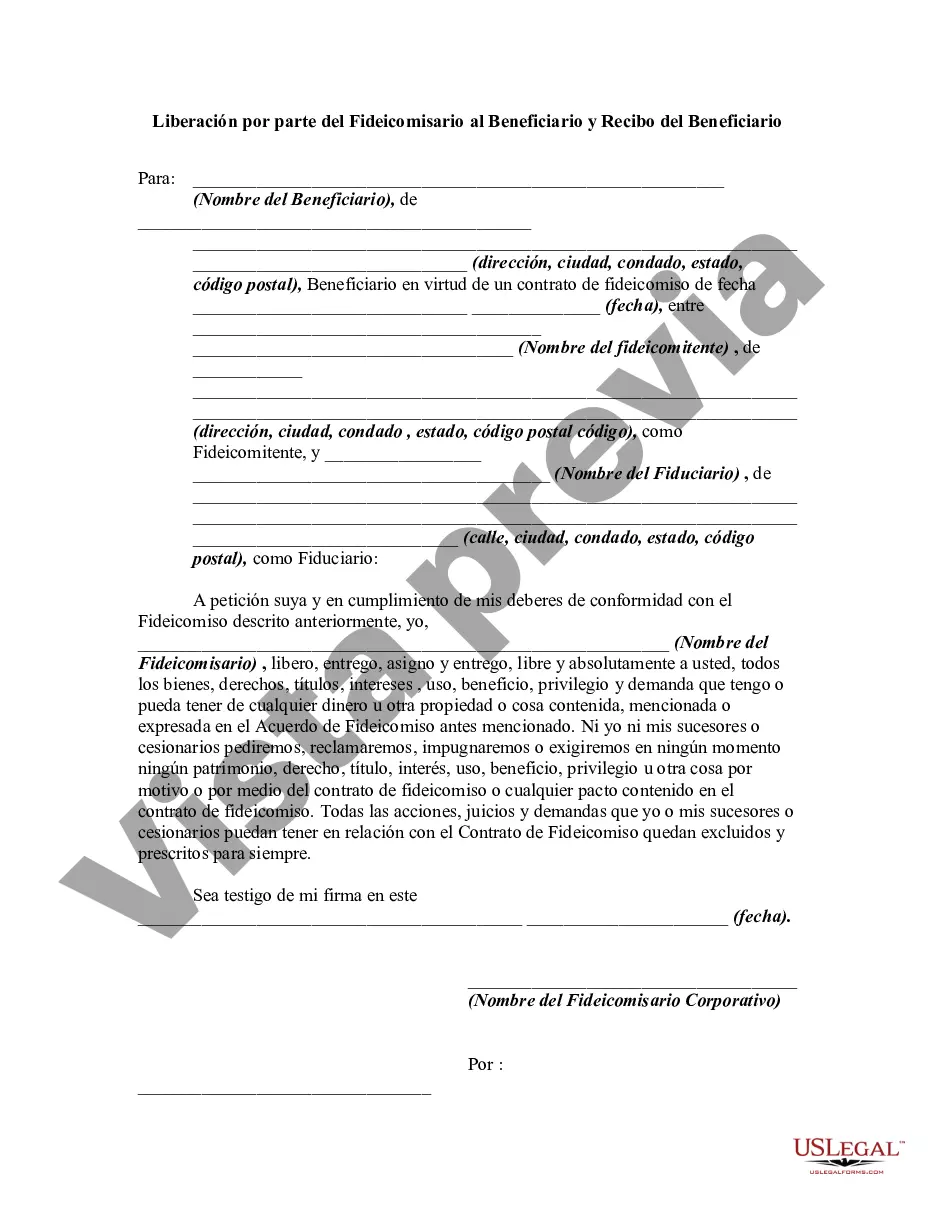

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document commonly used in trust administration. It is a formal acknowledgment, signed by both the trustee and beneficiary, which declares that the trustee has fulfilled their obligations and distributions towards the beneficiary. This document serves as evidence of the transfer of trust assets, and it ensures transparency and legal compliance in the overall trust management process. In Hawaii, there are several types of Release by Trustee to Beneficiary and Receipt from Beneficiary. Some of the most common types include: 1. Full Release: This type of release signifies the complete settlement of the trust. The trustee transfers all the trust assets to the beneficiary, and the beneficiary acknowledges full receipt and satisfaction of their entitlements. 2. Partial Release: In specific situations, a trust may be partially released. This occurs when the trustee distributes only a portion of the trust assets to the beneficiary, often due to specific conditions or limitations specified in the trust document. 3. Conditional Release: If there are specific terms or conditions set forth in the trust agreement, a conditional release may be utilized. In this context, the trustee releases the assets to the beneficiary only after certain requirements or conditions are fulfilled. 4. Interim Release: Sometimes, a trust may be settled in stages or gradually over time. In such cases, an interim release is employed to acknowledge the distribution of assets at a particular interval or phase, ensuring transparency and accurate record-keeping. Regardless of the type, a Hawaii Release by Trustee to Beneficiary and Receipt from Beneficiary generally includes vital information such as the names and addresses of both the trustee and beneficiary, the date of the release, a detailed description of the assets being released, including any encumbrances or liens, and the signatures of both parties involved. It is crucial to consult with a knowledgeable attorney or legal professional familiar with Hawaii trust laws to ensure the proper drafting and execution of a Release by Trustee to Beneficiary and Receipt from Beneficiary. This legal document protects the interests of both parties and provides a clear record of the distribution of trust assets, promoting trust administration efficiency and minimizing potential disputes.Hawaii Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document commonly used in trust administration. It is a formal acknowledgment, signed by both the trustee and beneficiary, which declares that the trustee has fulfilled their obligations and distributions towards the beneficiary. This document serves as evidence of the transfer of trust assets, and it ensures transparency and legal compliance in the overall trust management process. In Hawaii, there are several types of Release by Trustee to Beneficiary and Receipt from Beneficiary. Some of the most common types include: 1. Full Release: This type of release signifies the complete settlement of the trust. The trustee transfers all the trust assets to the beneficiary, and the beneficiary acknowledges full receipt and satisfaction of their entitlements. 2. Partial Release: In specific situations, a trust may be partially released. This occurs when the trustee distributes only a portion of the trust assets to the beneficiary, often due to specific conditions or limitations specified in the trust document. 3. Conditional Release: If there are specific terms or conditions set forth in the trust agreement, a conditional release may be utilized. In this context, the trustee releases the assets to the beneficiary only after certain requirements or conditions are fulfilled. 4. Interim Release: Sometimes, a trust may be settled in stages or gradually over time. In such cases, an interim release is employed to acknowledge the distribution of assets at a particular interval or phase, ensuring transparency and accurate record-keeping. Regardless of the type, a Hawaii Release by Trustee to Beneficiary and Receipt from Beneficiary generally includes vital information such as the names and addresses of both the trustee and beneficiary, the date of the release, a detailed description of the assets being released, including any encumbrances or liens, and the signatures of both parties involved. It is crucial to consult with a knowledgeable attorney or legal professional familiar with Hawaii trust laws to ensure the proper drafting and execution of a Release by Trustee to Beneficiary and Receipt from Beneficiary. This legal document protects the interests of both parties and provides a clear record of the distribution of trust assets, promoting trust administration efficiency and minimizing potential disputes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.