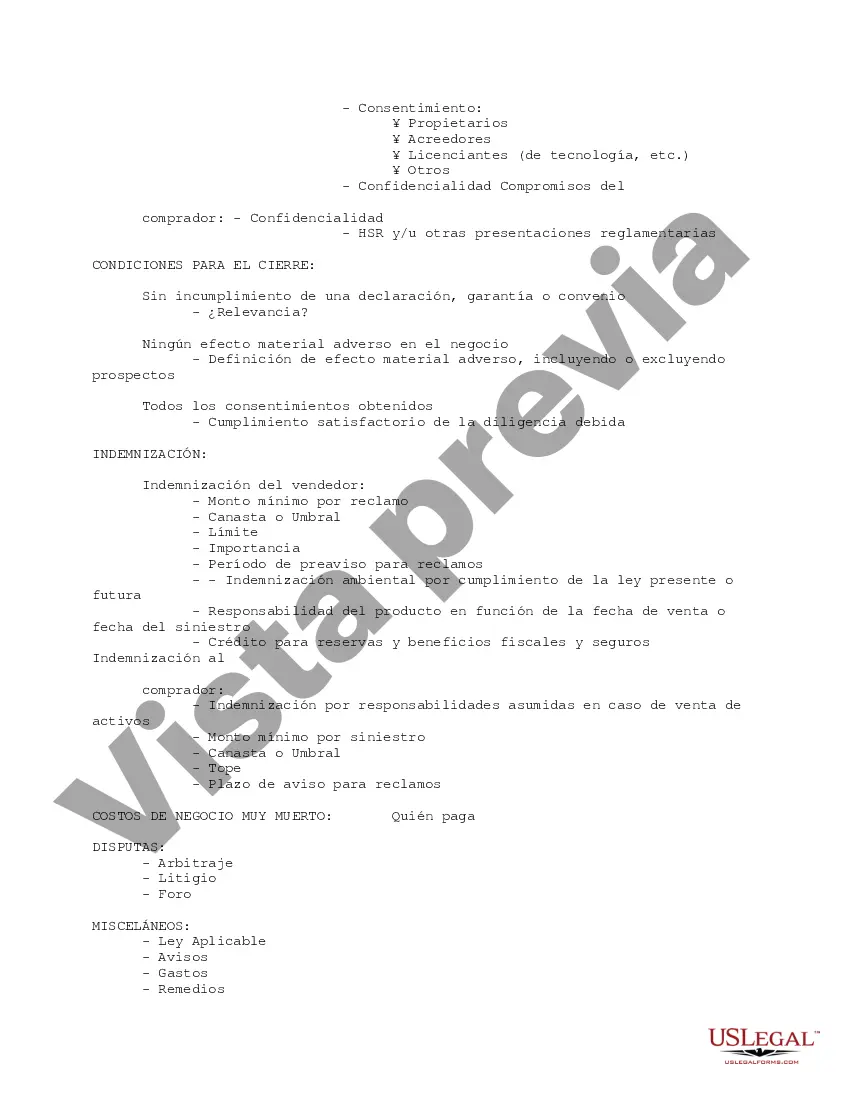

This is a checklist of considerations for a mergers and acquisitions transaction term sheet. It is a point-by-point reminder to consider whether it is a stock or asset sale, points on closing and warranties, covenants, indemnification, and other areas.

Guam M&A Transaction Term Sheet Guideline refers to a comprehensive document that outlines the key terms and conditions of a merger or acquisition agreement specifically tailored for transactions involving companies in Guam. This document serves as a guideline or template for negotiating and finalizing the terms of the deal between the buyer and the seller. The Guam M&A Transaction Term Sheet Guideline covers various aspects of the transaction, ensuring that all parties involved have a clear understanding of the terms and conditions before proceeding with the deal. It typically includes the following key elements: 1. Parties involved: Identifies the buyer and the seller, along with any other relevant parties participating in the transaction. 2. Effective date: States the date from which the terms and conditions of the agreement become effective. 3. Purchase price: Specifies the agreed-upon purchase price for the acquisition of the target company or assets. 4. Payment terms: Outlines the details of how and when the payment will be made, including any installment payments or adjustment mechanisms. 5. Transaction structure: Defines whether the transaction is structured as a stock purchase, asset purchase, or any other form applicable in M&A deals. 6. Representations and warranties: Details the representations and warranties made by both parties regarding the accuracy and completeness of the information provided, the legal standing of the company, and any other relevant aspects. 7. Due diligence: Specifies the scope and extent of the due diligence to be conducted by the buyer before the deal's completion. 8. Conditions precedent: Outlines any necessary conditions or requirements that must be fulfilled before the transaction can be completed, such as obtaining necessary regulatory approvals or third-party consents. 9. Allocation of liabilities: Addresses how any liabilities or risks associated with the target company will be allocated between the buyer and the seller. 10. Termination clauses: Describes the circumstances under which either party can terminate the agreement, including any penalties or remedies in case of breach. 11. Confidentiality and exclusivity: Sets forth provisions ensuring the confidential nature of the discussions and stipulates any exclusivity period during which the seller can't enter into negotiations with other potential buyers. 12. Governing law and jurisdiction: Determines the jurisdiction whose laws will govern the agreement and the forum for any disputes arising from the transaction. While there may not be specific types or variations of Guam M&A Transaction Term Sheet Guideline, the content may differ depending on the complexity and nature of the transaction. For instance, there might be variations for deals involving specific industries such as finance, real estate, or telecommunications. Furthermore, modifications might be made to accommodate unique elements or regulations relevant to Guam's legal environment.Guam M&A Transaction Term Sheet Guideline refers to a comprehensive document that outlines the key terms and conditions of a merger or acquisition agreement specifically tailored for transactions involving companies in Guam. This document serves as a guideline or template for negotiating and finalizing the terms of the deal between the buyer and the seller. The Guam M&A Transaction Term Sheet Guideline covers various aspects of the transaction, ensuring that all parties involved have a clear understanding of the terms and conditions before proceeding with the deal. It typically includes the following key elements: 1. Parties involved: Identifies the buyer and the seller, along with any other relevant parties participating in the transaction. 2. Effective date: States the date from which the terms and conditions of the agreement become effective. 3. Purchase price: Specifies the agreed-upon purchase price for the acquisition of the target company or assets. 4. Payment terms: Outlines the details of how and when the payment will be made, including any installment payments or adjustment mechanisms. 5. Transaction structure: Defines whether the transaction is structured as a stock purchase, asset purchase, or any other form applicable in M&A deals. 6. Representations and warranties: Details the representations and warranties made by both parties regarding the accuracy and completeness of the information provided, the legal standing of the company, and any other relevant aspects. 7. Due diligence: Specifies the scope and extent of the due diligence to be conducted by the buyer before the deal's completion. 8. Conditions precedent: Outlines any necessary conditions or requirements that must be fulfilled before the transaction can be completed, such as obtaining necessary regulatory approvals or third-party consents. 9. Allocation of liabilities: Addresses how any liabilities or risks associated with the target company will be allocated between the buyer and the seller. 10. Termination clauses: Describes the circumstances under which either party can terminate the agreement, including any penalties or remedies in case of breach. 11. Confidentiality and exclusivity: Sets forth provisions ensuring the confidential nature of the discussions and stipulates any exclusivity period during which the seller can't enter into negotiations with other potential buyers. 12. Governing law and jurisdiction: Determines the jurisdiction whose laws will govern the agreement and the forum for any disputes arising from the transaction. While there may not be specific types or variations of Guam M&A Transaction Term Sheet Guideline, the content may differ depending on the complexity and nature of the transaction. For instance, there might be variations for deals involving specific industries such as finance, real estate, or telecommunications. Furthermore, modifications might be made to accommodate unique elements or regulations relevant to Guam's legal environment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.