Title: Hawaii Checklist — Leasing vs. Purchasing: A Comprehensive Guide to Making the Right Decision Introduction: When it comes to acquiring property or assets in Hawaii, individuals and businesses often face the crucial decision of whether to lease or purchase. This comprehensive checklist will explore the key factors to consider and analyze the benefits and drawbacks of both options. By understanding the differences, costs, and legal aspects, readers can make an informed decision that aligns with their unique needs. Below, we delve into two types of Hawaii Checklists — Leasing vs. Purchasing: Residential and Commercial. 1. Residential Hawaii Checklist — Leasing vs. Purchasing— - Financing Options: Compare mortgage rates, down payment requirements, and loan terms for purchasing a Hawaii home versus upfront costs, security deposits, and monthly rent for leasing. — Long-Term Commitment: Evaluate your lifestyle and goals to determine if you prefer the flexibility of leasing or the stability of homeownership. — Property Management: Lease agreements generally include responsibilities for maintenance and repairs, while owning a home requires personally handling these tasks or hiring professional assistance. — Tax Implications: Understand the tax advantages and deductions available for homeowners versus potential tax benefits for renters. — Market Conditions: Analyze the current Hawaii real estate market trends, including property values, rental rates, and available inventory, to make an informed decision. 2. Commercial Hawaii Checklist — Leasing vs. Purchasing— - Location Suitability: Consider the ideal location for your business, taking into account customer accessibility, competition, and other relevant factors. — Financial Considerations: Compare the upfront costs, monthly payments, and potential return on investment between leasing commercial space in Hawaii or purchasing a property. — Flexibility and Expansion: Evaluate whether leasing or owning allows for future growth and expansion opportunities, considering lease terms, space requirements, and the potential resale value of a purchased property. — Customization and Control: Determine the degree of control and ability to customize the space to meet your business needs based on leasing restrictions or ownership privileges. — Maintenance and Responsibility: Understand the responsibilities for repairs, maintenance, and improvements under lease agreements or ownership, including associated costs. Conclusion: The decision to lease or purchase property in Hawaii requires careful consideration of financial, practical, and legal aspects specific to the residential or commercial sector. By following this detailed checklist, individuals and businesses alike can compare the benefits and drawbacks of both options and make an informed decision that best suits their needs, goals, and long-term aspirations in the beautiful state of Hawaii.

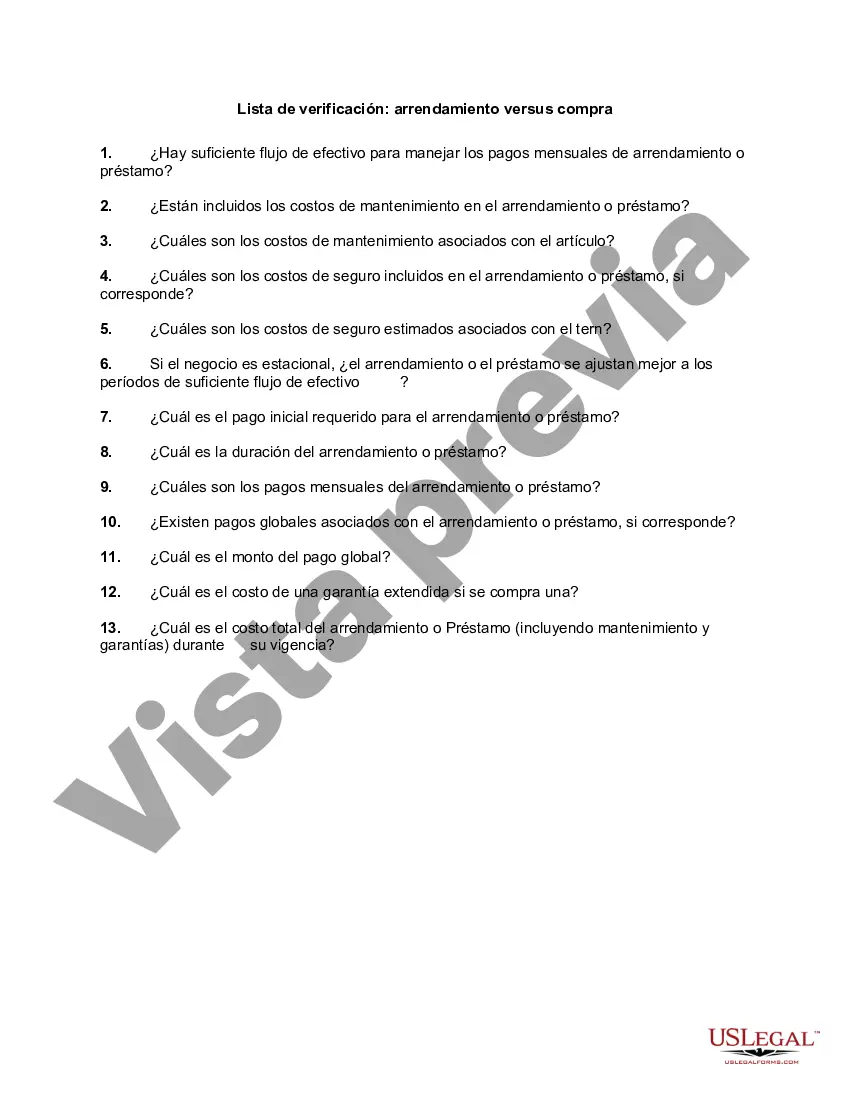

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Lista de verificación: arrendamiento versus compra - Checklist - Leasing vs. Purchasing

Description

How to fill out Hawaii Lista De Verificación: Arrendamiento Versus Compra?

You are able to invest several hours online searching for the legal document template that suits the federal and state needs you require. US Legal Forms gives a large number of legal kinds which are analyzed by pros. It is possible to obtain or produce the Hawaii Checklist - Leasing vs. Purchasing from our service.

If you already possess a US Legal Forms profile, you are able to log in and click the Download key. Afterward, you are able to complete, edit, produce, or indication the Hawaii Checklist - Leasing vs. Purchasing. Each and every legal document template you buy is your own property eternally. To get yet another copy of the acquired kind, check out the My Forms tab and click the corresponding key.

If you work with the US Legal Forms site the first time, adhere to the basic guidelines beneath:

- Initially, make certain you have chosen the right document template for the state/area of your choice. See the kind information to make sure you have selected the proper kind. If accessible, take advantage of the Review key to appear from the document template too.

- If you wish to locate yet another edition in the kind, take advantage of the Search discipline to discover the template that fits your needs and needs.

- Once you have discovered the template you desire, simply click Get now to move forward.

- Select the rates program you desire, type in your accreditations, and register for your account on US Legal Forms.

- Complete the financial transaction. You can use your charge card or PayPal profile to pay for the legal kind.

- Select the format in the document and obtain it in your gadget.

- Make adjustments in your document if required. You are able to complete, edit and indication and produce Hawaii Checklist - Leasing vs. Purchasing.

Download and produce a large number of document templates utilizing the US Legal Forms web site, which provides the most important assortment of legal kinds. Use professional and state-particular templates to deal with your business or specific requires.