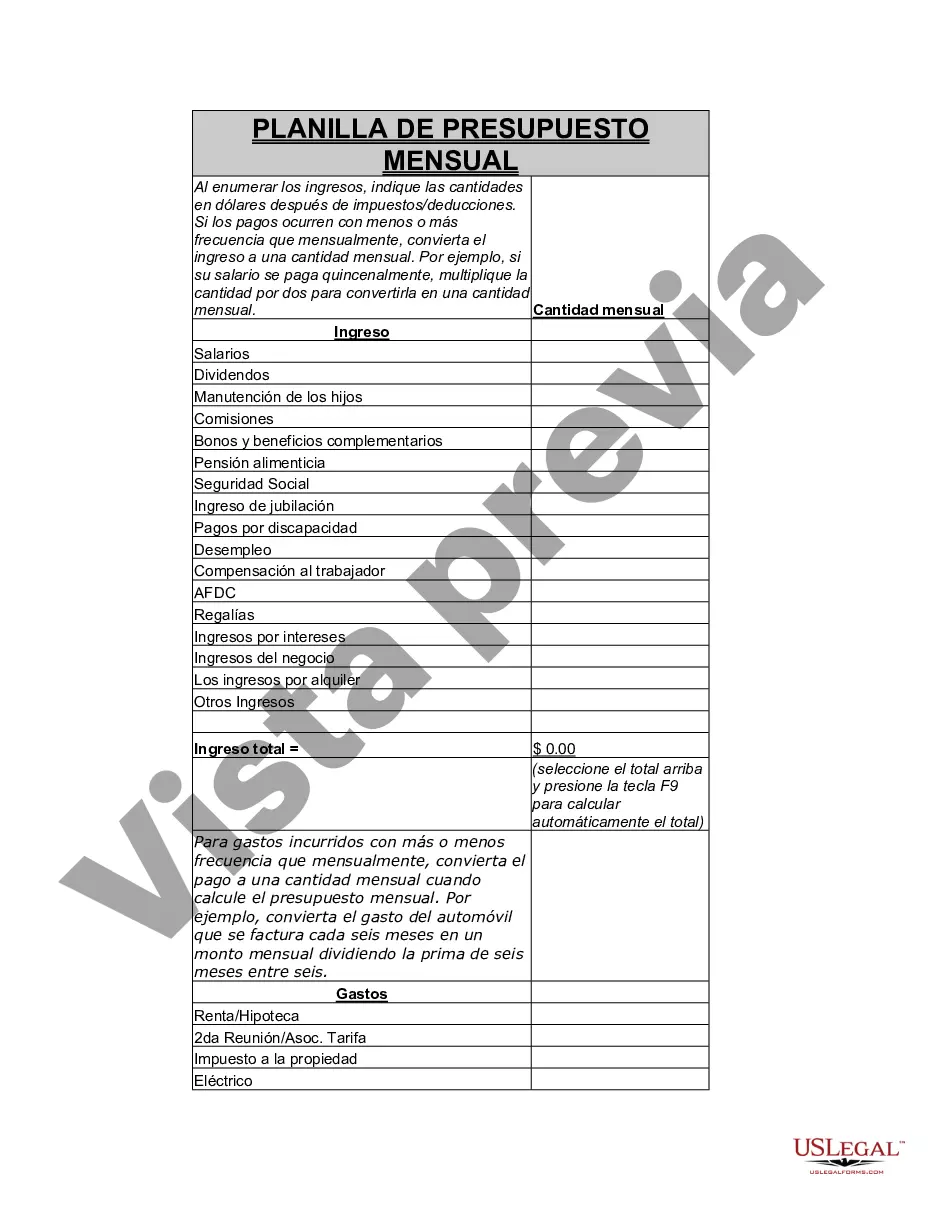

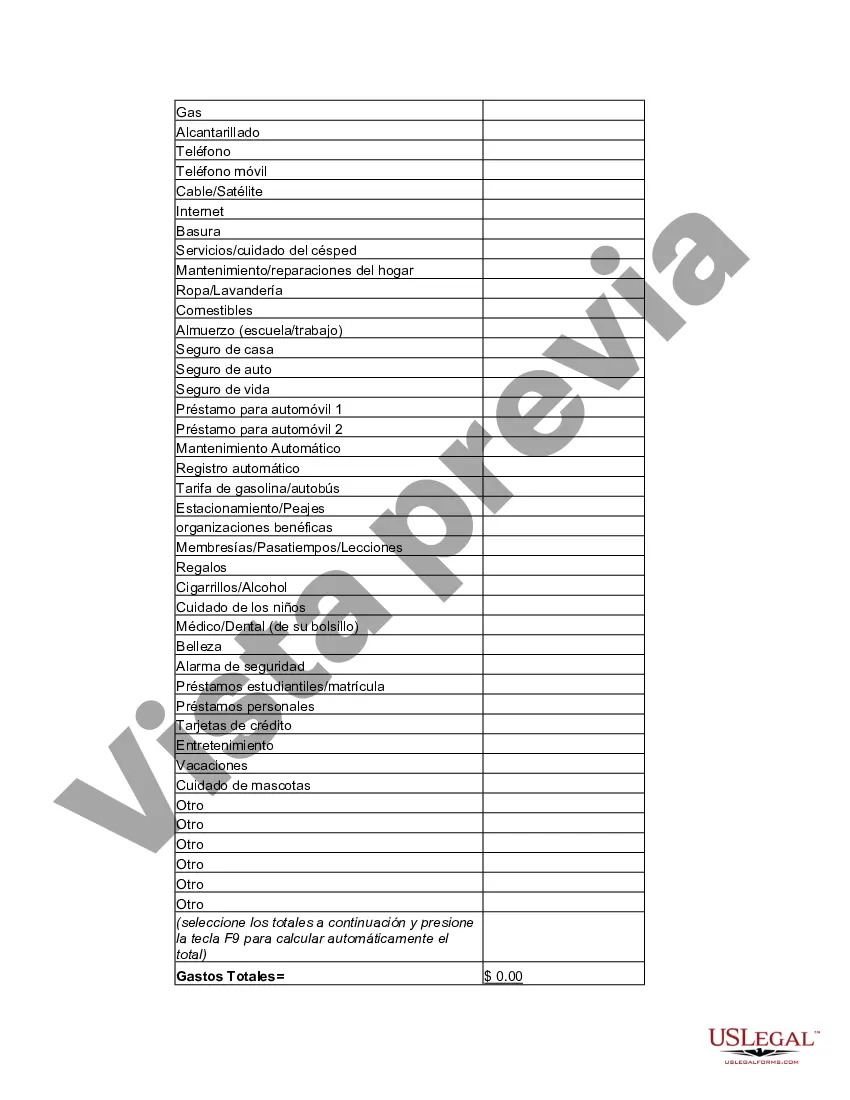

Hawaii Personal Monthly Budget Worksheet: A Comprehensive Guide to Financial Planning A Hawaii Personal Monthly Budget Worksheet is an essential tool for individuals living in the beautiful Hawaiian islands to maintain a healthy and organized financial lifestyle. This worksheet serves as a detailed guide to help individuals track their income, expenses, and savings throughout each month, ensuring a balanced financial outlook. To start, the Hawaii Personal Monthly Budget Worksheet provides a section to list all sources of income. Whether it's a fixed salary, freelance work, or investment returns, this worksheet allows individuals to accurately record their total monthly earnings. By keeping track of income sources, Hawaiian residents can identify opportunities for growth and optimize their budgeting strategies. The worksheet then emphasizes categorizing expenses, which play a crucial role in maintaining financial stability. It includes categories like housing expenses, utilities, transportation, groceries, dining out, entertainment, healthcare, debt repayments, saving goals, and many more. Such categories highlight the unique aspects of living in Hawaii, accounting for the higher cost of living, tropical climate considerations, and local lifestyle choices. Moreover, the Hawaii Personal Monthly Budget Worksheet provides a dedicated section to monitor savings and investment goals. Savings are an integral part of financial planning, and this worksheet enables individuals to set targets and track progress towards achieving them. This section also encourages Hawaiians to consider future financial goals, such as retirement plans, education funding, emergency funds, or saving for a dream vacation. There may also be different types or versions of the Hawaii Personal Monthly Budget Worksheet available, tailored to specific purposes or preferences. For instance, some worksheets may be designed explicitly for residents living in popular Hawaiian cities, like Honolulu or Maui, taking into account their unique cost of living factors. Other variations may cater to individuals with specific financial goals, such as paying off a mortgage, starting a business, or managing multiple income streams. In summary, a Hawaii Personal Monthly Budget Worksheet is a valuable resource that helps Hawaiian residents take control of their finances and maintain financial well-being. By diligently using this worksheet, individuals can closely monitor their income, expenses, and savings, making informed financial decisions and ensuring a comfortable and fulfilling life in the Aloha State.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Hoja de trabajo de presupuesto mensual personal - Personal Monthly Budget Worksheet

Description

How to fill out Hawaii Hoja De Trabajo De Presupuesto Mensual Personal?

Are you currently within a place in which you need to have papers for either enterprise or personal uses just about every day? There are a variety of lawful file layouts available on the net, but discovering versions you can rely isn`t straightforward. US Legal Forms offers a huge number of form layouts, much like the Hawaii Personal Monthly Budget Worksheet, that happen to be published to meet federal and state demands.

If you are presently knowledgeable about US Legal Forms internet site and get a merchant account, merely log in. After that, it is possible to down load the Hawaii Personal Monthly Budget Worksheet template.

If you do not have an profile and want to begin using US Legal Forms, follow these steps:

- Find the form you need and ensure it is for that correct city/region.

- Make use of the Review option to examine the form.

- Look at the outline to actually have selected the right form.

- If the form isn`t what you are trying to find, make use of the Search discipline to obtain the form that meets your requirements and demands.

- When you obtain the correct form, click on Purchase now.

- Opt for the prices prepare you would like, fill out the specified information to make your money, and pay for the order using your PayPal or bank card.

- Select a convenient file formatting and down load your version.

Find all of the file layouts you may have bought in the My Forms food list. You can obtain a additional version of Hawaii Personal Monthly Budget Worksheet at any time, if necessary. Just select the necessary form to down load or print out the file template.

Use US Legal Forms, probably the most extensive variety of lawful varieties, to conserve efforts and avoid mistakes. The assistance offers appropriately manufactured lawful file layouts which can be used for a selection of uses. Make a merchant account on US Legal Forms and start creating your life a little easier.