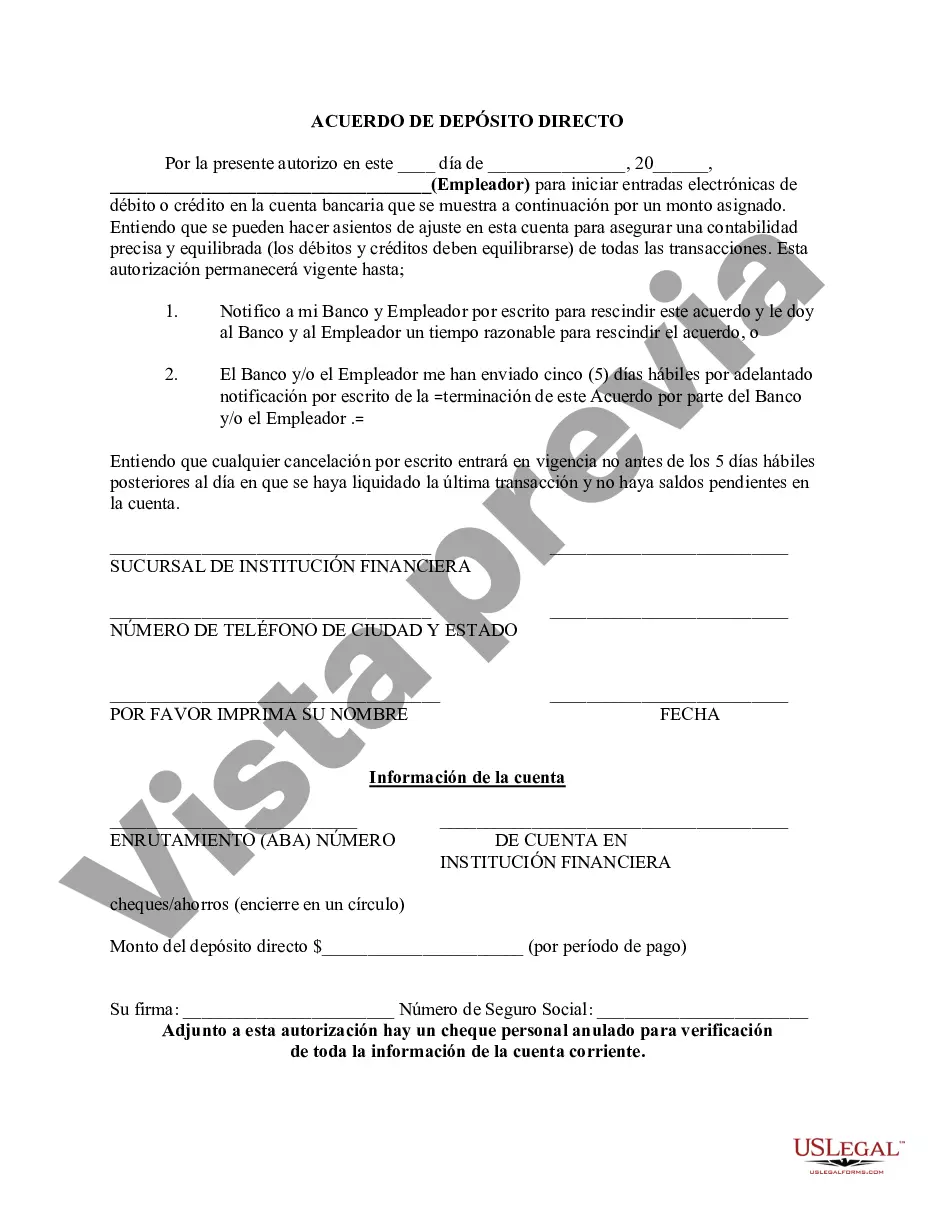

The Hawaii Direct Deposit Form for Employer is a document that facilitates the electronic transfer of funds from an employer's bank account to their employee's bank account. It eliminates the need for issuing paper checks, providing a more efficient and convenient method of payment. This form serves as a formal agreement between the employer and employee, authorizing the employer to deposit the employee's wages directly into their designated bank account. The Hawaii Direct Deposit Form typically consists of several sections, including personal information, bank account details, and authorization. The personal information section requires the employee to provide their full name, address, social security number, and contact information. This ensures that the employer can accurately identify and process the direct deposit. Next, the form asks the employee to provide their bank account details. This includes the bank name, routing number, and account number. It is crucial to double-check these details for accuracy to avoid any payment errors. Additionally, the employee may have the option to split their direct deposit into multiple accounts by specifying the allocation percentages for each account, if applicable. The authorization section of the form requires the employee's signature, indicating their consent and acknowledgment of the direct deposit arrangement. By signing the form, the employee agrees to receive their wages through direct deposit and acknowledges that they are responsible for providing accurate information. It is important to note that there might be different types or variations of the Hawaii Direct Deposit Form for Employer, depending on the specific employer or company. These variations may include additional fields or sections tailored to the employer's requirements or industry regulations. Employers may also have their own customized direct deposit forms, but they must comply with the relevant state laws and regulations governing direct deposit in Hawaii. In summary, the Hawaii Direct Deposit Form for Employer streamlines the payment process by allowing employers to electronically deposit employees' wages directly into their bank accounts. It requires employees to provide personal and bank account information and obtain their authorization through a signature. Different variations of the form may exist to cater to the specific needs of employers while adhering to Hawaii state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Formulario de depósito directo para el empleador - Direct Deposit Form for Employer

Description

How to fill out Hawaii Formulario De Depósito Directo Para El Empleador?

Discovering the right legal document design could be a have a problem. Of course, there are a variety of themes available on the net, but how can you obtain the legal develop you require? Take advantage of the US Legal Forms site. The assistance provides thousands of themes, including the Hawaii Direct Deposit Form for Employer, which can be used for business and personal needs. Every one of the types are checked by specialists and fulfill state and federal requirements.

In case you are presently listed, log in in your profile and click the Obtain option to have the Hawaii Direct Deposit Form for Employer. Utilize your profile to appear throughout the legal types you have ordered previously. Go to the My Forms tab of the profile and have one more backup of the document you require.

In case you are a fresh user of US Legal Forms, allow me to share simple recommendations for you to stick to:

- First, be sure you have chosen the correct develop for the area/region. You are able to check out the shape making use of the Preview option and study the shape information to guarantee this is the best for you.

- If the develop does not fulfill your needs, take advantage of the Seach discipline to discover the proper develop.

- Once you are sure that the shape would work, click the Purchase now option to have the develop.

- Select the rates strategy you desire and enter in the necessary info. Make your profile and pay for an order with your PayPal profile or charge card.

- Choose the file formatting and obtain the legal document design in your device.

- Complete, modify and print out and indication the received Hawaii Direct Deposit Form for Employer.

US Legal Forms is definitely the biggest library of legal types that you can see various document themes. Take advantage of the company to obtain professionally-created documents that stick to status requirements.