- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. Hawaii Direct Deposit Agreement is a formal agreement between an individual or business and a financial institution in the state of Hawaii, specifically pertaining to the direct deposit of funds into a designated account. Direct deposit is a convenient and secure method of transferring funds electronically, eliminating the need for paper checks and physical transactions. The Hawaii Direct Deposit Agreement typically defines the terms and conditions under which the direct deposit service will be provided. It outlines the responsibilities and obligations of both the account holder and the financial institution, ensuring a smooth and efficient process for depositing funds. Some important elements covered in the agreement include: 1. Account Information: The agreement identifies the account details, such as the account holder's name, account number, and routing number. This information ensures that the correct account receives the deposited funds. 2. Authorization: The agreement includes the account holder's explicit consent and authorization for the financial institution to receive and deposit funds on their behalf. This authorization usually continues until cancelled or modified by the account holder. 3. Funding Sources: The agreement may specify the types of funds eligible for direct deposit, such as salary, government benefits, or other income sources. It helps in clarifying the legitimacy of the funds and ensuring compliance with legal and regulatory requirements. 4. Deposit Timing: The agreement outlines the expected timeline for funds to be deposited into the account, which varies depending on the specific source and financial institution. It may also include information about any potential delays or processing times. 5. Notification: The agreement may require the financial institution to provide the account holder with notifications regarding each direct deposit, including the amount and date deposited. These notifications can be useful for record-keeping and tracking purposes. It is important to note that while the general structure of the Hawaii Direct Deposit Agreement remains consistent, there may be variations or specific types depending on the financial institution or the nature of the account. However, the underlying purpose of these agreements is to facilitate efficient and secure electronic fund transfers, benefiting both individuals and businesses.

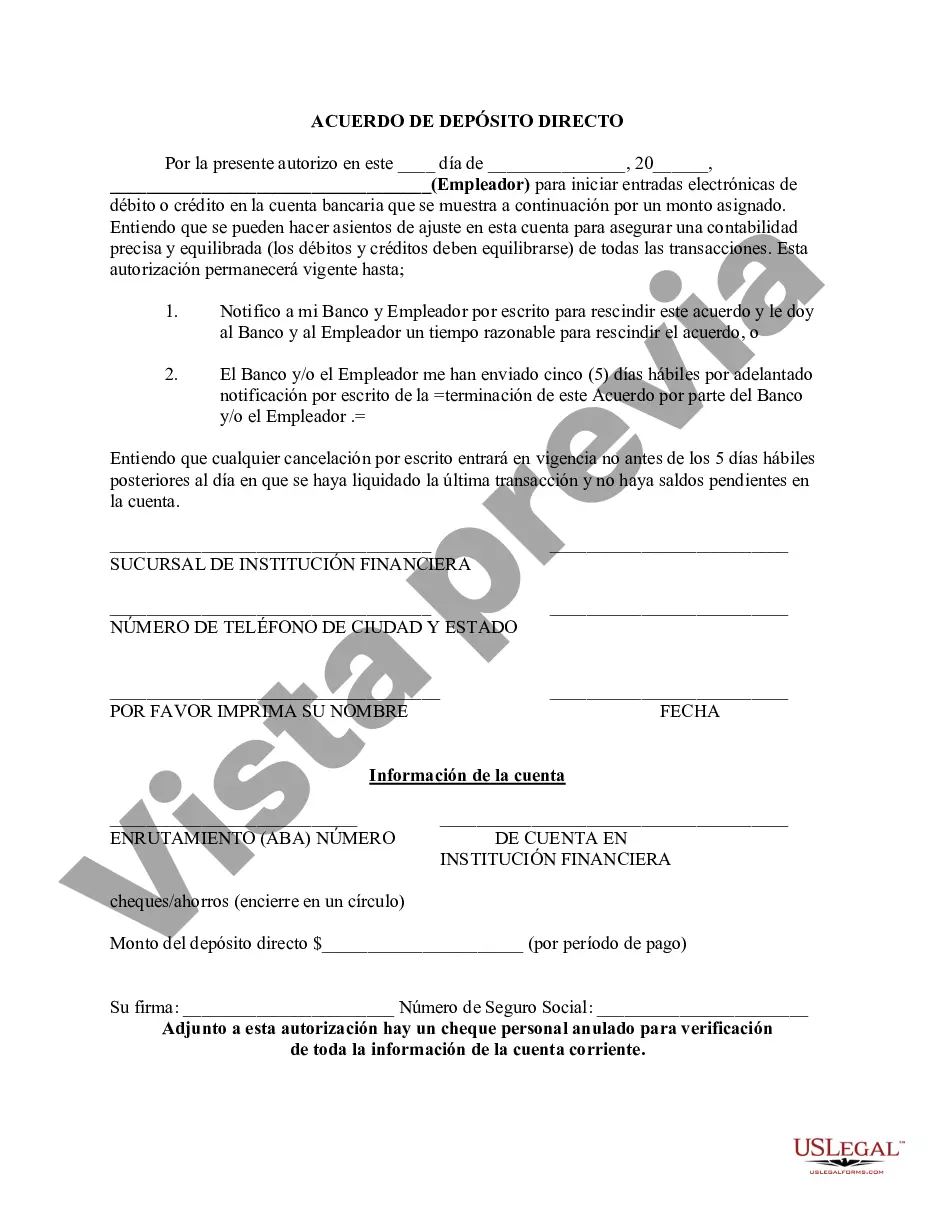

Hawaii Direct Deposit Agreement is a formal agreement between an individual or business and a financial institution in the state of Hawaii, specifically pertaining to the direct deposit of funds into a designated account. Direct deposit is a convenient and secure method of transferring funds electronically, eliminating the need for paper checks and physical transactions. The Hawaii Direct Deposit Agreement typically defines the terms and conditions under which the direct deposit service will be provided. It outlines the responsibilities and obligations of both the account holder and the financial institution, ensuring a smooth and efficient process for depositing funds. Some important elements covered in the agreement include: 1. Account Information: The agreement identifies the account details, such as the account holder's name, account number, and routing number. This information ensures that the correct account receives the deposited funds. 2. Authorization: The agreement includes the account holder's explicit consent and authorization for the financial institution to receive and deposit funds on their behalf. This authorization usually continues until cancelled or modified by the account holder. 3. Funding Sources: The agreement may specify the types of funds eligible for direct deposit, such as salary, government benefits, or other income sources. It helps in clarifying the legitimacy of the funds and ensuring compliance with legal and regulatory requirements. 4. Deposit Timing: The agreement outlines the expected timeline for funds to be deposited into the account, which varies depending on the specific source and financial institution. It may also include information about any potential delays or processing times. 5. Notification: The agreement may require the financial institution to provide the account holder with notifications regarding each direct deposit, including the amount and date deposited. These notifications can be useful for record-keeping and tracking purposes. It is important to note that while the general structure of the Hawaii Direct Deposit Agreement remains consistent, there may be variations or specific types depending on the financial institution or the nature of the account. However, the underlying purpose of these agreements is to facilitate efficient and secure electronic fund transfers, benefiting both individuals and businesses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.