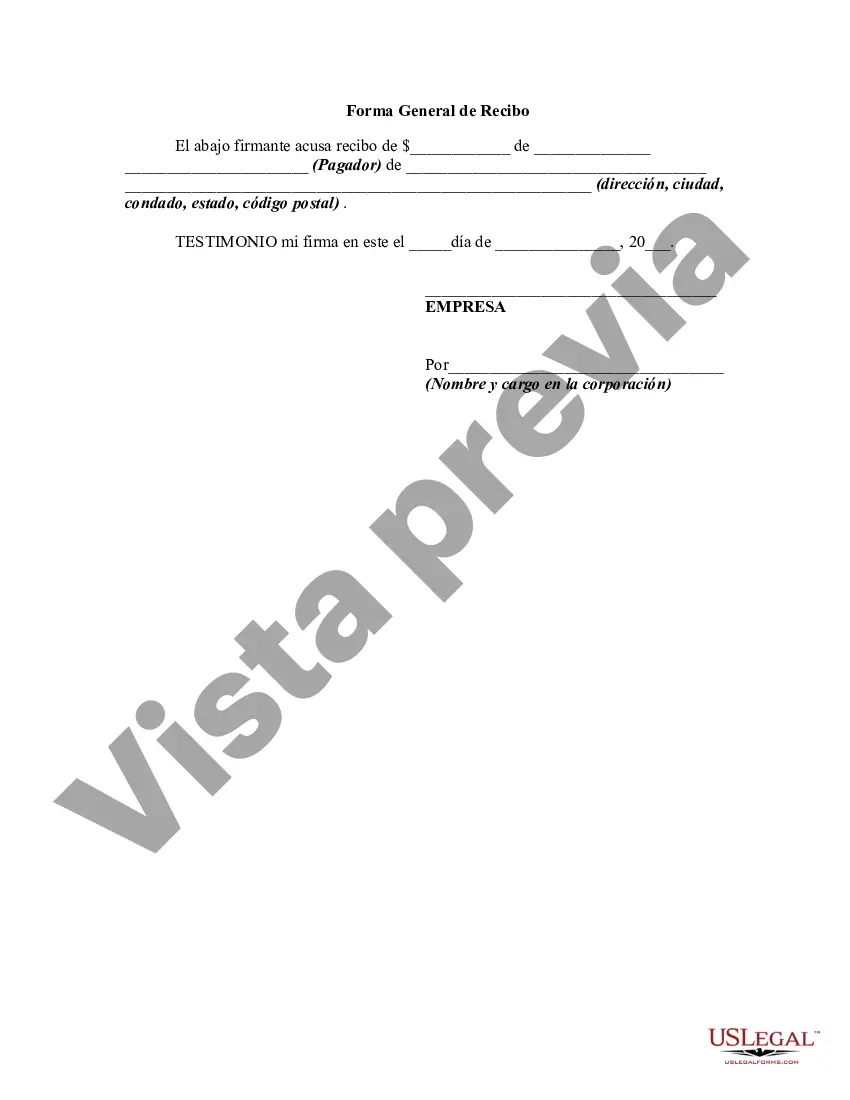

Hawaii General Form of Receipt is a legal document used in the state of Hawaii that serves as proof of payment or transaction. It is a standardized form designed to accurately record essential details of a transaction, allowing both the buyer and seller to maintain a record of the exchange. This versatile form is widely used in various industries and can be customized to accommodate specific requirements. The Hawaii General Form of Receipt typically includes the following key information: the date of the transaction, the name and contact details of the buyer and seller, a description of the goods or services provided, the quantity or duration of the transaction, the total amount paid, and the method of payment (cash, check, credit card, etc.). Moreover, it may also contain space for additional notes or terms and conditions agreed upon between the parties involved. There might be different types or variations of the Hawaii General Form of Receipt based on specific industries or purposes. Here are a few examples: 1. Retail Receipts: These are commonly used in retail stores, supermarkets, or shops for documenting sales of products. They include itemized details of each purchased item, its price, and any applicable taxes. 2. Service Receipts: These receipts are used for service-based businesses, such as salons, repair shops, or consultants. They outline the specific services rendered, the duration or time spent, and any associated charges or fees. 3. Rental Receipts: Rental businesses, whether for housing, vehicles, or equipment, utilize these receipts. They mention the rented item, the rental period, any additional charges (like late fees or damages), and the security deposit if applicable. 4. Donation Receipts: Non-profit organizations issue these receipts to acknowledge financial contributions or donations made by individuals or businesses. These receipts include the organization's details, the donated amount, and a statement confirming the tax-exempt status of the organization. It is important to note that while the Hawaii General Form of Receipt serves as a valuable record, it may not replace specific documents required for tax purposes, warranty claims, or other legal procedures. It is always advisable to consult with professionals or legal authorities to ensure compliance with relevant regulations and requirements specific to each situation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Forma General de Recibo - General Form of Receipt

Description

How to fill out Hawaii Forma General De Recibo?

If you need to complete, obtain, or print authorized file layouts, use US Legal Forms, the biggest assortment of authorized varieties, that can be found on the Internet. Utilize the site`s easy and convenient lookup to obtain the papers you need. Various layouts for company and person functions are categorized by categories and says, or keywords. Use US Legal Forms to obtain the Hawaii General Form of Receipt within a handful of clicks.

In case you are currently a US Legal Forms customer, log in for your account and then click the Download button to get the Hawaii General Form of Receipt. You can also gain access to varieties you previously downloaded inside the My Forms tab of your own account.

If you work with US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for that appropriate city/region.

- Step 2. Take advantage of the Review choice to look through the form`s content material. Do not overlook to read the description.

- Step 3. In case you are not happy together with the type, make use of the Search industry near the top of the display to discover other types from the authorized type design.

- Step 4. When you have located the shape you need, go through the Buy now button. Opt for the costs prepare you favor and put your credentials to sign up for an account.

- Step 5. Approach the financial transaction. You may use your credit card or PayPal account to complete the financial transaction.

- Step 6. Find the structure from the authorized type and obtain it on your own product.

- Step 7. Total, modify and print or indicator the Hawaii General Form of Receipt.

Every authorized file design you get is your own property for a long time. You possess acces to every single type you downloaded with your acccount. Click the My Forms segment and decide on a type to print or obtain yet again.

Remain competitive and obtain, and print the Hawaii General Form of Receipt with US Legal Forms. There are millions of specialist and status-certain varieties you may use to your company or person demands.