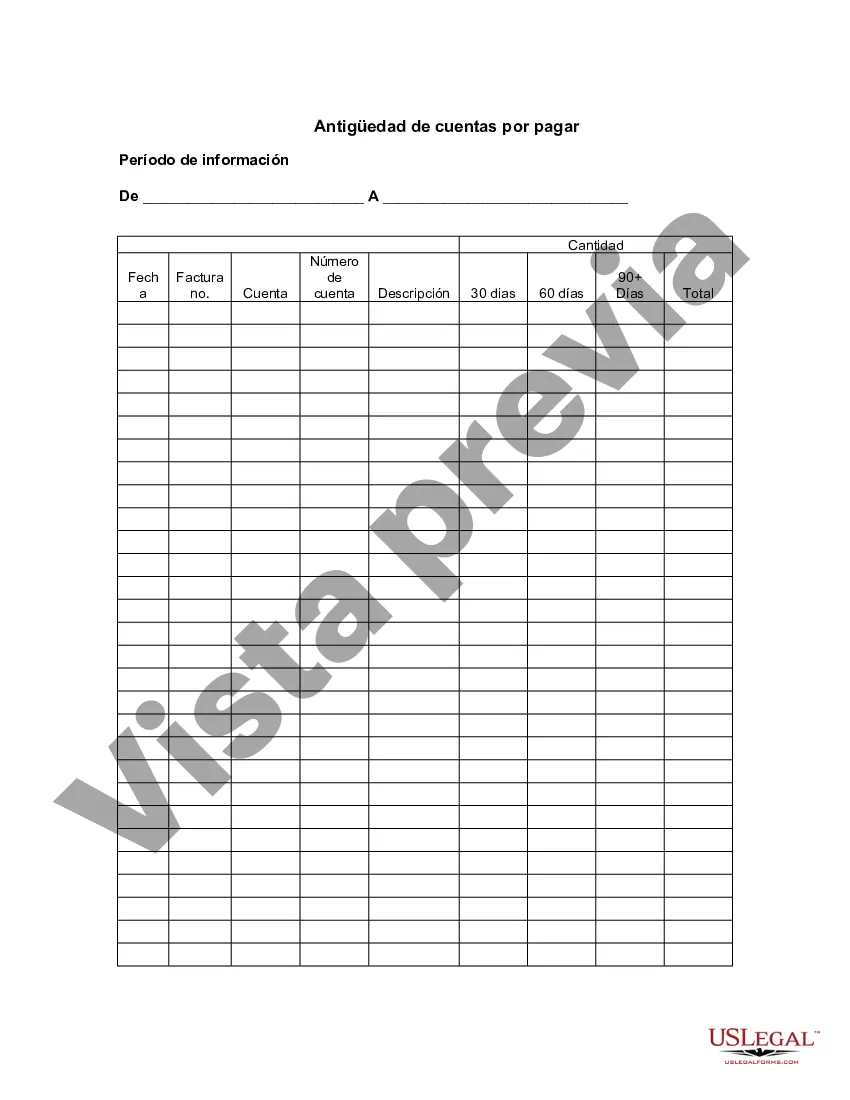

The Hawaii Aging of Accounts Payable is a financial management tool used by businesses to analyze and track the payment status of outstanding invoices or bills owed to vendors or creditors. It provides a detailed view of the unpaid balances, age of the debts, and the overall health of a company's accounts payable. Keywords: Hawaii Aging of Accounts Payable, payment status, outstanding invoices, bills owed, vendors, creditors, financial management tool, unpaid balances, age of debts, accounts payable. The Hawaii Aging of Accounts Payable categorizes outstanding debts into different time periods based on their age, providing a clearer picture of which bills are overdue and need immediate attention. This tool aids businesses in identifying potential cash flow issues, managing vendor relationships, and forecasting financial obligations. Here are the types of Hawaii Aging of Accounts Payable commonly used: 1. Current: This category represents invoices or bills that are due within the current payment period. Typically, payments for these outstanding balances are expected to be made promptly and are considered up-to-date. 2. 30 Days: In this category, invoices or bills that are overdue by 30 days from the due date are grouped together. Businesses should give priority to paying these balances to avoid late payment penalties and maintain good relationships with vendors or creditors. 3. 60 Days: This group consists of invoices or bills that have remained unpaid for 60 days beyond the due date. It implies a longer delinquency period and requires immediate attention to prevent further consequences such as damaged credit ratings or legal actions from creditors. 4. 90 Days or more: Accounts payable that have reached a 90-day or more overdue period fall into this category. These prolonged delinquent debts can significantly impact a company's financial stability and may require more aggressive actions, such as negotiations, payment plans, or debt collections strategies. Businesses utilize the Hawaii Aging of Accounts Payable as a powerful tool to manage their finances effectively and maintain positive relationships with vendors and creditors. By regularly analyzing this report, companies can identify trends, spot potential bottlenecks in payment processes, implement necessary adjustments, and stay on top of outstanding debts, ultimately improving their overall financial health. In conclusion, the Hawaii Aging of Accounts Payable is an essential financial management tool that enables businesses to monitor and analyze their outstanding invoices or bills. By using this tool and differentiating debts into various time periods such as current, 30 days, 60 days, and 90 days or more, businesses can efficiently manage their accounts payable and ensure timely payments to vendors and creditors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Hawaii Antigüedad De Cuentas Por Pagar?

You can devote several hours online searching for the lawful document web template that meets the state and federal needs you want. US Legal Forms supplies a huge number of lawful kinds which are examined by specialists. You can easily obtain or print the Hawaii Aging of Accounts Payable from your services.

If you have a US Legal Forms bank account, you may log in and click on the Down load option. Next, you may complete, modify, print, or indicator the Hawaii Aging of Accounts Payable. Each lawful document web template you acquire is your own property for a long time. To acquire another backup of any acquired kind, proceed to the My Forms tab and click on the related option.

Should you use the US Legal Forms web site initially, stick to the easy instructions below:

- Very first, be sure that you have selected the best document web template for your county/area of your liking. Look at the kind description to make sure you have picked out the correct kind. If accessible, take advantage of the Review option to check from the document web template also.

- If you want to get another version of your kind, take advantage of the Lookup discipline to find the web template that meets your requirements and needs.

- Upon having found the web template you want, click on Get now to move forward.

- Find the pricing strategy you want, type your references, and sign up for a merchant account on US Legal Forms.

- Full the financial transaction. You can utilize your credit card or PayPal bank account to cover the lawful kind.

- Find the formatting of your document and obtain it to your product.

- Make modifications to your document if possible. You can complete, modify and indicator and print Hawaii Aging of Accounts Payable.

Down load and print a huge number of document themes using the US Legal Forms Internet site, that provides the biggest collection of lawful kinds. Use specialist and state-particular themes to handle your company or personal needs.