Hawaii Receipt and Withdrawal from Partnership refer to the legal processes involved when a partner joins or leaves a partnership in the state of Hawaii. These procedures ensure that the transition is handled properly and all parties are informed and protected. Here is a detailed description of the Hawaii Receipt and Withdrawal from Partnership, along with some notable types of partnerships in the state: Hawaii Receipt and Withdrawal from Partnership: In Hawaii, when an individual decides to become a partner or withdraw from a partnership, specific steps need to be followed to maintain transparency and legal compliance. The process involves the agreement of all partners and adherence to state laws governing partnerships. When a partner joins a partnership, a receipt of partnership is typically executed. This receipt formally documents the incoming partner's admission into the partnership, the capital contribution made by the partner, and any profit or loss allocation. It may also cover other essential details, such as the partner's role, responsibilities, and ownership percentage within the partnership. This document serves as evidence of the newly formed partnership and protects the rights and interests of all partners involved. On the other hand, when a partner withdraws from a partnership, a withdrawal agreement is created. This agreement outlines the terms and conditions under which the partner's departure will occur. It defines the partner's rights and obligations before and after the withdrawal, including the distribution of assets, settlement of debts, and any ongoing responsibilities. The withdrawal agreement allows for a smooth transition and prevents disputes or confusion among remaining partners. Types of partnerships in Hawaii: 1. General Partnership: This is the most common type of partnership in Hawaii. In a general partnership, all partners share equal rights and responsibilities. They jointly manage the business, contribute to its capital, and share in its profits and losses. 2. Limited Partnership: A limited partnership in Hawaii comprises at least one general partner and one or more limited partners. General partners have unlimited liability for the business's debts and obligations, while limited partners have limited liability, usually limited to their investment amounts. 3. Limited Liability Partnership (LLP): An LLP in Hawaii allows professionals, such as attorneys or accountants, to form a partnership while protecting themselves from personal liability for the partnership's obligations. The partnership's liabilities are limited to the extent of the partners' investment, and each partner is not personally responsible for the actions of other partners. It is crucial to note that partnership laws can vary, and seeking professional legal advice is recommended before executing any partnership agreement or withdrawal. The specific requirements and legal procedures for Hawaii Receipt and Withdrawal from Partnership can be found in Hawaii Revised Statutes Chapter 425. In summary, Hawaii Receipt and Withdrawal from Partnership involve the necessary legal steps when a partner joins or departs from a partnership in Hawaii. Understanding the specific partnership type and complying with state laws are crucial to ensure a smooth and legally compliant transition.

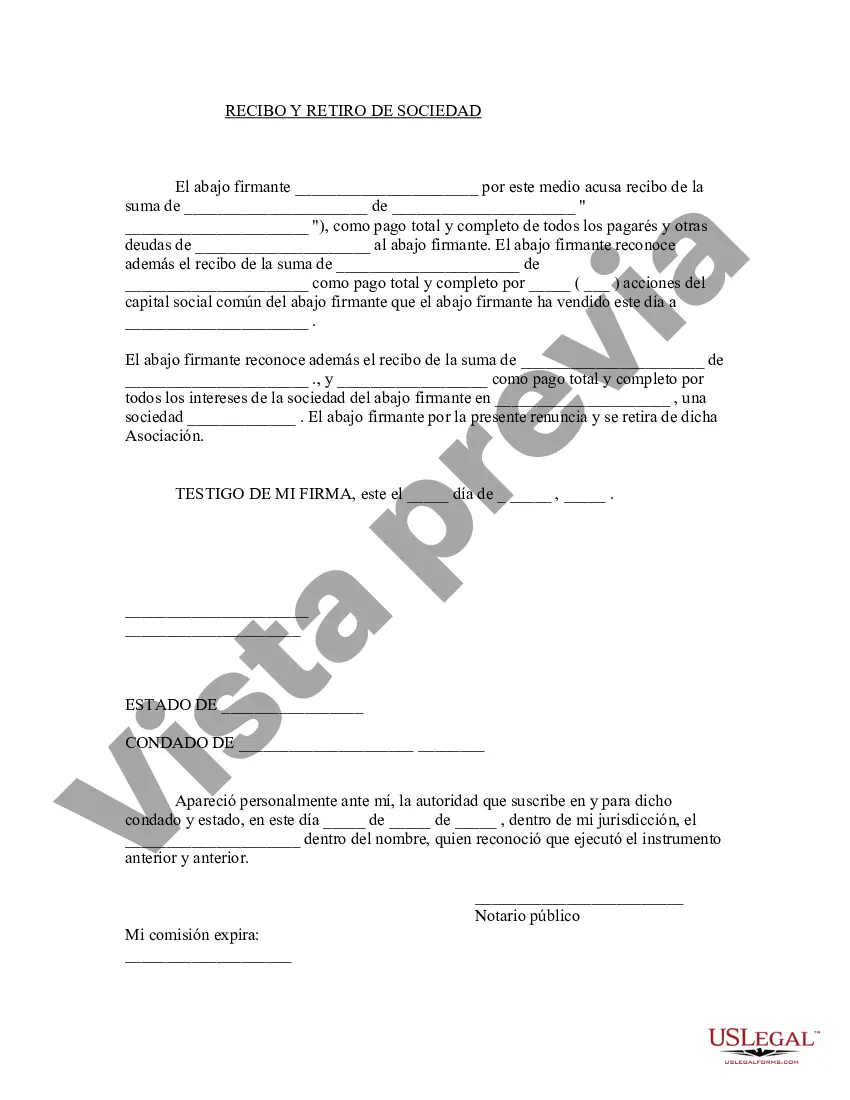

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out Hawaii Recepción Y Retiro De La Sociedad?

Are you in the position where you will need papers for either organization or person functions nearly every working day? There are plenty of legitimate papers layouts accessible on the Internet, but discovering kinds you can trust isn`t simple. US Legal Forms gives 1000s of form layouts, much like the Hawaii Receipt and Withdrawal from Partnership, which can be created to fulfill federal and state needs.

In case you are previously acquainted with US Legal Forms website and also have an account, merely log in. Next, you are able to down load the Hawaii Receipt and Withdrawal from Partnership format.

Should you not have an account and wish to start using US Legal Forms, adopt these measures:

- Discover the form you want and ensure it is for that correct city/state.

- Make use of the Preview option to analyze the form.

- Read the description to actually have chosen the right form.

- If the form isn`t what you are looking for, take advantage of the Search discipline to obtain the form that meets your needs and needs.

- If you get the correct form, just click Acquire now.

- Pick the costs prepare you desire, submit the required info to create your account, and pay money for an order with your PayPal or bank card.

- Choose a handy paper format and down load your duplicate.

Find all the papers layouts you may have purchased in the My Forms menus. You can aquire a extra duplicate of Hawaii Receipt and Withdrawal from Partnership whenever, if required. Just select the required form to down load or print the papers format.

Use US Legal Forms, probably the most comprehensive variety of legitimate types, to save lots of efforts and avoid mistakes. The service gives appropriately manufactured legitimate papers layouts that you can use for a selection of functions. Produce an account on US Legal Forms and begin making your daily life a little easier.