Title: Understanding Hawaii Sample Letter for Requesting a Free Credit Report, Permitted by Federal Law Introduction: In Hawaii, just like anywhere else in the United States, consumers have the right to obtain a free credit report every year, as mandated by the Federal Law. This article aims to provide a comprehensive overview of the Hawaii Sample Letter for Requesting a Free Credit Report, along with its variations. 1. What is a Free Credit Report? A free credit report is a document that outlines an individual's credit history, including details about their credit accounts, outstanding debts, payment history, and any negative marks on their credit file. It is essential for individuals to review their credit report regularly to ensure accuracy and detect any signs of identity theft or fraudulent activity. 2. The Importance of Requesting Regular Credit Reports: By obtaining a free credit report, individuals gain insight into their financial profile and evaluate their creditworthiness. Monitoring credit reports ensures financial health and empowers individuals to make informed decisions related to loans, mortgages, or even employment prospects. Timely identification of errors or suspicious activities can help prevent potential damage to their financial reputation. 3. How to Request a Free Credit Report in Hawaii: To request a free credit report in Hawaii, individuals can utilize the Hawaii Sample Letter, which adheres to federal guidelines. The letter should include personal information, such as full name, address, Social Security number, and date of birth. It should clearly state the intent to obtain a free credit report. 4. Different Types of Hawaii Sample Letters for Requesting Free Credit Reports: a. Initial Credit Report Request: Individuals who have never requested a credit report before or haven't done so in the past year can utilize this letter type to obtain their first free credit report. b. Annual Credit Report Request: This letter, commonly employed by individuals who have already used their free credit report for the current year, helps them request another copy at no cost. c. Additional Credit Report Requests: In certain circumstances, individuals may be eligible for additional free credit reports within a year. This letter type permits requesting a free credit report due to reasons like identity theft, fraud, or if the individual is unemployed and actively seeking employment. Remember, the text within the Hawaii Sample Letters should remain professional, concise, and focused on the purpose of requesting the credit report as per federal regulations. Following the guidelines outlined by the law can increase the chances of a successful request. Conclusion: Hawaii residents are entitled to a complimentary credit report annually, sanctioned by federal legislation. By utilizing the appropriate Hawaii Sample Letter, individuals can make efficient requests for their credit reports, enabling them to stay informed about their financial standing and detect any inaccuracies or fraudulent activities. Maintaining a vigilant approach towards monitoring credit reports helps protect personal finances and fosters financial well-being.

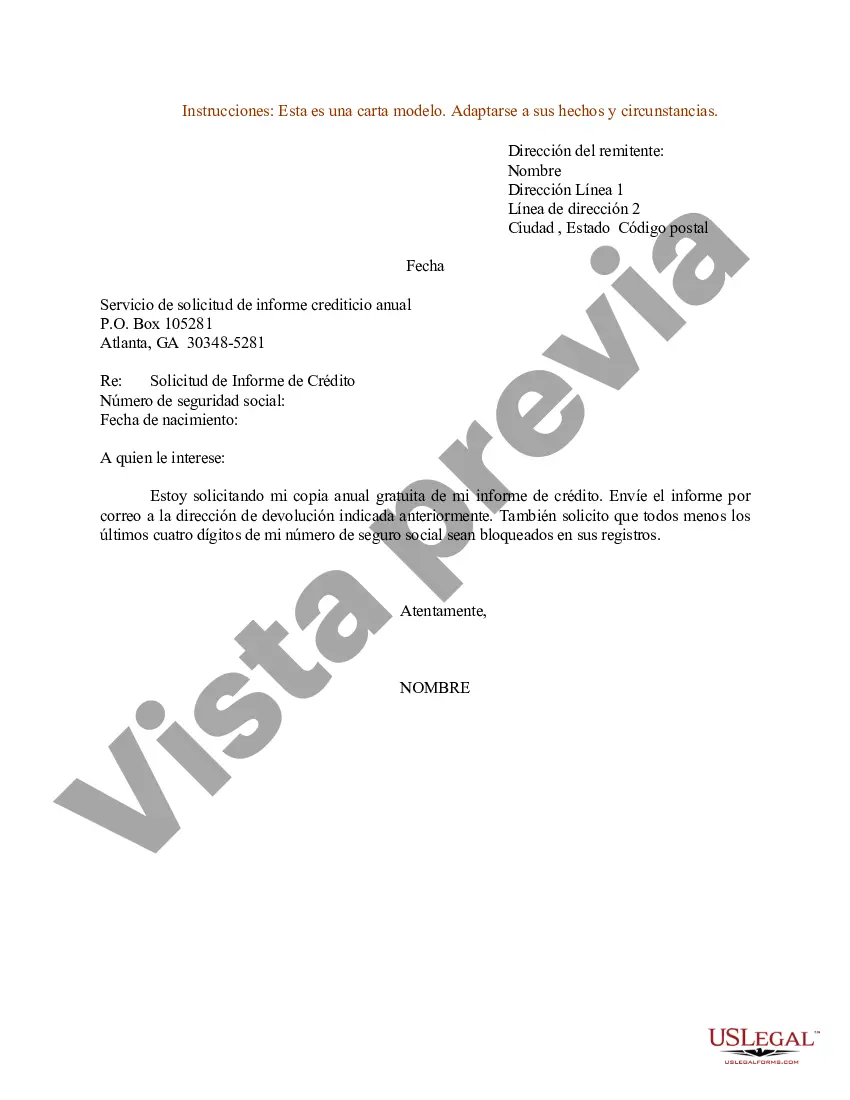

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Ejemplo de carta de solicitud de informe de crédito gratuito permitido por la ley federal - Sample Letter for Request for Free Credit Report Allowed by Federal Law

Description

How to fill out Hawaii Ejemplo De Carta De Solicitud De Informe De Crédito Gratuito Permitido Por La Ley Federal?

You may devote hours on the web searching for the authorized file web template which fits the state and federal needs you want. US Legal Forms offers thousands of authorized varieties which can be evaluated by experts. It is possible to obtain or print out the Hawaii Sample Letter for Request for Free Credit Report Allowed by Federal Law from our service.

If you currently have a US Legal Forms bank account, you can log in and click on the Down load button. Afterward, you can total, edit, print out, or signal the Hawaii Sample Letter for Request for Free Credit Report Allowed by Federal Law. Each and every authorized file web template you get is yours eternally. To obtain one more duplicate associated with a acquired kind, check out the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms internet site the first time, follow the easy guidelines under:

- Very first, make sure that you have chosen the proper file web template for your region/metropolis of your liking. See the kind information to make sure you have picked out the right kind. If readily available, take advantage of the Preview button to appear through the file web template as well.

- If you wish to discover one more model from the kind, take advantage of the Lookup discipline to find the web template that fits your needs and needs.

- After you have discovered the web template you want, simply click Get now to carry on.

- Find the prices strategy you want, key in your credentials, and register for a free account on US Legal Forms.

- Total the purchase. You can use your charge card or PayPal bank account to purchase the authorized kind.

- Find the formatting from the file and obtain it to the device.

- Make modifications to the file if necessary. You may total, edit and signal and print out Hawaii Sample Letter for Request for Free Credit Report Allowed by Federal Law.

Down load and print out thousands of file web templates while using US Legal Forms Internet site, which provides the largest selection of authorized varieties. Use specialist and condition-particular web templates to deal with your business or individual requires.