The Hawaii Assumption Agreement of Loan Payments is a legal document that allows a borrower to transfer their loan to another party, often referred to as the "assumption". This agreement is commonly used when a property is being sold, and the new owner wishes to take over the existing loan instead of obtaining a new one. The assumption agreement typically outlines the terms and conditions of the original loan, including the outstanding balance, interest rate, repayment schedule, and any other pertinent details. It serves as a binding agreement between the current borrower, the assumption, and the lender. The Hawaii Assumption Agreement of Loan Payments is an essential tool in real estate transactions, facilitating the transfer of debts owed by the seller to the buyer. By assuming the loan, the buyer is not required to secure a new loan or go through the lengthy loan application process. This can save time, paperwork, and potentially even money in certain situations. There are different types of Hawaii Assumption Agreement of Loan Payments, depending on the type of loan being assumed and the specific requirements of the lender. The most common types include: 1. Conventional Loan Assumption Agreement: This type of assumption agreement is used for conventional mortgage loans, which are not insured or guaranteed by any government agency. It may involve a credit check and qualification process for the assumption, as determined by the lender. 2. FHA Loan Assumption Agreement: The Federal Housing Administration (FHA) allows for the assumption of FHA-insured loans, subject to certain conditions. The assumption must meet the FHA's eligibility criteria, including creditworthiness and ability to repay. 3. VA Loan Assumption Agreement: The Department of Veterans Affairs (VA) also permits the assumption of VA-guaranteed loans. The assumption must be an eligible veteran or meet specific requirements outlined by the VA. It's important to note that not all loans are assumable, and even if they are, the lender's approval is typically required before the assumption can take place. Additionally, the assumption may be required to pay assumption fees and meet certain financial qualifications. In summary, the Hawaii Assumption Agreement of Loan Payments is a legal document that allows for the transfer of loan obligations from the current borrower to a new buyer. It streamlines the loan acquisition process and saves the buyer from applying for a new loan. Different types of assumption agreements exist, including conventional, FHA, and VA loan assumptions, each with their own set of criteria and requirements.

Hawaii Assumption Agreement of Loan Payments

Description

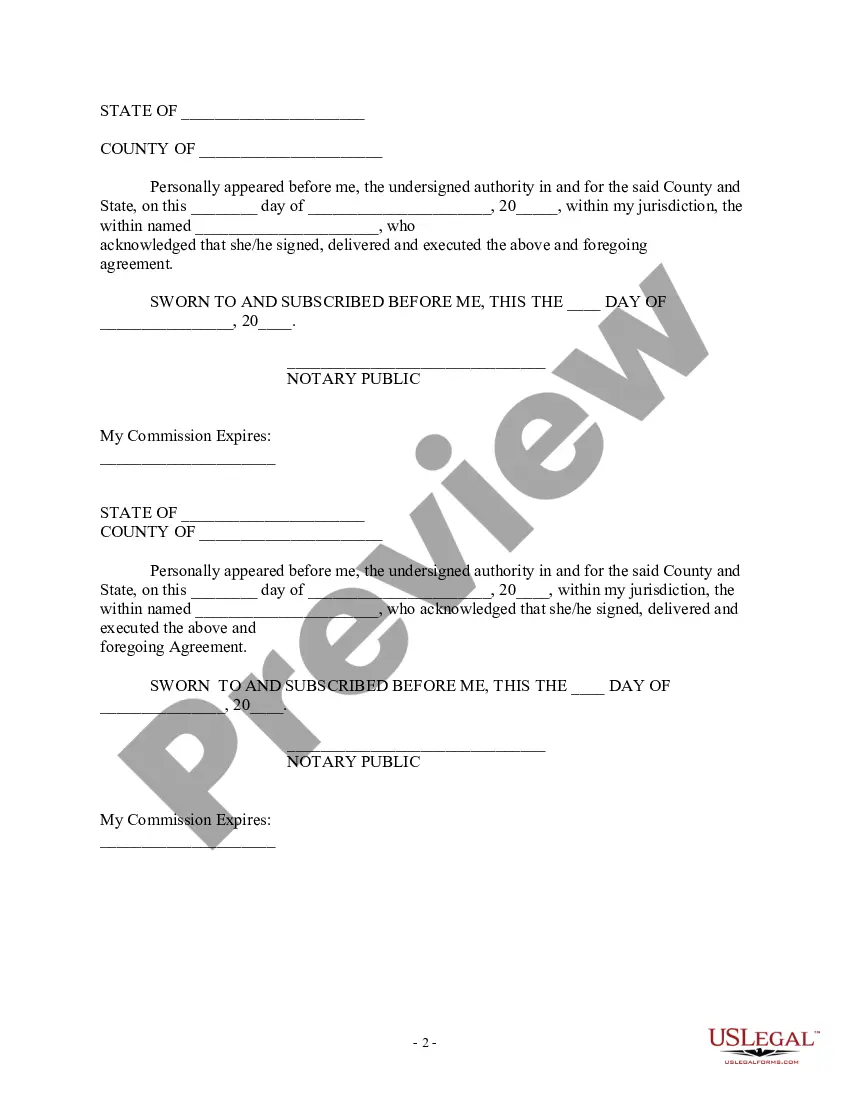

How to fill out Hawaii Assumption Agreement Of Loan Payments?

Finding the right legitimate file design might be a have difficulties. Needless to say, there are tons of templates available on the Internet, but how would you find the legitimate kind you require? Utilize the US Legal Forms website. The support delivers 1000s of templates, like the Hawaii Assumption Agreement of Loan Payments, which you can use for organization and personal needs. Each of the kinds are checked by experts and meet federal and state specifications.

When you are already signed up, log in to your account and click on the Down load option to get the Hawaii Assumption Agreement of Loan Payments. Utilize your account to check with the legitimate kinds you might have ordered earlier. Proceed to the My Forms tab of the account and obtain another duplicate in the file you require.

When you are a whole new end user of US Legal Forms, here are basic recommendations that you should follow:

- Very first, be sure you have selected the correct kind to your metropolis/area. You can look through the form utilizing the Review option and study the form description to guarantee it is the best for you.

- In case the kind fails to meet your preferences, utilize the Seach discipline to find the proper kind.

- Once you are sure that the form is acceptable, click on the Get now option to get the kind.

- Pick the prices plan you desire and enter in the required information. Design your account and buy an order utilizing your PayPal account or bank card.

- Opt for the submit structure and download the legitimate file design to your product.

- Comprehensive, edit and print and signal the received Hawaii Assumption Agreement of Loan Payments.

US Legal Forms may be the largest library of legitimate kinds where you can discover various file templates. Utilize the service to download skillfully-manufactured files that follow status specifications.