Hawaii Sales Commission Policy refers to the set of guidelines and regulations governing the payment of commissions to sales professionals in the state of Hawaii. Commissions are a form of compensation that is performance-based and is typically awarded to salespeople who successfully generate sales and meet predetermined targets. This policy ensures transparency, fairness, and clarity in commission calculation and payment processes. The Hawaii Sales Commission Policy outlines the terms and conditions under which commissions are earned and paid. It establishes the criteria for commission eligibility, such as achieving sales goals, meeting deadlines, or securing new clients. The policy also defines the commission structure, including the rate or percentage assigned to each sale or sales category, and any additional incentives, bonuses, or tiers that may exist. One type of Sales Commission Policy found in Hawaii is the Straight Commission Policy. In this approach, sales professionals are solely compensated based on a percentage of the total value of sales they generate. This policy aligns the interests of salespeople with the company's revenue goals, as they earn more when they sell more. Another type of Sales Commission Policy is the Base Plus Commission Policy. Under this framework, sales professionals receive a base salary along with a commission based on their sales performance. This policy provides stability through a consistent income while still offering the incentive of additional earnings through commissions. In some cases, companies may have a tiered commission structure as part of their Sales Commission Policy. This means that as sales professionals reach specific revenue targets or milestones, their commission percentage increases. Tiered commission structures aims to motivate and reward salespeople for surpassing goals and driving higher sales volumes. Moreover, the Hawaii Sales Commission Policy may outline the rules and procedures for commission calculations, including the timing and frequency of payments. It may also address matters such as commission disputes, deductions, clawbacks, and commission recovery in case of canceled or refunded sales. In summary, Hawaii Sales Commission Policy dictates how commissions are determined, earned, and distributed to sales professionals in accordance with Hawaii labor laws. The policy can take various forms, including Straight Commission, Base Plus Commission, and Tiered Commission structures. It ensures transparency, fairness, and proper compensation for salespeople in Hawaii.

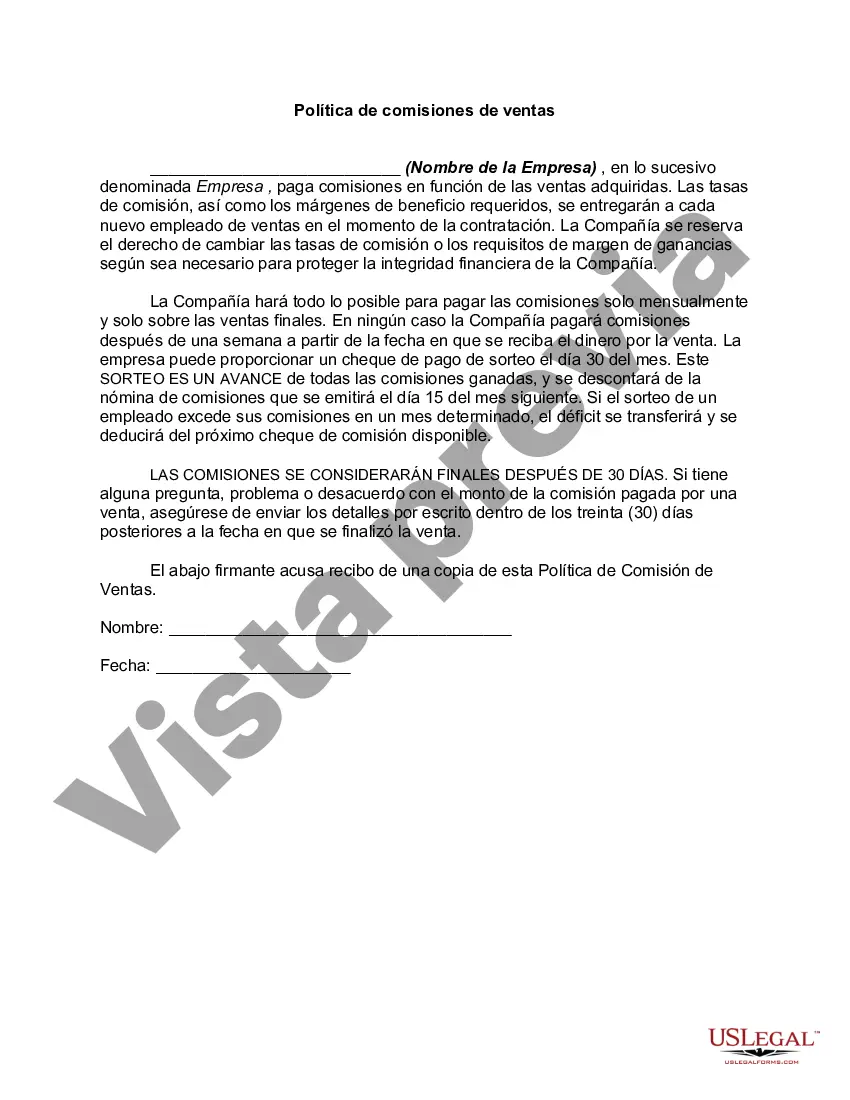

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Política de comisiones de ventas - Sales Commission Policy

Description

How to fill out Hawaii Política De Comisiones De Ventas?

You may spend hours on the web trying to find the authorized document design which fits the federal and state demands you will need. US Legal Forms gives a large number of authorized types which can be analyzed by experts. You can actually download or printing the Hawaii Sales Commission Policy from our assistance.

If you already have a US Legal Forms account, you can log in and click on the Acquire switch. After that, you can full, revise, printing, or indication the Hawaii Sales Commission Policy. Each authorized document design you buy is the one you have eternally. To obtain one more version for any obtained develop, check out the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms website the first time, adhere to the basic recommendations under:

- Very first, be sure that you have selected the best document design for that county/area that you pick. Look at the develop description to make sure you have picked the appropriate develop. If accessible, utilize the Review switch to look with the document design at the same time.

- If you want to get one more edition of your develop, utilize the Search discipline to get the design that meets your needs and demands.

- After you have located the design you need, simply click Buy now to move forward.

- Find the pricing strategy you need, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Full the financial transaction. You can utilize your Visa or Mastercard or PayPal account to purchase the authorized develop.

- Find the file format of your document and download it in your system.

- Make modifications in your document if possible. You may full, revise and indication and printing Hawaii Sales Commission Policy.

Acquire and printing a large number of document themes while using US Legal Forms website, that provides the largest variety of authorized types. Use skilled and express-particular themes to take on your small business or specific requires.