In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Hawaii Report from Review of Financial Statements and Compilation by Accounting Firm: Hawaii, the picturesque archipelago located in the central Pacific Ocean, is not only known for its stunning landscapes and vibrant culture but also for its robust and flourishing economy. As businesses thrive amidst this tropical paradise, the need for accurate and reliable financial reporting becomes paramount. To ensure transparency and compliance with accounting standards, many companies in Hawaii seek the expertise of accounting firms to conduct thorough reviews and compilations of their financial statements. The Hawaii Report from Review of Financial Statements and Compilation is a comprehensive analysis prepared by a reputable accounting firm, focusing on an entity's financial records and transactions. It serves as a crucial tool for business owners, shareholders, investors, and regulatory bodies to assess the financial health and performance of an organization. This report is typically divided into different sections that encompass vital financial information and key findings. Some common sections within the Hawaii Report from Review of Financial Statements and Compilation include: 1. Executive Summary: This section provides an overview of the report, highlighting the key findings, financial ratios, and significant areas of concern or improvement. 2. Introduction: This part briefly describes the purpose and scope of the report, the accounting firm involved, and the time period covered. 3. Management's Responsibilities: Here, the report outlines the responsibilities of the company's management regarding the financial statements' preparation, integrity, and accuracy. 4. Independent Auditor's Responsibilities: This section details the responsibilities of the accounting firm in conducting the review or compilation, following generally accepted auditing and accounting principles. 5. Report on Review of Financial Statements: In case of a review engagement, this section includes the findings, examination of financial statement components, and any identified material misstatements or concerns. 6. Report on Compilation of Financial Statements: If the engagement is a compilation, this section presents the accounting firm's work in organizing and presenting the financial statements, without providing assurance on its accuracy or completeness. 7. Financial Statements: This segment comprises the balance sheet, income statement, cash flow statement, and other relevant financial disclosures. It outlines the company's financial position, performance, and cash flows during the specific period. 8. Notes to the Financial Statements: These footnotes provide additional explanations and disclosures related to the financial statements. They assist readers in understanding the significant accounting policies, contingencies, and other pertinent information. 9. Other Information: In some cases, the report may include supplementary information such as a management commentary, industry trends analysis, or comparative financial data for better context. 10. Independent Auditor's Opinion: This is a crucial section where the accounting firm provides their professional opinion on the fair presentation of the financial statements in conformity with accounting standards. Different types of Hawaii Reports from Review of Financial Statements and Compilation by Accounting Firm may vary in the level of assurance provided. One type is a review engagement, in which the accounting firm performs analytical procedures and inquiries to express limited assurance on the financial statements. Another type is a compilation engagement, wherein the accounting firm assists in organizing and presenting the financial statements but does not provide any assurance. In conclusion, the Hawaii Report from Review of Financial Statements and Compilation by Accounting Firm is a detailed and standardized document that provides an accurate depiction of a company's financial performance and position. By availing the services of accounting firms, businesses in Hawaii can ensure transparency, compliance, and gain valuable insights to facilitate informed decision-making.Hawaii Report from Review of Financial Statements and Compilation by Accounting Firm: Hawaii, the picturesque archipelago located in the central Pacific Ocean, is not only known for its stunning landscapes and vibrant culture but also for its robust and flourishing economy. As businesses thrive amidst this tropical paradise, the need for accurate and reliable financial reporting becomes paramount. To ensure transparency and compliance with accounting standards, many companies in Hawaii seek the expertise of accounting firms to conduct thorough reviews and compilations of their financial statements. The Hawaii Report from Review of Financial Statements and Compilation is a comprehensive analysis prepared by a reputable accounting firm, focusing on an entity's financial records and transactions. It serves as a crucial tool for business owners, shareholders, investors, and regulatory bodies to assess the financial health and performance of an organization. This report is typically divided into different sections that encompass vital financial information and key findings. Some common sections within the Hawaii Report from Review of Financial Statements and Compilation include: 1. Executive Summary: This section provides an overview of the report, highlighting the key findings, financial ratios, and significant areas of concern or improvement. 2. Introduction: This part briefly describes the purpose and scope of the report, the accounting firm involved, and the time period covered. 3. Management's Responsibilities: Here, the report outlines the responsibilities of the company's management regarding the financial statements' preparation, integrity, and accuracy. 4. Independent Auditor's Responsibilities: This section details the responsibilities of the accounting firm in conducting the review or compilation, following generally accepted auditing and accounting principles. 5. Report on Review of Financial Statements: In case of a review engagement, this section includes the findings, examination of financial statement components, and any identified material misstatements or concerns. 6. Report on Compilation of Financial Statements: If the engagement is a compilation, this section presents the accounting firm's work in organizing and presenting the financial statements, without providing assurance on its accuracy or completeness. 7. Financial Statements: This segment comprises the balance sheet, income statement, cash flow statement, and other relevant financial disclosures. It outlines the company's financial position, performance, and cash flows during the specific period. 8. Notes to the Financial Statements: These footnotes provide additional explanations and disclosures related to the financial statements. They assist readers in understanding the significant accounting policies, contingencies, and other pertinent information. 9. Other Information: In some cases, the report may include supplementary information such as a management commentary, industry trends analysis, or comparative financial data for better context. 10. Independent Auditor's Opinion: This is a crucial section where the accounting firm provides their professional opinion on the fair presentation of the financial statements in conformity with accounting standards. Different types of Hawaii Reports from Review of Financial Statements and Compilation by Accounting Firm may vary in the level of assurance provided. One type is a review engagement, in which the accounting firm performs analytical procedures and inquiries to express limited assurance on the financial statements. Another type is a compilation engagement, wherein the accounting firm assists in organizing and presenting the financial statements but does not provide any assurance. In conclusion, the Hawaii Report from Review of Financial Statements and Compilation by Accounting Firm is a detailed and standardized document that provides an accurate depiction of a company's financial performance and position. By availing the services of accounting firms, businesses in Hawaii can ensure transparency, compliance, and gain valuable insights to facilitate informed decision-making.

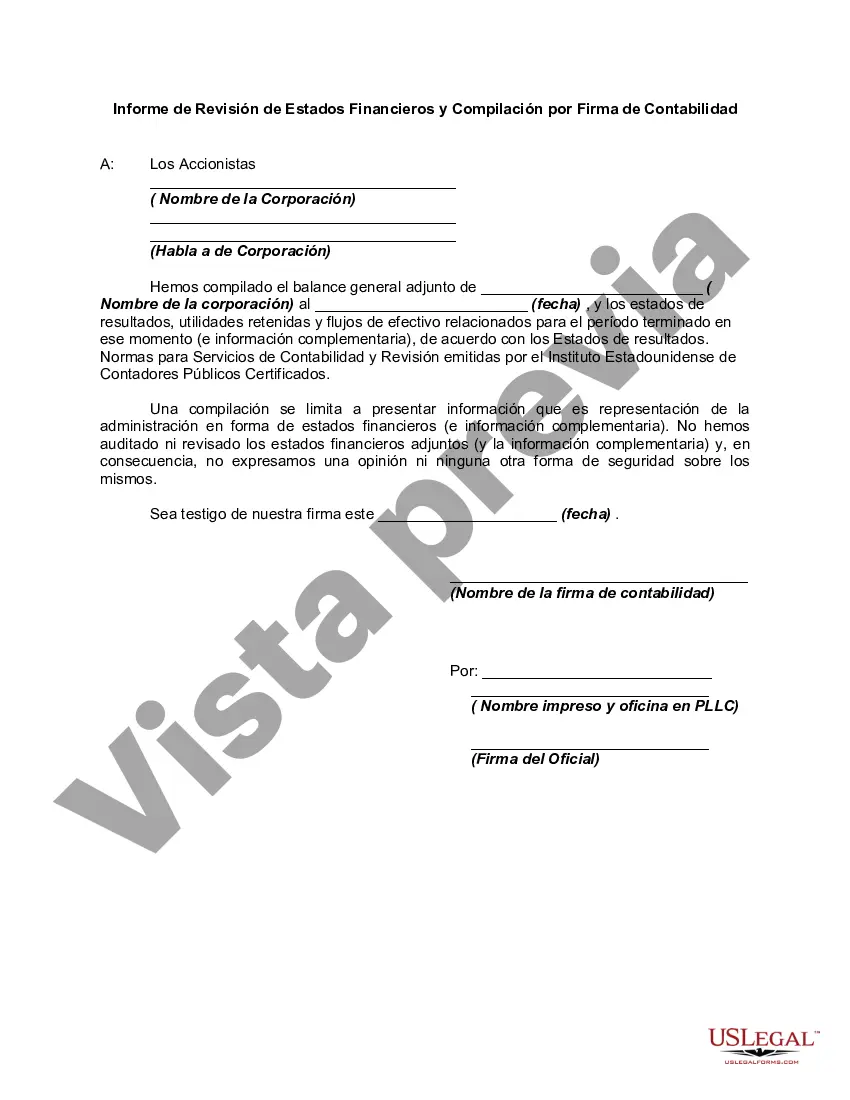

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.