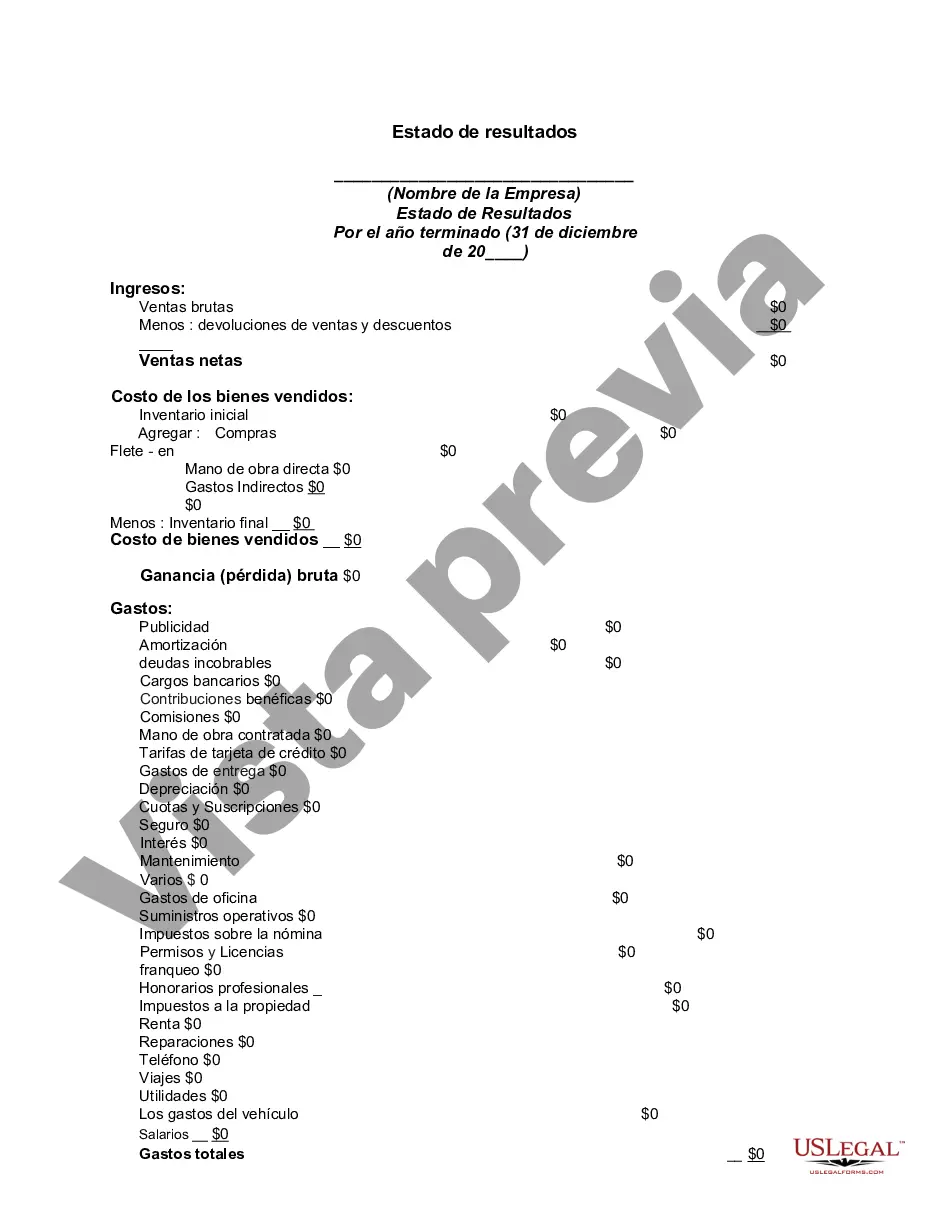

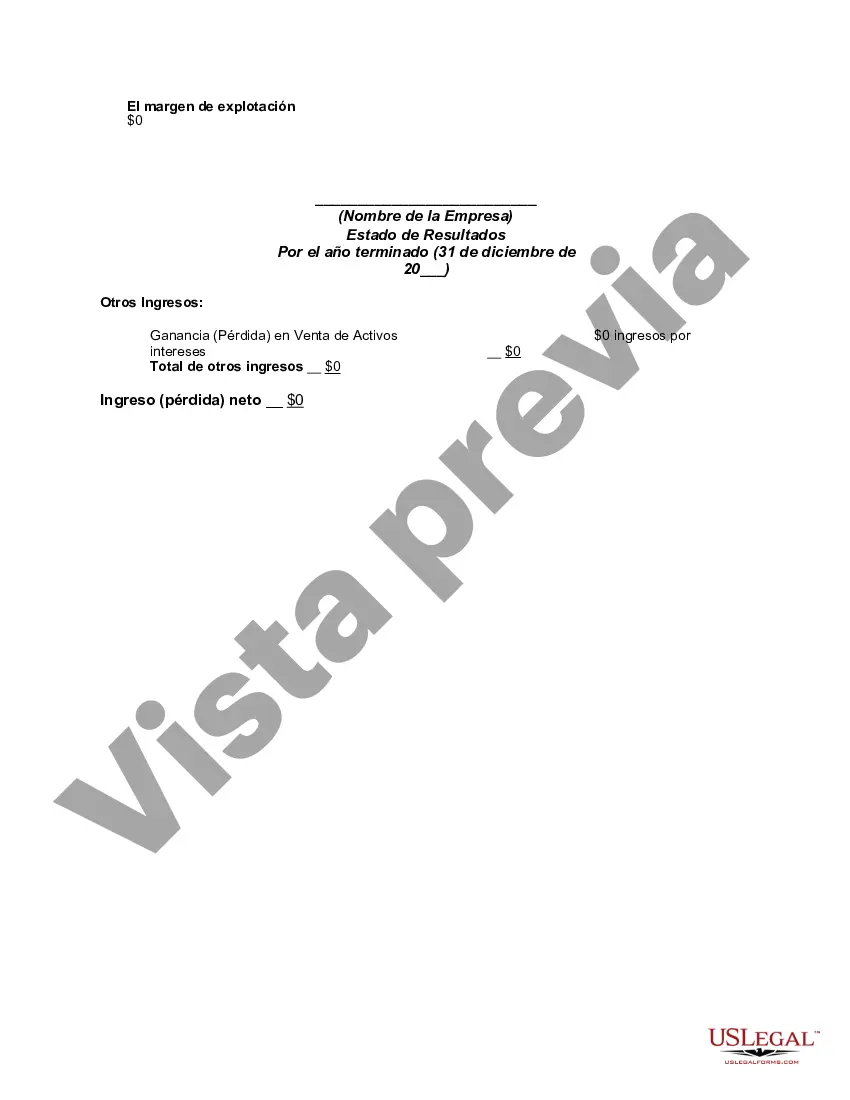

An income statement (sometimes called a profit and loss statement) lists your revenues and expenses, and tells you the profit or loss of your business for a given period of time. You can use this income statement form as a starting point to create one yourself.

The Hawaii Income Statement, also known as the Hawaii Financial Statement, is a critical document used in accounting to assess and analyze the financial performance of a company or individual in Hawaii. This statement provides an overview of the revenue, expenses, and net income earned during a specific period, typically on an annual or quarterly basis. It plays a crucial role in evaluating the profitability, efficiency, and overall financial health of an entity operating in Hawaii. The Hawaii Income Statement contains various key components that help in evaluating the financial performance. The revenue section outlines the income generated by the entity from its primary sources, such as sales of products or services, interest income, or rental income. This section indicates the core operating activities' success and growth potential in the Hawaii market. In contrast, the expense section of the Hawaii Income Statement lists various costs incurred by the entity to generate revenue. These expenses can include materials and supplies, wages and salaries, rent, utilities, advertising, taxes, and depreciation. Analyzing these expenses helps understand the operating efficiency and cost management capabilities of the entity within the Hawaii market. The Hawaii Income Statement presents an intermediate subtotal known as operating income, which is derived by deducting the total expenses from the total revenue. This figure helps evaluate the entity's profitability from its core operations within Hawaii specifically. Furthermore, the Hawaii Income Statement may include non-operating income or expenses. These non-operating items are revenue or expenses generated from activities outside the entity's primary operations. They may include income from investments, gains or losses from the sale of assets, or interest expenses on loans. The inclusion of these items allows for a comprehensive evaluation of the entity's overall financial performance. Finally, the Hawaii Income Statement calculates the net income, also referred to as net profit or net earnings. It represents the final result after deducting all operating and non-operating expenses from the operating income. Net income demonstrates the financial success or failure of an entity in Hawaii, reflecting whether the revenues generated were sufficient to cover the costs incurred during the specified period. While the Hawaii Income Statement generally follows a standard format, specific types of income statements may differ based on the entity's nature, industry, or regulatory requirements in Hawaii. Examples include a single-step income statement, which presents all revenues and expenses in one section, or a multi-step income statement, which separates operating and non-operating activities and calculates intermediate subtotals. Additionally, Hawaii Income Statements can vary based on the entity's legal structure, such as a sole proprietorship, partnership, corporation, or non-profit organization. In conclusion, the Hawaii Income Statement provides a comprehensive overview of an entity's financial performance within the specific market of Hawaii. It assesses revenue, expenses, and net income, allowing for an evaluation of profitability, efficiency, and overall financial health. Having a clear understanding of the Hawaii Income Statement plays a vital role in decision-making processes, financial analysis, and strategic planning for individuals and businesses operating in Hawaii.The Hawaii Income Statement, also known as the Hawaii Financial Statement, is a critical document used in accounting to assess and analyze the financial performance of a company or individual in Hawaii. This statement provides an overview of the revenue, expenses, and net income earned during a specific period, typically on an annual or quarterly basis. It plays a crucial role in evaluating the profitability, efficiency, and overall financial health of an entity operating in Hawaii. The Hawaii Income Statement contains various key components that help in evaluating the financial performance. The revenue section outlines the income generated by the entity from its primary sources, such as sales of products or services, interest income, or rental income. This section indicates the core operating activities' success and growth potential in the Hawaii market. In contrast, the expense section of the Hawaii Income Statement lists various costs incurred by the entity to generate revenue. These expenses can include materials and supplies, wages and salaries, rent, utilities, advertising, taxes, and depreciation. Analyzing these expenses helps understand the operating efficiency and cost management capabilities of the entity within the Hawaii market. The Hawaii Income Statement presents an intermediate subtotal known as operating income, which is derived by deducting the total expenses from the total revenue. This figure helps evaluate the entity's profitability from its core operations within Hawaii specifically. Furthermore, the Hawaii Income Statement may include non-operating income or expenses. These non-operating items are revenue or expenses generated from activities outside the entity's primary operations. They may include income from investments, gains or losses from the sale of assets, or interest expenses on loans. The inclusion of these items allows for a comprehensive evaluation of the entity's overall financial performance. Finally, the Hawaii Income Statement calculates the net income, also referred to as net profit or net earnings. It represents the final result after deducting all operating and non-operating expenses from the operating income. Net income demonstrates the financial success or failure of an entity in Hawaii, reflecting whether the revenues generated were sufficient to cover the costs incurred during the specified period. While the Hawaii Income Statement generally follows a standard format, specific types of income statements may differ based on the entity's nature, industry, or regulatory requirements in Hawaii. Examples include a single-step income statement, which presents all revenues and expenses in one section, or a multi-step income statement, which separates operating and non-operating activities and calculates intermediate subtotals. Additionally, Hawaii Income Statements can vary based on the entity's legal structure, such as a sole proprietorship, partnership, corporation, or non-profit organization. In conclusion, the Hawaii Income Statement provides a comprehensive overview of an entity's financial performance within the specific market of Hawaii. It assesses revenue, expenses, and net income, allowing for an evaluation of profitability, efficiency, and overall financial health. Having a clear understanding of the Hawaii Income Statement plays a vital role in decision-making processes, financial analysis, and strategic planning for individuals and businesses operating in Hawaii.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.