An escrow account refers to an account held in the name of the borrower which is returnable to the borrower on the performance of certain conditions.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

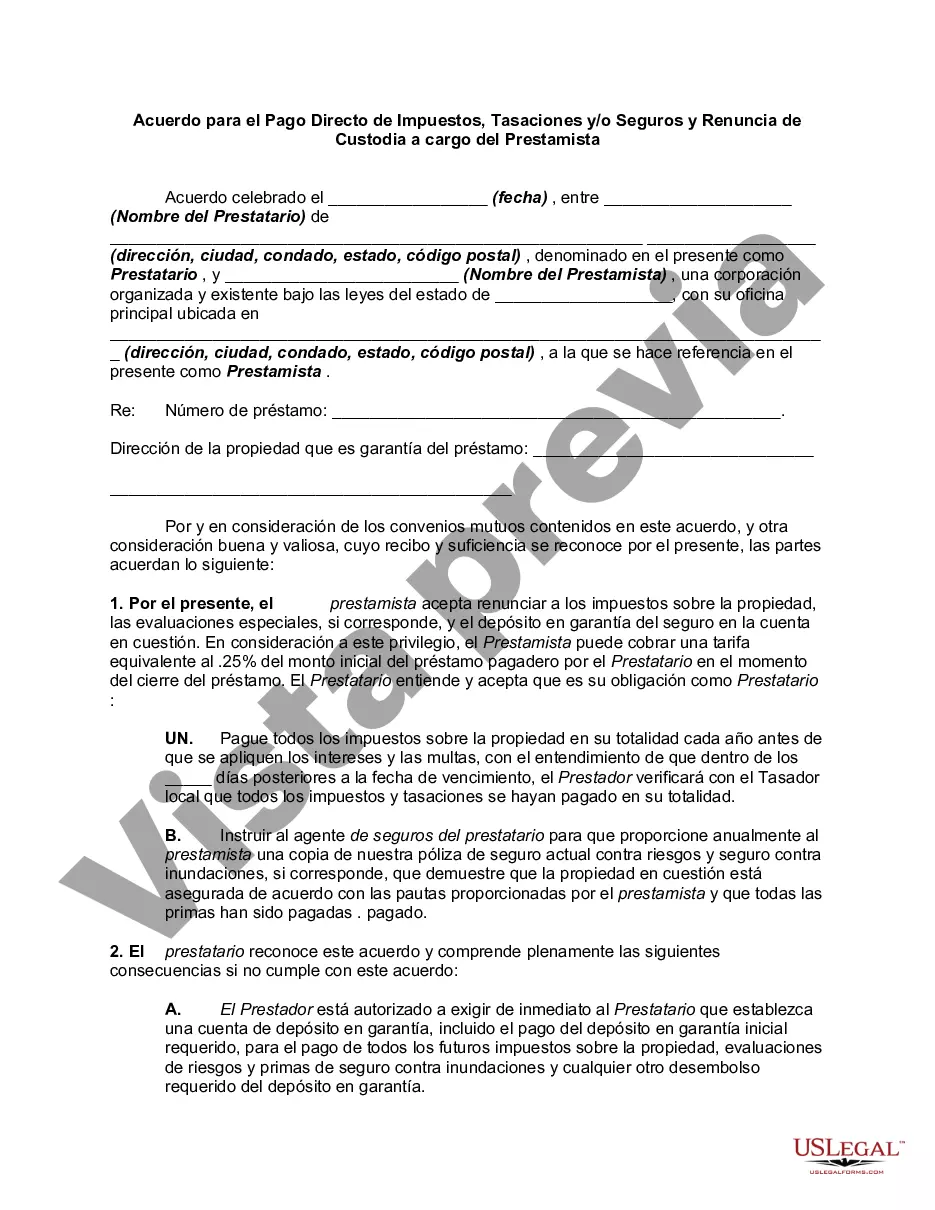

The Hawaii Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that establishes the terms and conditions related to the direct payment of taxes, assessments, and/or insurance by the borrower, rather than through an escrow account held by the lender. This agreement is common in Hawaii, where property taxes, assessments, and insurance premiums can vary significantly. It allows the borrower to take control of these payments while providing the lender with certain protections. The agreement typically includes the following key provisions: 1. Direct Payment Responsibility: The borrower agrees to assume the responsibility for making timely and accurate payments for property taxes, assessments, and/or insurance premiums directly to the appropriate authorities or insurance providers. 2. Lender Oversight: The lender retains the right to audit the borrower's payments to ensure compliance with the agreement. This is to ensure that the property taxes, assessments, and insurance are adequately paid and that the property remains adequately protected. 3. Waiver of Escrow: The borrower acknowledges that by entering into this agreement, they are waiving their right to have the lender collect and hold funds in an escrow account for the payment of taxes, assessments, and/or insurance. This means that the borrower should plan accordingly to have sufficient funds available for these payments. 4. Default and Remedies: The agreement may outline the consequences of any default by the borrower in making the required payments. This may include the lender's ability to pursue remedies such as accelerating the loan or placing the loan into default, subject to applicable laws and regulations. It's important to note that there may be different variations of the Hawaii Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, depending on specific circumstances or lender preferences. Some examples of these variations could include: 1. Partial Escrow Waiver: This type of agreement allows the borrower to waive the escrow for certain taxes or assessments while still requiring the escrow for insurance premiums. 2. Limited Terms Agreement: This agreement could have a predetermined duration, such as a specific number of years, after which the escrow account will be reinstated. 3. Escrow Account Reinstatement: In some cases, the lender and borrower may agree that the escrow account will be reinstated if certain conditions are met, such as a change in the borrower's financial situation. 4. Prepaid Escrow Waiver: This type of agreement allows the borrower to waive the escrow account for a specific period ahead, provided that the borrower can demonstrate the ability to make timely payments. In conclusion, the Hawaii Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that allows borrowers in Hawaii to take control of their property tax, assessment, and insurance payments. While the key provisions remain consistent, there may be variations of this agreement depending on specific circumstances or lender preferences.The Hawaii Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that establishes the terms and conditions related to the direct payment of taxes, assessments, and/or insurance by the borrower, rather than through an escrow account held by the lender. This agreement is common in Hawaii, where property taxes, assessments, and insurance premiums can vary significantly. It allows the borrower to take control of these payments while providing the lender with certain protections. The agreement typically includes the following key provisions: 1. Direct Payment Responsibility: The borrower agrees to assume the responsibility for making timely and accurate payments for property taxes, assessments, and/or insurance premiums directly to the appropriate authorities or insurance providers. 2. Lender Oversight: The lender retains the right to audit the borrower's payments to ensure compliance with the agreement. This is to ensure that the property taxes, assessments, and insurance are adequately paid and that the property remains adequately protected. 3. Waiver of Escrow: The borrower acknowledges that by entering into this agreement, they are waiving their right to have the lender collect and hold funds in an escrow account for the payment of taxes, assessments, and/or insurance. This means that the borrower should plan accordingly to have sufficient funds available for these payments. 4. Default and Remedies: The agreement may outline the consequences of any default by the borrower in making the required payments. This may include the lender's ability to pursue remedies such as accelerating the loan or placing the loan into default, subject to applicable laws and regulations. It's important to note that there may be different variations of the Hawaii Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender, depending on specific circumstances or lender preferences. Some examples of these variations could include: 1. Partial Escrow Waiver: This type of agreement allows the borrower to waive the escrow for certain taxes or assessments while still requiring the escrow for insurance premiums. 2. Limited Terms Agreement: This agreement could have a predetermined duration, such as a specific number of years, after which the escrow account will be reinstated. 3. Escrow Account Reinstatement: In some cases, the lender and borrower may agree that the escrow account will be reinstated if certain conditions are met, such as a change in the borrower's financial situation. 4. Prepaid Escrow Waiver: This type of agreement allows the borrower to waive the escrow account for a specific period ahead, provided that the borrower can demonstrate the ability to make timely payments. In conclusion, the Hawaii Agreement for Direct Payment of Taxes, Assessments, and/or Insurance and Waiver of Escrow to be held by Lender is a legal document that allows borrowers in Hawaii to take control of their property tax, assessment, and insurance payments. While the key provisions remain consistent, there may be variations of this agreement depending on specific circumstances or lender preferences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.