A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

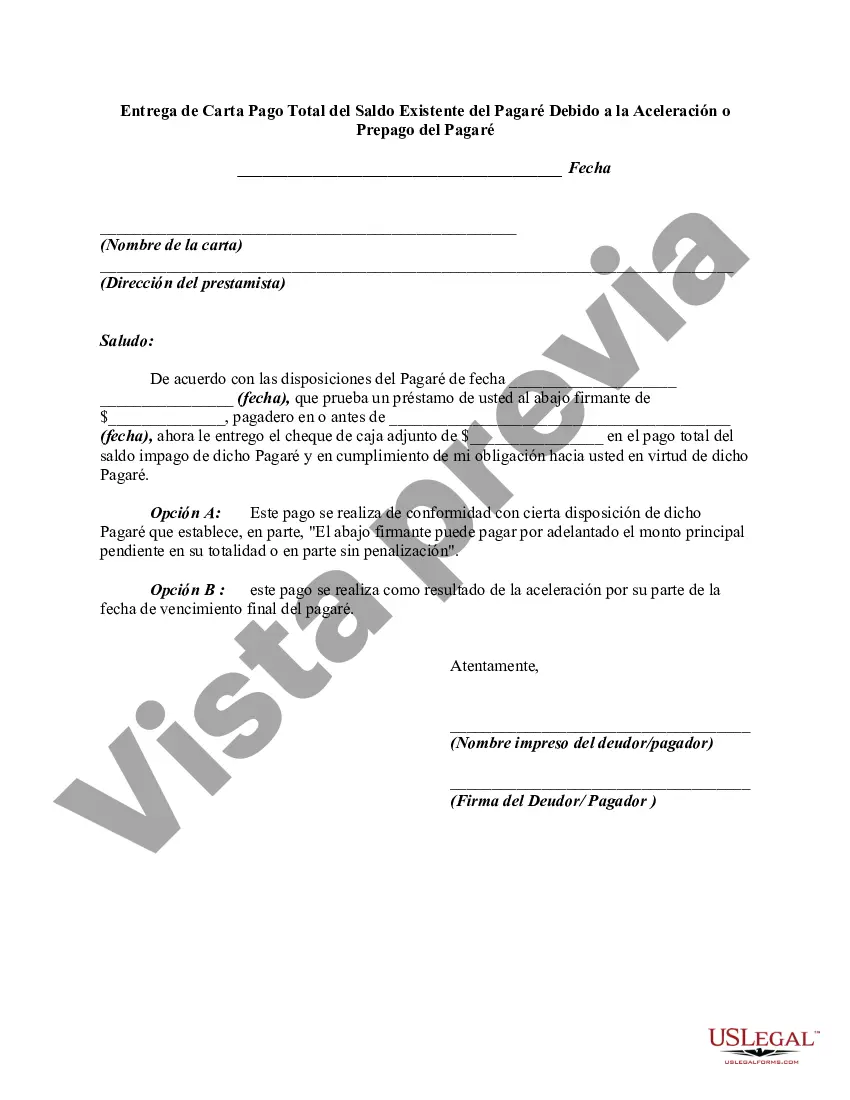

Title: Hawaii Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note Introduction: A Hawaii Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note is a formal document issued by a borrower in the state of Hawaii to the lender. This letter signifies the borrower's intention to pay off the entire outstanding balance on a promissory note, either due to acceleration (early repayment) or prepayment. The purpose of this letter is to provide a detailed explanation of the payment, ensure the request is formally recorded, and establish the borrower's compliance with the terms of the original promissory note. Key Components of the Letter: 1. Opening Segment: — Greeting and salutation— - Reference to the original promissory note's details, including the date, recipient, and amount. 2. Statement of Intent: — Clearly state the intention to tender full payment of the existing balance. — Specify the reason for accelerated or early payment, such as financial capabilities, refinance, or any other applicable circumstance. — Include the borrower's desire to satisfy all financial obligations associated with the promissory note. 3. Description of Outstanding Balance: — Provide a comprehensive breakdown of the outstanding balance, including the principal amount, accrued interest, late fees (if applicable), and any other relevant charges. — Mention the payment due date as per the original promissory note, and explain that tendering full payment will settle the loan in its entirety. 4. Method and Timing of Payment: — Clearly state the desired payment method, such as wire transfer, certified check, or any preferred mode specified by the lender. — Specify the date by which the payment will be made, allowing reasonable time for processing and transfer of funds to avoid any potential late fees or penalties. 5. Request for Confirmation and Receipt: — Ask the lender to confirm the receipt of the payment and provide a return letter acknowledging the satisfaction of the loan. — Include contact information for the borrower, including phone number, email address, and mailing address for communication purposes. Types of Hawaii Letter Tendering Full Payment: 1. Hawaii Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration: — This type of letter is used when the borrower wants to pay off the remaining balance of a promissory note earlier than its agreed-upon term. It could be due to improved financial circumstances or a desire to reduce interest expenses. 2. Hawaii Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Prepayment: — Here, the borrower chooses to pay off the entire outstanding balance on a promissory note before it becomes due. Prepayment often occurs if the borrower secures funds from another source with better terms or intends to refinance the loan amount. Conclusion: A Hawaii Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment is a crucial document for borrowers who wish to settle their debts ahead of schedule. By providing comprehensive details regarding the outstanding balance, payment method, and requesting confirmation and receipt, this letter ensures a transparent transaction and evidence of repayment compliance.Title: Hawaii Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note Introduction: A Hawaii Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note is a formal document issued by a borrower in the state of Hawaii to the lender. This letter signifies the borrower's intention to pay off the entire outstanding balance on a promissory note, either due to acceleration (early repayment) or prepayment. The purpose of this letter is to provide a detailed explanation of the payment, ensure the request is formally recorded, and establish the borrower's compliance with the terms of the original promissory note. Key Components of the Letter: 1. Opening Segment: — Greeting and salutation— - Reference to the original promissory note's details, including the date, recipient, and amount. 2. Statement of Intent: — Clearly state the intention to tender full payment of the existing balance. — Specify the reason for accelerated or early payment, such as financial capabilities, refinance, or any other applicable circumstance. — Include the borrower's desire to satisfy all financial obligations associated with the promissory note. 3. Description of Outstanding Balance: — Provide a comprehensive breakdown of the outstanding balance, including the principal amount, accrued interest, late fees (if applicable), and any other relevant charges. — Mention the payment due date as per the original promissory note, and explain that tendering full payment will settle the loan in its entirety. 4. Method and Timing of Payment: — Clearly state the desired payment method, such as wire transfer, certified check, or any preferred mode specified by the lender. — Specify the date by which the payment will be made, allowing reasonable time for processing and transfer of funds to avoid any potential late fees or penalties. 5. Request for Confirmation and Receipt: — Ask the lender to confirm the receipt of the payment and provide a return letter acknowledging the satisfaction of the loan. — Include contact information for the borrower, including phone number, email address, and mailing address for communication purposes. Types of Hawaii Letter Tendering Full Payment: 1. Hawaii Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration: — This type of letter is used when the borrower wants to pay off the remaining balance of a promissory note earlier than its agreed-upon term. It could be due to improved financial circumstances or a desire to reduce interest expenses. 2. Hawaii Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Prepayment: — Here, the borrower chooses to pay off the entire outstanding balance on a promissory note before it becomes due. Prepayment often occurs if the borrower secures funds from another source with better terms or intends to refinance the loan amount. Conclusion: A Hawaii Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment is a crucial document for borrowers who wish to settle their debts ahead of schedule. By providing comprehensive details regarding the outstanding balance, payment method, and requesting confirmation and receipt, this letter ensures a transparent transaction and evidence of repayment compliance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.