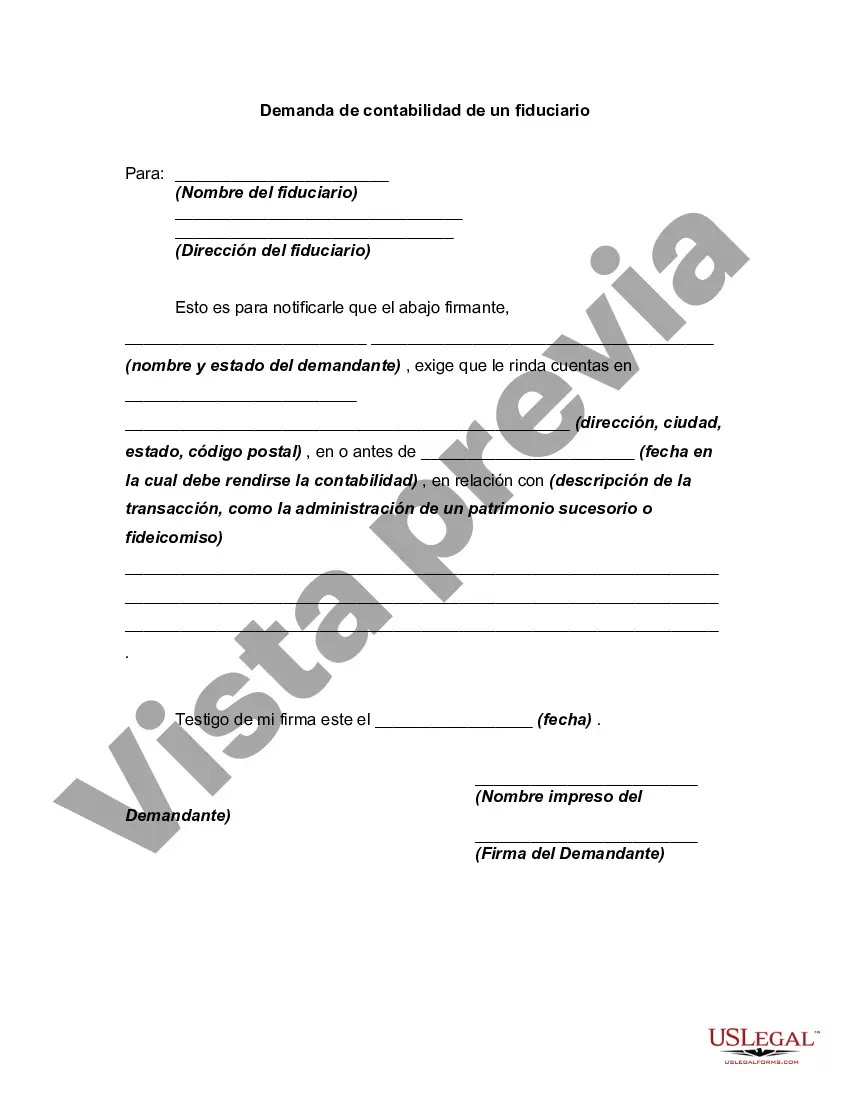

Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Demand for Accounting from a Fiduciary: Introduction: Hawaii maintains a legal framework to protect the rights and ensure accountability in fiduciary relationships. A fiduciary is an individual or entity entrusted with managing financial matters on behalf of another party. In various situations, the need may arise to demand accounting from a fiduciary in Hawaii. This article explores the concept of Hawaii Demand for Accounting from a Fiduciary, its significance, applicable laws, and different types of fiduciaries involved. What is Demand for Accounting from a Fiduciary? Demand for accounting from a fiduciary refers to the legal process through which a beneficiary or interested party requests a fiduciary to provide a detailed financial report or account for their actions, performance, and management of assets entrusted to them. This demand helps ensure transparency, identify any potential breaches of fiduciary duty, and safeguard the interests of the beneficiaries. Relevant Keywords: Hawaii Demand for Accounting, Fiduciary Duty, Financial Accountability, Beneficiary Rights, Asset Management. Types of Hawaii Demand for Accounting from a Fiduciary: 1. Trust Demand for Accounting: In the context of trusts, beneficiaries have the right to demand accounting from a trustee. A trustee manages trust assets, distributes income, and protects the financial interests of beneficiaries. Should a beneficiary feel uncertain about the trustee's handling of the trust, they can demand accounting to assess the trustee's performance and adherence to fiduciary duties. 2. Estate Demand for Accounting: When an individual passes away, an executor or personal representative is appointed to administer the deceased's estate. Beneficiaries or interested parties may demand accounting from the executor to ensure the proper distribution of assets, the payment of debts, and the fulfillment of other legal obligations. 3. Guardianship Demand for Accounting: A guardian is appointed to protect the interests of an individual who is unable to manage their own affairs due to incapacity. Interested parties, such as family members or beneficiaries, can seek a demand for accounting from the guardian to guarantee appropriate management and a responsible use of the ward's assets. 4. Power of Attorney Demand for Accounting: Under a power of attorney, an appointed agent handles financial and legal matters on behalf of another person. If concerns regarding the agent's actions or potential misuse of authority arise, beneficiaries or stakeholders may demand accounting to verify the agent's compliance with their fiduciary obligations. Conclusion: The demand for accounting from a fiduciary is an essential legal recourse available to beneficiaries or interested parties to ensure transparency, accountability, and proper management of assets. In Hawaii, several types of fiduciaries, including trustees, executors, guardians, and agents under a power of attorney, may be subject to such demands. Understanding the importance of demanding accounting from a fiduciary helps beneficiaries protect their rights and interests within the framework of Hawaii's fiduciary laws. Relevant Keywords: Hawaii, Demand for Accounting, Fiduciary Relationships, Beneficiaries, Transparency, Trusts, Estates, Guardianship, Power of Attorney.Hawaii Demand for Accounting from a Fiduciary: Introduction: Hawaii maintains a legal framework to protect the rights and ensure accountability in fiduciary relationships. A fiduciary is an individual or entity entrusted with managing financial matters on behalf of another party. In various situations, the need may arise to demand accounting from a fiduciary in Hawaii. This article explores the concept of Hawaii Demand for Accounting from a Fiduciary, its significance, applicable laws, and different types of fiduciaries involved. What is Demand for Accounting from a Fiduciary? Demand for accounting from a fiduciary refers to the legal process through which a beneficiary or interested party requests a fiduciary to provide a detailed financial report or account for their actions, performance, and management of assets entrusted to them. This demand helps ensure transparency, identify any potential breaches of fiduciary duty, and safeguard the interests of the beneficiaries. Relevant Keywords: Hawaii Demand for Accounting, Fiduciary Duty, Financial Accountability, Beneficiary Rights, Asset Management. Types of Hawaii Demand for Accounting from a Fiduciary: 1. Trust Demand for Accounting: In the context of trusts, beneficiaries have the right to demand accounting from a trustee. A trustee manages trust assets, distributes income, and protects the financial interests of beneficiaries. Should a beneficiary feel uncertain about the trustee's handling of the trust, they can demand accounting to assess the trustee's performance and adherence to fiduciary duties. 2. Estate Demand for Accounting: When an individual passes away, an executor or personal representative is appointed to administer the deceased's estate. Beneficiaries or interested parties may demand accounting from the executor to ensure the proper distribution of assets, the payment of debts, and the fulfillment of other legal obligations. 3. Guardianship Demand for Accounting: A guardian is appointed to protect the interests of an individual who is unable to manage their own affairs due to incapacity. Interested parties, such as family members or beneficiaries, can seek a demand for accounting from the guardian to guarantee appropriate management and a responsible use of the ward's assets. 4. Power of Attorney Demand for Accounting: Under a power of attorney, an appointed agent handles financial and legal matters on behalf of another person. If concerns regarding the agent's actions or potential misuse of authority arise, beneficiaries or stakeholders may demand accounting to verify the agent's compliance with their fiduciary obligations. Conclusion: The demand for accounting from a fiduciary is an essential legal recourse available to beneficiaries or interested parties to ensure transparency, accountability, and proper management of assets. In Hawaii, several types of fiduciaries, including trustees, executors, guardians, and agents under a power of attorney, may be subject to such demands. Understanding the importance of demanding accounting from a fiduciary helps beneficiaries protect their rights and interests within the framework of Hawaii's fiduciary laws. Relevant Keywords: Hawaii, Demand for Accounting, Fiduciary Relationships, Beneficiaries, Transparency, Trusts, Estates, Guardianship, Power of Attorney.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.