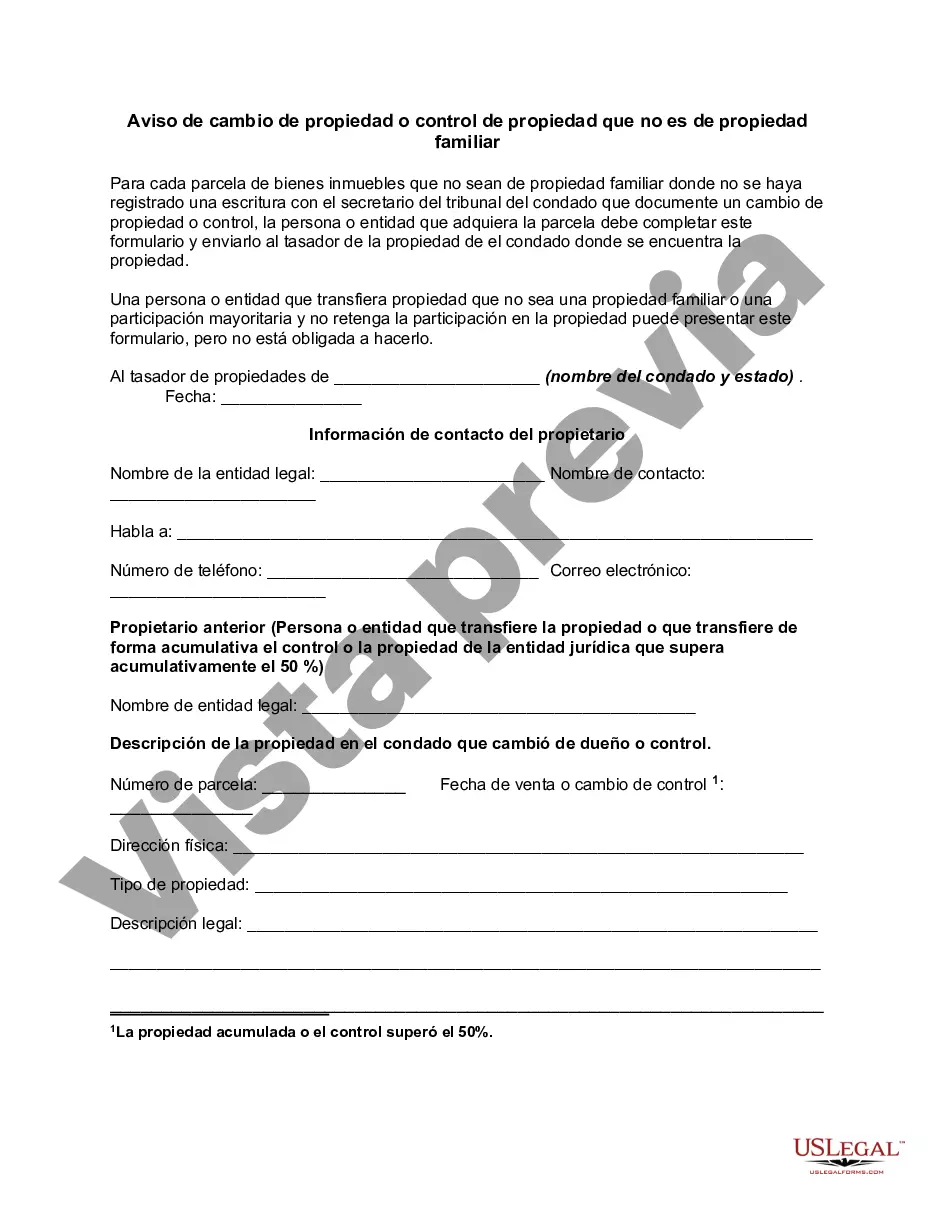

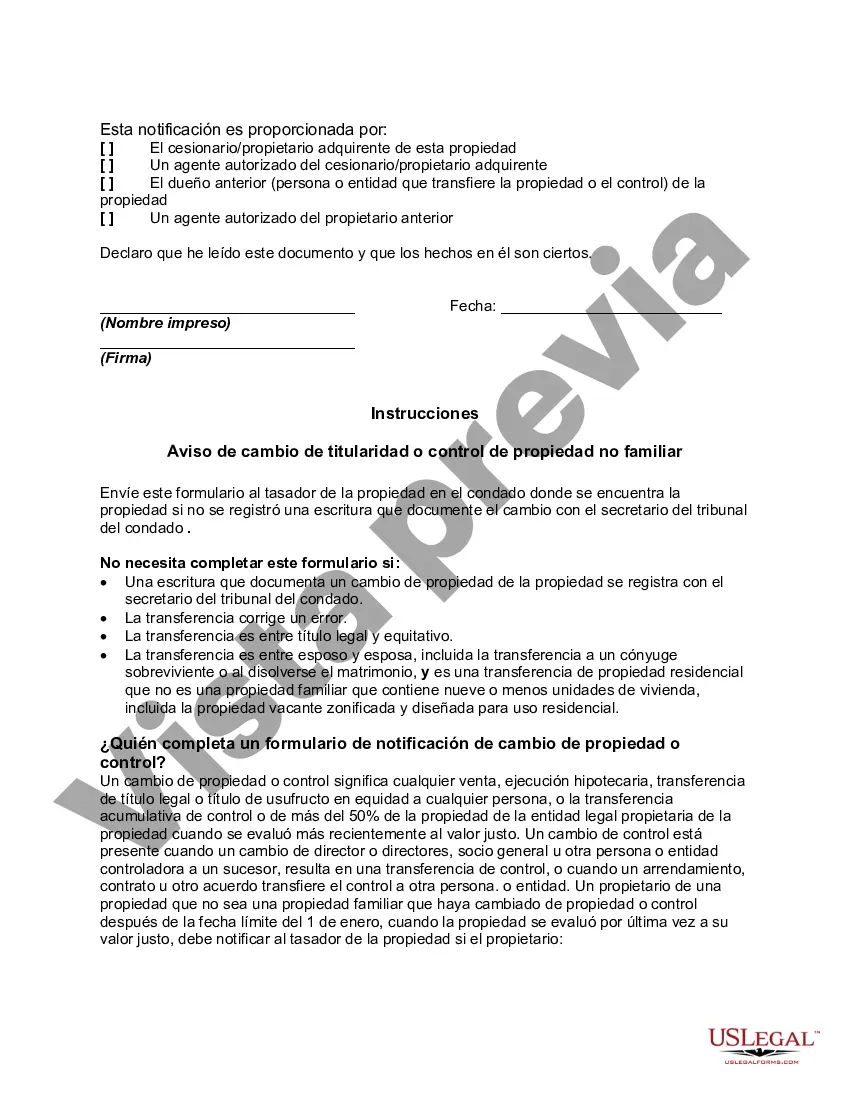

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

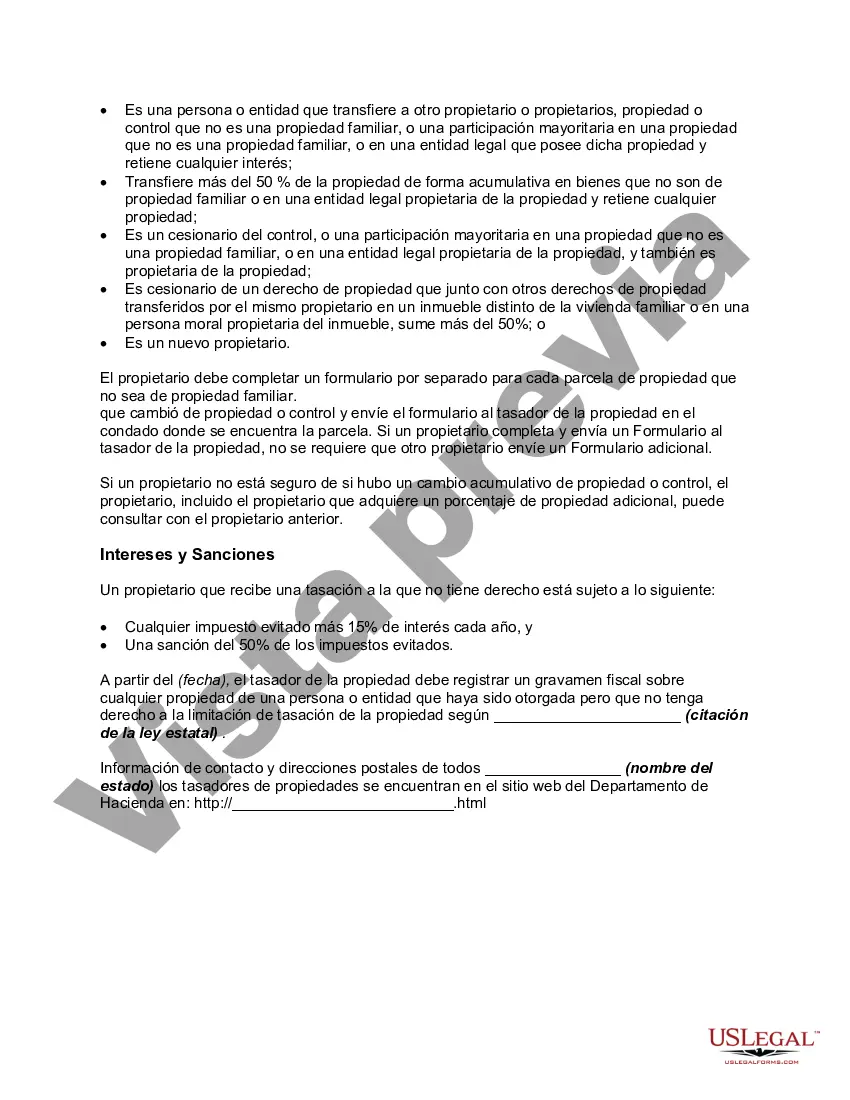

A Hawaii Notice of Change of Ownership or Control Non-Homestead Property is a legal document that must be filed when there is a change in ownership or control of a non-homestead property in the state of Hawaii. This notice is typically submitted to the county tax assessor's office within a specified time frame after the ownership transfer or control change occurs. The purpose of the Hawaii Notice of Change of Ownership or Control Non-Homestead Property is to inform the tax assessor's office about the new ownership or controlling party so that property taxes can be accurately assessed and collected. Failure to file this notice can lead to penalties or fines imposed by the state. Once the notice is filed, it allows the tax assessor's office to update their records accordingly and adjust the property tax liability, ensuring that the new owner or controlling party is correctly held responsible for the property taxes associated with the non-homestead property. Different types of Hawaii Notice of Change of Ownership or Control Non-Homestead Property include: 1. Commercial Real Estate Change of Ownership: This type of notice applies to commercial properties such as office buildings, retail spaces, hotels, or warehouses. When there is a change in ownership or control of these properties, the notice must be filed to notify the tax assessor's office. 2. Industrial Property Change of Ownership: This type of notice is specific to industrial properties such as manufacturing plants, factories, or facilities used for resource extraction. When any change occurs in the ownership or control of these properties, the notice must be submitted to the tax assessor's office. 3. Agricultural Land Change of Ownership: Agricultural properties, including farmlands, ranches, or vineyards, fall under this category. Whenever there is a transfer of ownership or control of such agricultural land, the Notice of Change of Ownership or Control Non-Homestead Property should be filed with the tax assessor's office. 4. Vacant Land Change of Ownership: Vacant parcels of land that are not utilized for residential purposes are considered non-homestead properties. When these vacant lands change hands, the notice must be filed to update the tax assessment records for accurate tax collection. By promptly filing the Hawaii Notice of Change of Ownership or Control Non-Homestead Property, property owners can fulfill their legal obligation and ensure that the appropriate property taxes are assessed and paid. It is essential to consult with a legal professional or the tax assessor's office for specific filing requirements and deadlines to avoid any penalties associated with non-compliance.A Hawaii Notice of Change of Ownership or Control Non-Homestead Property is a legal document that must be filed when there is a change in ownership or control of a non-homestead property in the state of Hawaii. This notice is typically submitted to the county tax assessor's office within a specified time frame after the ownership transfer or control change occurs. The purpose of the Hawaii Notice of Change of Ownership or Control Non-Homestead Property is to inform the tax assessor's office about the new ownership or controlling party so that property taxes can be accurately assessed and collected. Failure to file this notice can lead to penalties or fines imposed by the state. Once the notice is filed, it allows the tax assessor's office to update their records accordingly and adjust the property tax liability, ensuring that the new owner or controlling party is correctly held responsible for the property taxes associated with the non-homestead property. Different types of Hawaii Notice of Change of Ownership or Control Non-Homestead Property include: 1. Commercial Real Estate Change of Ownership: This type of notice applies to commercial properties such as office buildings, retail spaces, hotels, or warehouses. When there is a change in ownership or control of these properties, the notice must be filed to notify the tax assessor's office. 2. Industrial Property Change of Ownership: This type of notice is specific to industrial properties such as manufacturing plants, factories, or facilities used for resource extraction. When any change occurs in the ownership or control of these properties, the notice must be submitted to the tax assessor's office. 3. Agricultural Land Change of Ownership: Agricultural properties, including farmlands, ranches, or vineyards, fall under this category. Whenever there is a transfer of ownership or control of such agricultural land, the Notice of Change of Ownership or Control Non-Homestead Property should be filed with the tax assessor's office. 4. Vacant Land Change of Ownership: Vacant parcels of land that are not utilized for residential purposes are considered non-homestead properties. When these vacant lands change hands, the notice must be filed to update the tax assessment records for accurate tax collection. By promptly filing the Hawaii Notice of Change of Ownership or Control Non-Homestead Property, property owners can fulfill their legal obligation and ensure that the appropriate property taxes are assessed and paid. It is essential to consult with a legal professional or the tax assessor's office for specific filing requirements and deadlines to avoid any penalties associated with non-compliance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.