A Hawaii Lease Purchase Agreement for Equipment is a legally binding contract between a lessor (equipment owner) and a lessee (user or renter) in the state of Hawaii. This agreement allows the lessee to rent and use equipment for a specified period while also providing an option to purchase the equipment at the end of the lease term. The equipment covered in this agreement can vary widely, ranging from construction machinery and heavy equipment to office furniture, vehicles, or technology devices. This flexibility allows businesses in Hawaii to acquire essential equipment without the need for a hefty upfront investment, conserving their capital for other business operations. What sets the Hawaii Lease Purchase Agreement for Equipment apart is that it includes a purchase option. This option provides the lessee with the right to buy the equipment they have been leasing at a predetermined price, usually referred to as the "purchase price" or "option price." The lessee can exercise this option at any time during or at the end of the lease term, depending on the terms specified in the agreement. By entering into this agreement, the lessee gains access to high-quality equipment without immediate ownership obligations. This arrangement offers flexibility and safeguards against the risks of equipment obsolescence or the need for expensive repairs or maintenance. It is particularly beneficial for businesses that require technologically advanced or rapidly evolving equipment, as they can easily upgrade or replace the leased equipment at the end of the lease term. There are several types of Hawaii Lease Purchase Agreements for Equipment, suited to different business needs. These include: 1. Traditional Lease Purchase Agreement: This is the most common type of lease purchase agreement, where the lessee makes regular payments towards the equipment's rental while having the option to buy at a fixed price at the end of the lease. 2. Lease with Option to Purchase: Here, the lessee has the choice to exercise the purchase option at any point during the lease term. This flexibility allows businesses to assess the equipment's performance and suitability before committing to the purchase. 3. Capital Lease Agreement: This type of lease purchase agreement is structured similarly to a loan, where the lessee takes ownership of the equipment at the end of the lease term. The equipment's purchase price is often set at a symbolic amount (e.g., $1) to signify transferring ownership. 4. Conditional Sales Contract: In this agreement, the lessee treats the lease payments as installment payments toward purchasing the equipment. This type of lease agreement is often used when the lessee intends to acquire the equipment definitively but needs additional time or financial resources before completing the purchase. In conclusion, a Hawaii Lease Purchase Agreement for Equipment provides businesses with a flexible and cost-effective way to obtain necessary equipment. With different types of agreements available, businesses can choose the one that best suits their needs and financial situation.

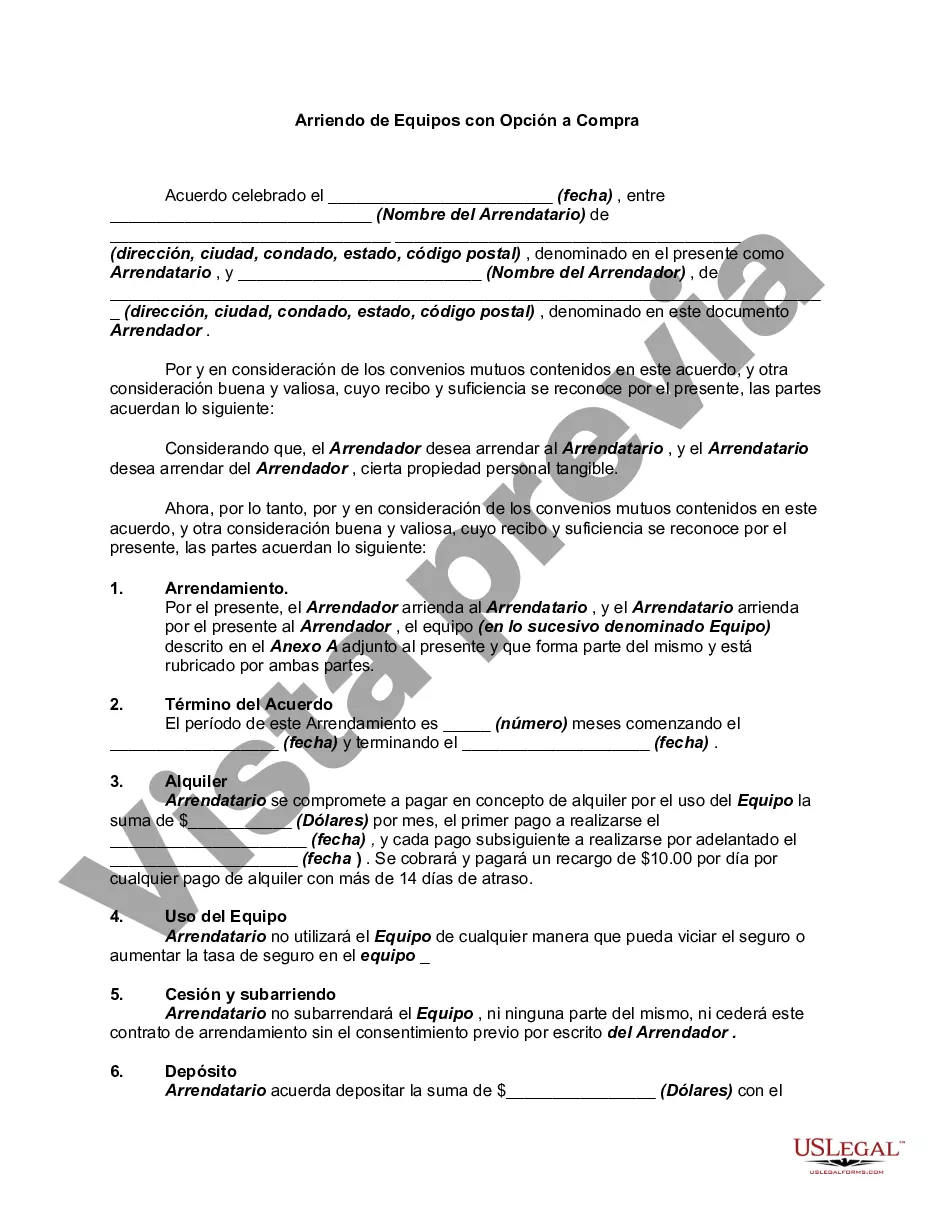

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Acuerdo de compra de arrendamiento de equipo - Lease Purchase Agreement for Equipment

Description

How to fill out Hawaii Acuerdo De Compra De Arrendamiento De Equipo?

Have you been in a place that you need to have papers for either company or individual purposes almost every time? There are a lot of lawful record layouts available on the Internet, but getting ones you can trust is not straightforward. US Legal Forms gives thousands of develop layouts, such as the Hawaii Lease Purchase Agreement for Equipment, which are published in order to meet state and federal specifications.

Should you be presently knowledgeable about US Legal Forms internet site and also have an account, basically log in. Next, it is possible to obtain the Hawaii Lease Purchase Agreement for Equipment design.

If you do not offer an profile and need to start using US Legal Forms, adopt these measures:

- Obtain the develop you want and ensure it is for the right area/area.

- Utilize the Review switch to check the form.

- Look at the explanation to ensure that you have selected the right develop.

- When the develop is not what you are looking for, take advantage of the Research field to discover the develop that fits your needs and specifications.

- If you find the right develop, click on Buy now.

- Select the prices plan you need, submit the required info to make your money, and buy the order using your PayPal or credit card.

- Choose a convenient file file format and obtain your backup.

Discover each of the record layouts you may have bought in the My Forms menu. You can get a additional backup of Hawaii Lease Purchase Agreement for Equipment at any time, if required. Just click on the essential develop to obtain or print the record design.

Use US Legal Forms, one of the most extensive variety of lawful varieties, to save lots of efforts and avoid blunders. The service gives skillfully created lawful record layouts that can be used for a range of purposes. Create an account on US Legal Forms and initiate generating your lifestyle a little easier.