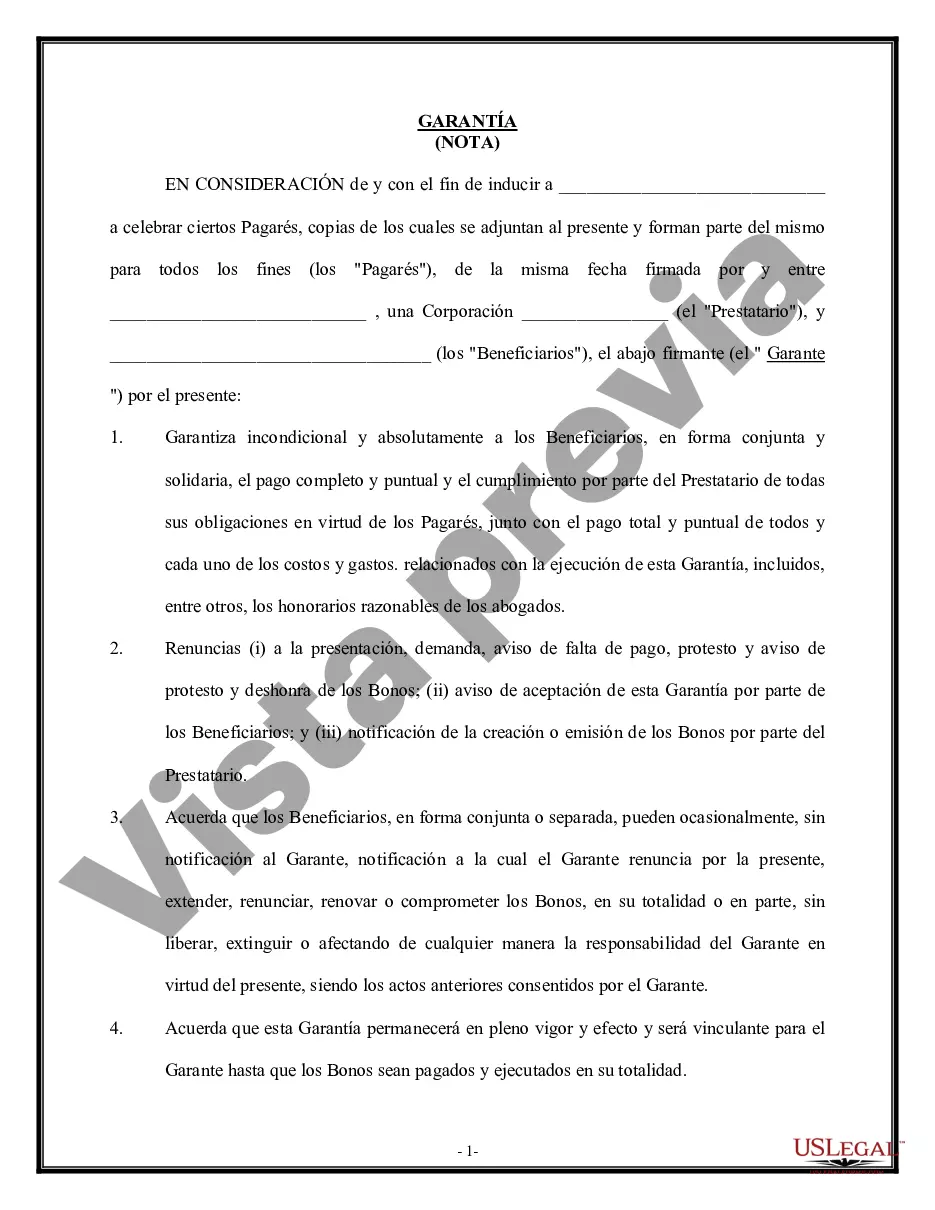

The Hawaii Guaranty of Promissory Note by Individual — Corporate Borrower is a legal document that serves as a guarantee for the repayment of a promissory note by a corporate borrower. In this type of guaranty, an individual (the guarantor) agrees to be personally responsible for the repayment of a promissory note issued by a corporate borrower if the borrower fails to fulfill its obligations. The guarantor essentially acts as a co-signer for the loan, ensuring that the lender receives payment even if the corporate borrower defaults. The guaranty typically outlines the terms and conditions under which the guarantor will assume responsibility for the loan. This includes the amount of the loan, the interest rate, the repayment schedule, and any other relevant terms and conditions specified in the promissory note. It is important to note that there may be different types of Guaranty of Promissory Note by Individual — Corporate Borrower in Hawaii, depending on the specific circumstances and requirements of the lender. These variations may include specific provisions or clauses tailored to the unique needs of the lender or borrower. Some possible variations of the Hawaii Guaranty of Promissory Note by Individual — Corporate Borrower could include: 1. Limited Guaranty: This type of guaranty limits the guarantor's obligation to a specific amount or time frame. For example, the guarantor may only be responsible for a certain percentage of the debt or for a set period. 2. Unconditional Guaranty: In this type of guaranty, the guarantor agrees to be fully responsible for the repayment of the promissory note without any limitations or conditions. 3. Continuing Guaranty: A continuing guaranty is a long-term guarantee where the guarantor remains responsible for the repayment of the promissory note until the debt is fully paid off or until the guarantor is released from the obligation by the lender. 4. Specific Performance Guaranty: This type of guaranty allows the lender to seek specific performance from the guarantor if the corporate borrower defaults on the loan. This means that the guarantor can be compelled by a court to fulfill their obligation to repay the debt. It is important for both the guarantor and the corporate borrower to carefully review the terms of the guaranty and seek legal advice if necessary before signing the document. This will ensure that both parties fully understand their rights and obligations regarding the repayment of the promissory note.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Garantía de Pagaré por Individuo - Prestatario Corporativo - Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Hawaii Garantía De Pagaré Por Individuo - Prestatario Corporativo?

If you have to complete, acquire, or print legitimate papers layouts, use US Legal Forms, the biggest collection of legitimate varieties, which can be found online. Make use of the site`s easy and practical lookup to discover the paperwork you want. A variety of layouts for company and personal uses are sorted by groups and claims, or keywords. Use US Legal Forms to discover the Hawaii Guaranty of Promissory Note by Individual - Corporate Borrower in just a couple of click throughs.

When you are presently a US Legal Forms client, log in to your account and click the Obtain switch to find the Hawaii Guaranty of Promissory Note by Individual - Corporate Borrower. You can even accessibility varieties you previously downloaded in the My Forms tab of your respective account.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for your appropriate town/nation.

- Step 2. Make use of the Preview solution to look over the form`s content material. Do not forget to read through the outline.

- Step 3. When you are not satisfied using the form, take advantage of the Look for field at the top of the display screen to discover other types of your legitimate form format.

- Step 4. After you have found the form you want, select the Get now switch. Opt for the rates strategy you like and add your accreditations to sign up to have an account.

- Step 5. Procedure the deal. You may use your Мisa or Ьastercard or PayPal account to complete the deal.

- Step 6. Choose the file format of your legitimate form and acquire it on your device.

- Step 7. Total, change and print or sign the Hawaii Guaranty of Promissory Note by Individual - Corporate Borrower.

Each legitimate papers format you get is your own property forever. You may have acces to each and every form you downloaded with your acccount. Click the My Forms section and decide on a form to print or acquire once again.

Remain competitive and acquire, and print the Hawaii Guaranty of Promissory Note by Individual - Corporate Borrower with US Legal Forms. There are millions of professional and state-specific varieties you can utilize for the company or personal demands.