Disclosure of credit terms should have the content and form required under the federal Truth in Lending Act (15 U.S.C.A. §§ 1601 et seq.) and applicable regulations (Regulation Z, 12 C.F.R. § 226), and under state consumer credit laws to the extent that they differ from the federal Act. In connection with specified installment sales and other consumer credit transactions, these enactments require written disclosure and advice as to finance charges, annual percentage rates and other matters relating to credit. Under the federal Act, the disclosures may be set forth in the contract document itself or in a separate statement or statements.

A federal notice regarding preservation of the consumer's claims and defenses is required on all consumer credit contracts by Federal Trade Commission regulation. 16 C.F.R. § 433.2. The notice must appear in 10-point bold type or print and must be worded as set forth in the above form.

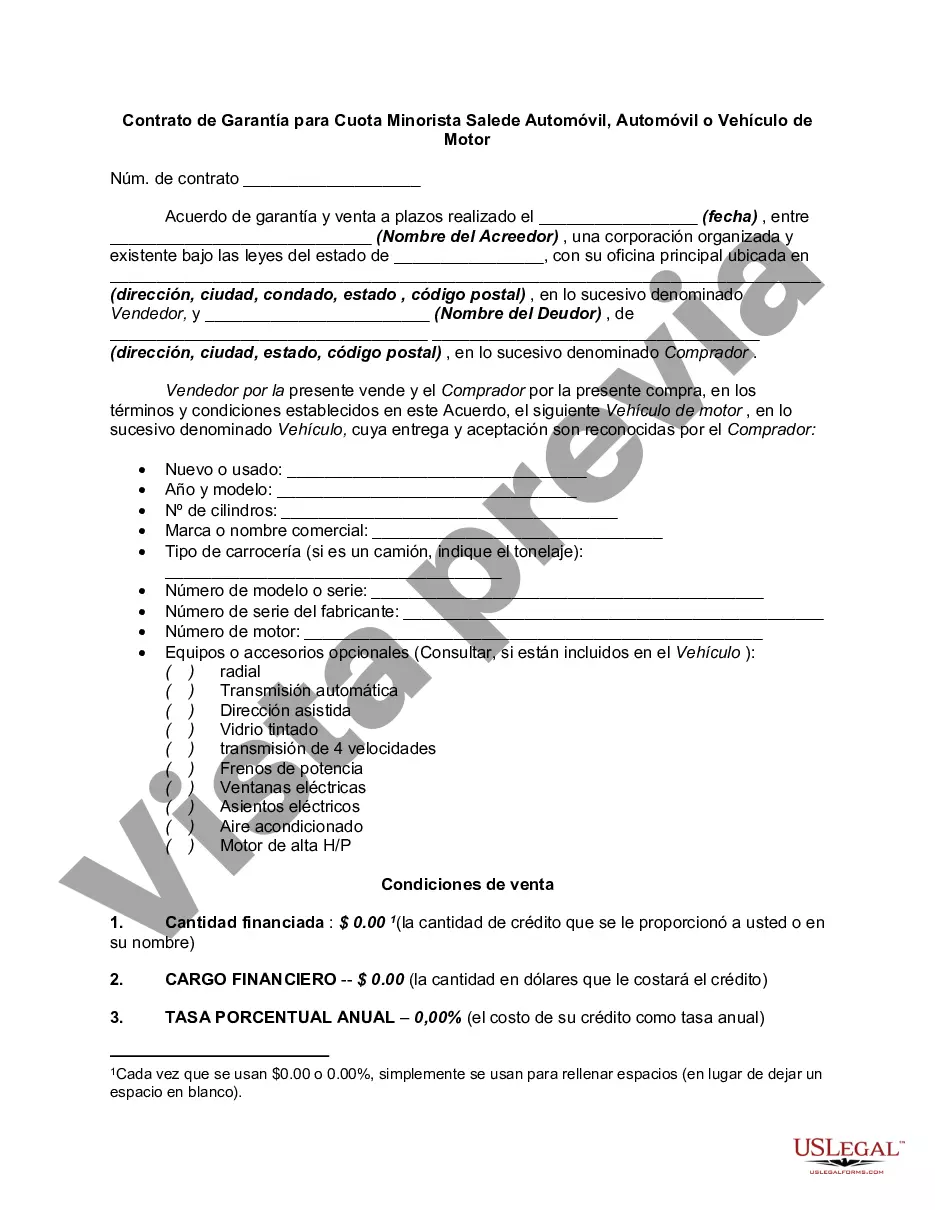

The Hawaii Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a legal document that outlines the terms and conditions of financing a vehicle purchase in the state of Hawaii. This agreement establishes a security interest in the vehicle, ensuring that the lender has the right to repossess the car if the borrower defaults on the loan. Keywords: Hawaii, Security Agreement, Retail Installment Sale, Automobile, Car, Motor Vehicle There are two primary types of Hawaii Security Agreements for Retail Installment Sale of Automobile, Car, or Motor Vehicle: 1. Traditional Security Agreement: This type of agreement is used when a borrower finances the purchase of an automobile, car, or motor vehicle. It details the repayment terms, interest rates, and any collateral provided against the loan. The lender holds the security interest and can legally take possession of the vehicle in case of non-payment. 2. Lease Agreement: In some cases, individuals may opt for leasing a vehicle instead of purchasing one. The Hawaii Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle can also be used for lease agreements. This type of agreement specifies the terms of the lease, including monthly payments, duration, mileage limitations, and the right of the lessor to repossess the vehicle if the lessee fails to fulfill the terms outlined in the agreement. When preparing a Hawaii Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle, the following information is typically included: — Parties Involved: The agreement identifies the buyer (borrower/lessee) and the seller (lender/lessor) and provides their contact information, including names, addresses, and contact numbers. — Vehicle Details: The agreement includes a detailed description of the vehicle being financed or leased. This includes the make, model, year, vehicle identification number (VIN), license plate number, and any other distinguishing features. — Purchase or Lease Terms: The agreement outlines the agreed-upon purchase price or lease terms, including the amount financed, interest rate (if applicable), payment schedule (monthly, bi-monthly, etc.), and the due date of each payment. — Collateral and Security Interest: The agreement specifies the vehicle being financed or leased as collateral, granting the lender/lessor a security interest. This allows the seller to take possession of the vehicle if the buyer/lessee defaults on their payments. — Insurance Requirements: The agreement may include provisions specifying the minimum insurance coverage required by the buyer/lessee, such as comprehensive and collision coverage, and it may require the lender/lessor to be named as an additional insured or loss payee on the policy. — Default and Remedies: The agreement describes the actions that will be taken by the lender/lessor in case of default, including repossession and selling of the vehicle, penalties for late payments, and any additional fees or charges that may be incurred. — Governing Law: The agreement highlights that it is governed by the laws of the state of Hawaii and any disputes arising from the agreement will be resolved in the appropriate Hawaii court. It is important to note that the exact content and provisions of the Hawaii Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle may vary depending on the lender/lessor and the specific terms agreed upon by the parties involved.The Hawaii Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle is a legal document that outlines the terms and conditions of financing a vehicle purchase in the state of Hawaii. This agreement establishes a security interest in the vehicle, ensuring that the lender has the right to repossess the car if the borrower defaults on the loan. Keywords: Hawaii, Security Agreement, Retail Installment Sale, Automobile, Car, Motor Vehicle There are two primary types of Hawaii Security Agreements for Retail Installment Sale of Automobile, Car, or Motor Vehicle: 1. Traditional Security Agreement: This type of agreement is used when a borrower finances the purchase of an automobile, car, or motor vehicle. It details the repayment terms, interest rates, and any collateral provided against the loan. The lender holds the security interest and can legally take possession of the vehicle in case of non-payment. 2. Lease Agreement: In some cases, individuals may opt for leasing a vehicle instead of purchasing one. The Hawaii Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle can also be used for lease agreements. This type of agreement specifies the terms of the lease, including monthly payments, duration, mileage limitations, and the right of the lessor to repossess the vehicle if the lessee fails to fulfill the terms outlined in the agreement. When preparing a Hawaii Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle, the following information is typically included: — Parties Involved: The agreement identifies the buyer (borrower/lessee) and the seller (lender/lessor) and provides their contact information, including names, addresses, and contact numbers. — Vehicle Details: The agreement includes a detailed description of the vehicle being financed or leased. This includes the make, model, year, vehicle identification number (VIN), license plate number, and any other distinguishing features. — Purchase or Lease Terms: The agreement outlines the agreed-upon purchase price or lease terms, including the amount financed, interest rate (if applicable), payment schedule (monthly, bi-monthly, etc.), and the due date of each payment. — Collateral and Security Interest: The agreement specifies the vehicle being financed or leased as collateral, granting the lender/lessor a security interest. This allows the seller to take possession of the vehicle if the buyer/lessee defaults on their payments. — Insurance Requirements: The agreement may include provisions specifying the minimum insurance coverage required by the buyer/lessee, such as comprehensive and collision coverage, and it may require the lender/lessor to be named as an additional insured or loss payee on the policy. — Default and Remedies: The agreement describes the actions that will be taken by the lender/lessor in case of default, including repossession and selling of the vehicle, penalties for late payments, and any additional fees or charges that may be incurred. — Governing Law: The agreement highlights that it is governed by the laws of the state of Hawaii and any disputes arising from the agreement will be resolved in the appropriate Hawaii court. It is important to note that the exact content and provisions of the Hawaii Security Agreement for Retail Installment Sale of Automobile, Car, or Motor Vehicle may vary depending on the lender/lessor and the specific terms agreed upon by the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.