Hawaii Lease of Restaurant

Description

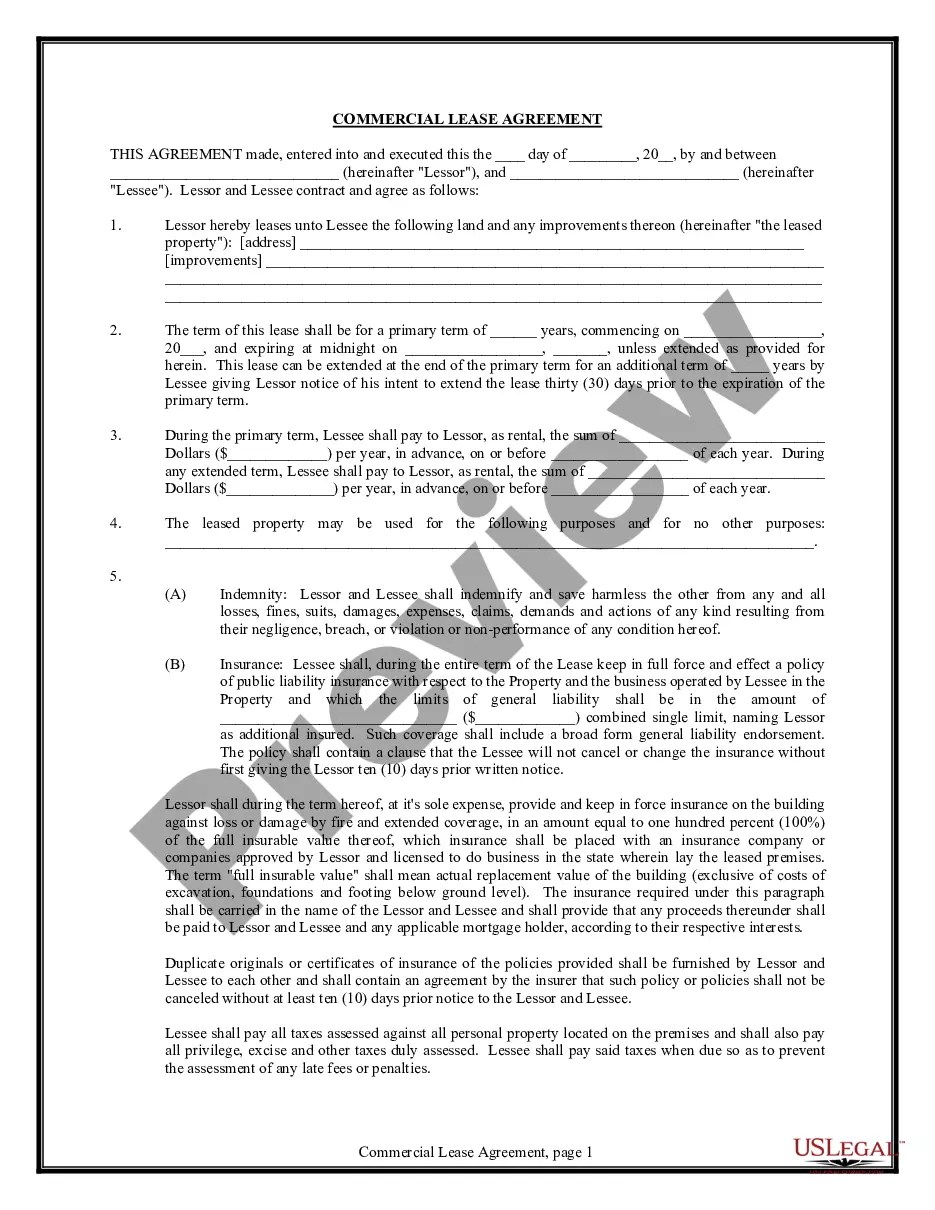

How to fill out Lease Of Restaurant?

It is feasible to spend hours online looking for the official document template that meets the state and federal requirements you have.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can easily download or print the Hawaii Lease of Restaurant from the platform.

If available, use the Review button to browse through the document template as well.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, edit, print, or sign the Hawaii Lease of Restaurant.

- Every legal document template you obtain is yours permanently.

- To get another copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city you choose.

- Check the form details to ensure you have selected the appropriate form.

Form popularity

FAQ

While breaking a lease should be approached with caution, common legitimate excuses include job relocation or significant family emergencies. However, these reasons must be documented and communicated to the landlord properly. Always refer back to your Hawaii Lease of Restaurant to gauge your rights and responsibilities before deciding to terminate the lease early. Consulting a legal professional can provide clarity and potential solutions.

The penalties for breaking a lease in Hawaii can include financial repercussions and legal actions. Typically, you could be responsible for paying rent until a new tenant is found to fill the space. Additionally, failure to abide by the lease terms may lead to legal disputes. It's vital to understand your lease terms thoroughly to minimize potential penalties.

Writing a lease agreement involves clearly outlining the terms of the rental arrangement. Include specifics such as rent amount, payment schedule, and rules for the property. Make sure to specify the duration of the lease and any clauses relating to breaking the lease. For effective drafting of a Hawaii Lease of Restaurant, consider using templates or legal services to ensure compliance with local laws.

tomonth lease agreement in Hawaii offers flexibility for both landlords and tenants. This type of lease allows you to rent a restaurant space on a shortterm basis, usually renewing every month. You can terminate the lease with proper notice, making it ideal for those exploring business opportunities without longterm commitments. For those interested in leasing a restaurant, understanding these terms is crucial.

Choosing the right type of ownership for your restaurant is crucial for your long-term success. Options include sole ownership, partnerships, or forming an LLC. Each type comes with different tax implications and liability protections. Assessing your business goals and consulting with a professional can help you determine the best fit, ensuring a solid foundation as you secure your Hawaii Lease of Restaurant.

The best type of commercial lease for your needs often depends on your business model and location. There are several types, including gross leases, net leases, and percentage leases. For a Hawaii Lease of Restaurant, a gross lease might simplify budgeting by covering many expenses in one monthly payment. Always read the lease terms in detail and consider seeking advice to ensure it fits your business needs.

The best business type for a restaurant usually depends on your specific vision and goals. Common structures include sole proprietorships, partnerships, and corporations. Each option has its unique benefits and legal implications, so it is crucial to weigh them carefully. Consulting your attorney can help you align your choice with your Hawaii Lease of Restaurant.

Most restaurant leases, including a Hawaii Lease of Restaurant, typically range from three to ten years. Longer leases often provide stability and predictability for business owners, while shorter leases offer flexibility. It's essential to consider your long-term business goals when choosing the length of your lease. Understanding the terms can help you make a more informed decision.

Filing a business in Hawaii involves several steps, including choosing a business structure and registering with the Department of Commerce and Consumer Affairs. You may also need to obtain a business license, especially if you plan to lease a restaurant. Utilizing resources like US Legal Forms can simplify the process and ensure compliance with legal requirements.

Hawaii does not have a sales tax; instead, it imposes a General Excise Tax at the rate of 4.712%. This tax applies to all business transactions in the state, including those related to your Hawaii Lease of Restaurant. Be sure to factor this into your overall business budgeting.