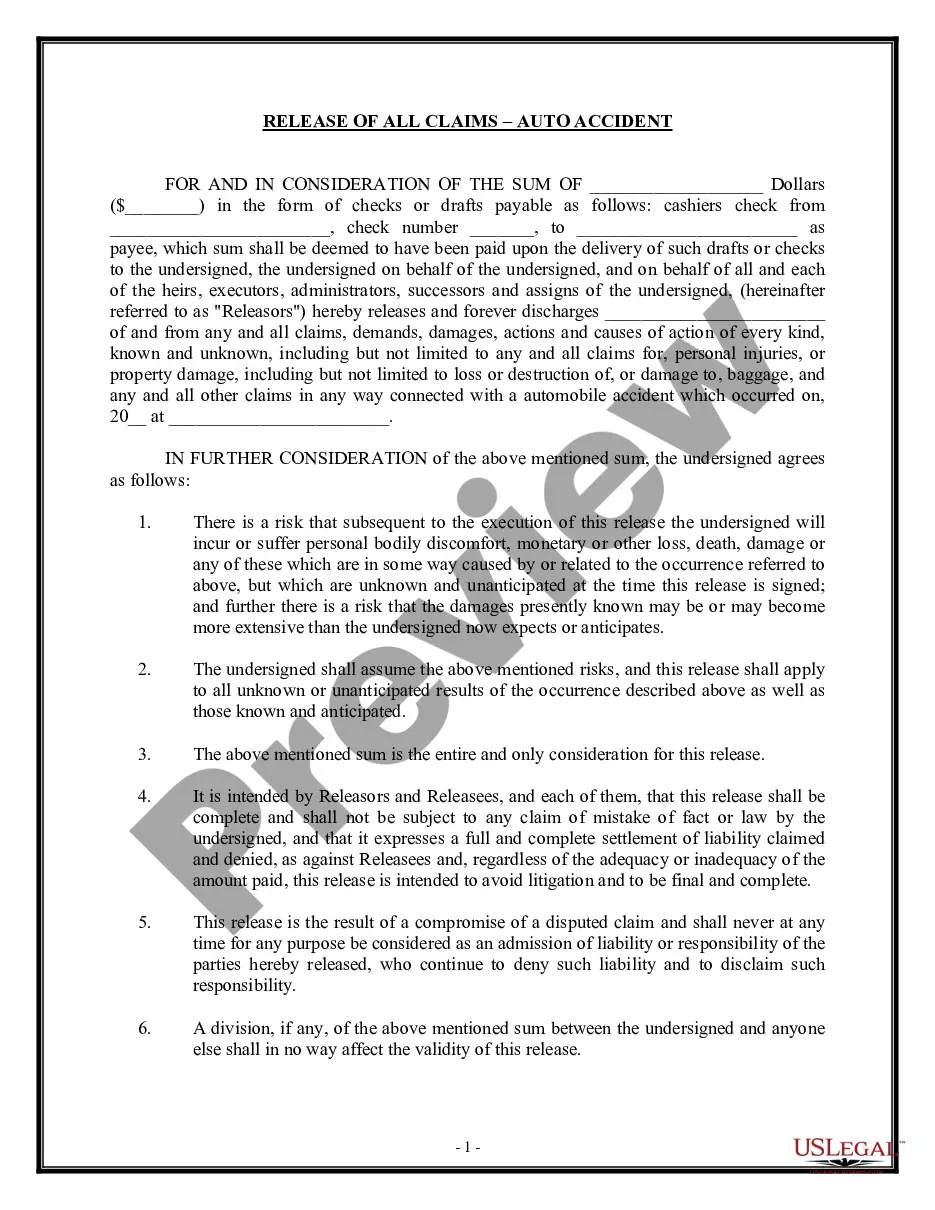

Hawaii Installment Promissory Note with Bank Deposit as Collateral is a legal document that outlines the terms and conditions of a loan agreement. It is specifically designed for borrowers in Hawaii who wish to provide a bank deposit as collateral to secure their loan. This promissory note allows borrowers to borrow a specific amount of money from a lender and repay it through a series of installment payments, including interest, over a predetermined period. The loan amount, interest rate, repayment schedule, and any other agreed-upon terms are clearly stated within the note. By using a bank deposit as collateral, the lender obtains additional security in case the borrower defaults on the loan. If the borrower fails to make the required payments, the lender has the right to seize the bank deposit and use it to recover the outstanding balance. In Hawaii, there may be different types of Installment Promissory Notes with Bank Deposit as Collateral available depending on the specific requirements and preferences of the borrower and lender. These variations may include: 1. Fixed Interest Rate Note: This type of promissory note features a fixed interest rate throughout the loan term. The interest rate remains constant, ensuring predictable monthly installment payments for the borrower. 2. Adjustable Interest Rate Note: Unlike the fixed interest rate note, the adjustable interest rate note allows the interest rate to fluctuate over time. The rate is typically tied to a specific financial index and may change periodically, causing the installment payments to vary. 3. Balloon Payment Note: A balloon payment note involves the borrower making smaller regular installment payments, with a larger final payment (balloon payment) due at the end of the loan term. This type of note is suitable for borrowers who anticipate having a lump sum of money available at the end of the loan term. 4. Amortized Note: An amortized note requires the borrower to make installment payments that cover both the principal loan amount and the interest charges. With each payment, a portion goes towards reducing the principal balance, resulting in gradual debt reduction over time. Borrowers and lenders engaging in Hawaii Installment Promissory Note with Bank Deposit as Collateral should carefully review and understand the terms outlined in the note. It is recommended to consult with legal professionals or financial advisors to ensure compliance with Hawaii laws and to protect the interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Hawaii Pagaré A Plazos Con Depósito Bancario Como Garantía?

US Legal Forms - among the largest libraries of authorized kinds in the United States - delivers a variety of authorized file templates you are able to download or produce. While using internet site, you will get 1000s of kinds for company and personal purposes, sorted by categories, suggests, or keywords.You will find the latest versions of kinds like the Hawaii Installment Promissory Note with Bank Deposit as Collateral in seconds.

If you already have a monthly subscription, log in and download Hawaii Installment Promissory Note with Bank Deposit as Collateral from the US Legal Forms catalogue. The Down load button can look on every form you perspective. You have accessibility to all earlier downloaded kinds in the My Forms tab of the accounts.

In order to use US Legal Forms the first time, listed below are easy instructions to help you started out:

- Be sure to have chosen the proper form for your area/state. Select the Review button to check the form`s content material. Browse the form description to ensure that you have chosen the appropriate form.

- When the form does not satisfy your needs, use the Research area at the top of the monitor to get the the one that does.

- In case you are content with the form, validate your choice by clicking on the Get now button. Then, select the costs prepare you prefer and offer your references to register to have an accounts.

- Procedure the financial transaction. Make use of credit card or PayPal accounts to perform the financial transaction.

- Select the structure and download the form on your device.

- Make adjustments. Complete, modify and produce and indicator the downloaded Hawaii Installment Promissory Note with Bank Deposit as Collateral.

Every template you put into your money does not have an expiration day and is the one you have eternally. So, if you wish to download or produce another backup, just check out the My Forms portion and click around the form you will need.

Obtain access to the Hawaii Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms, probably the most substantial catalogue of authorized file templates. Use 1000s of expert and status-distinct templates that fulfill your small business or personal requires and needs.