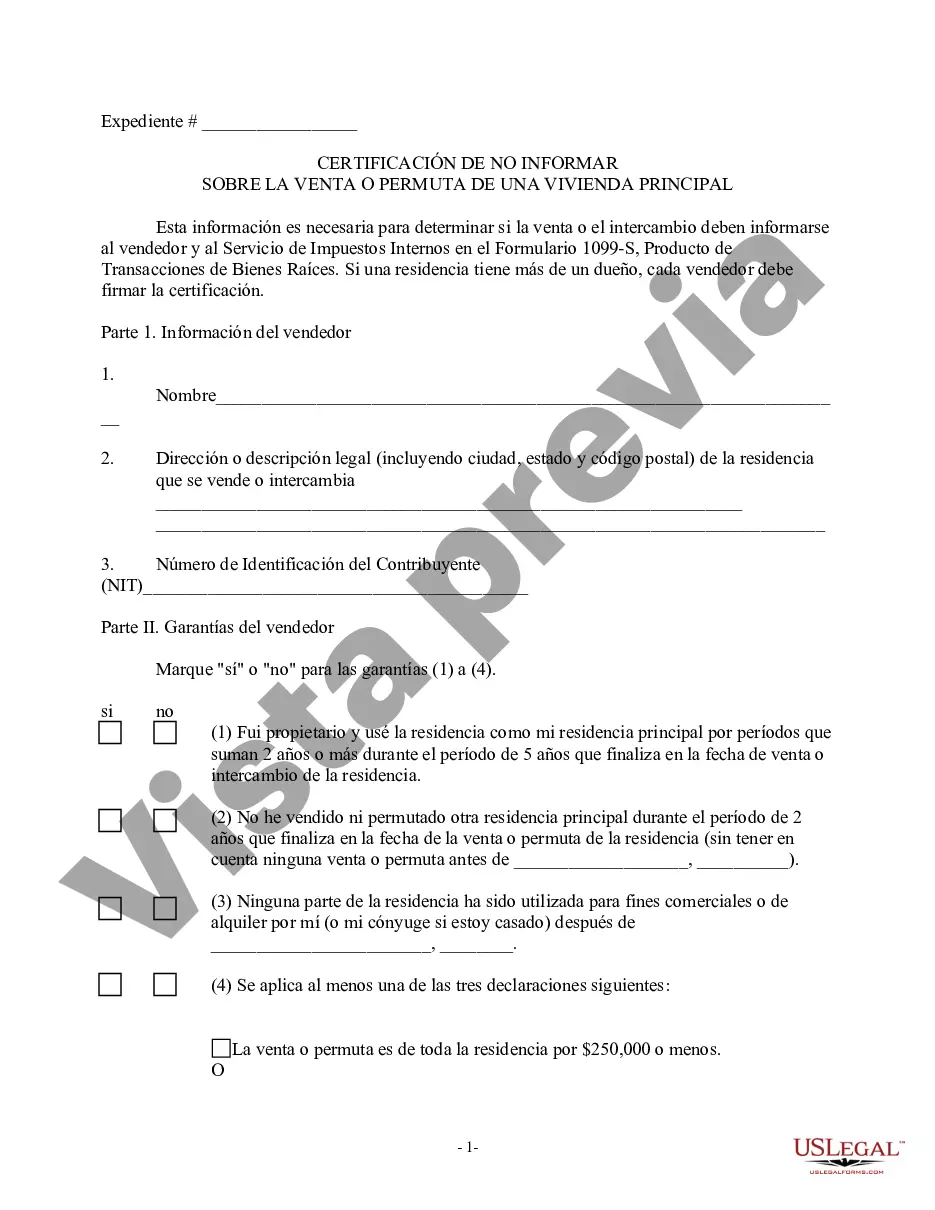

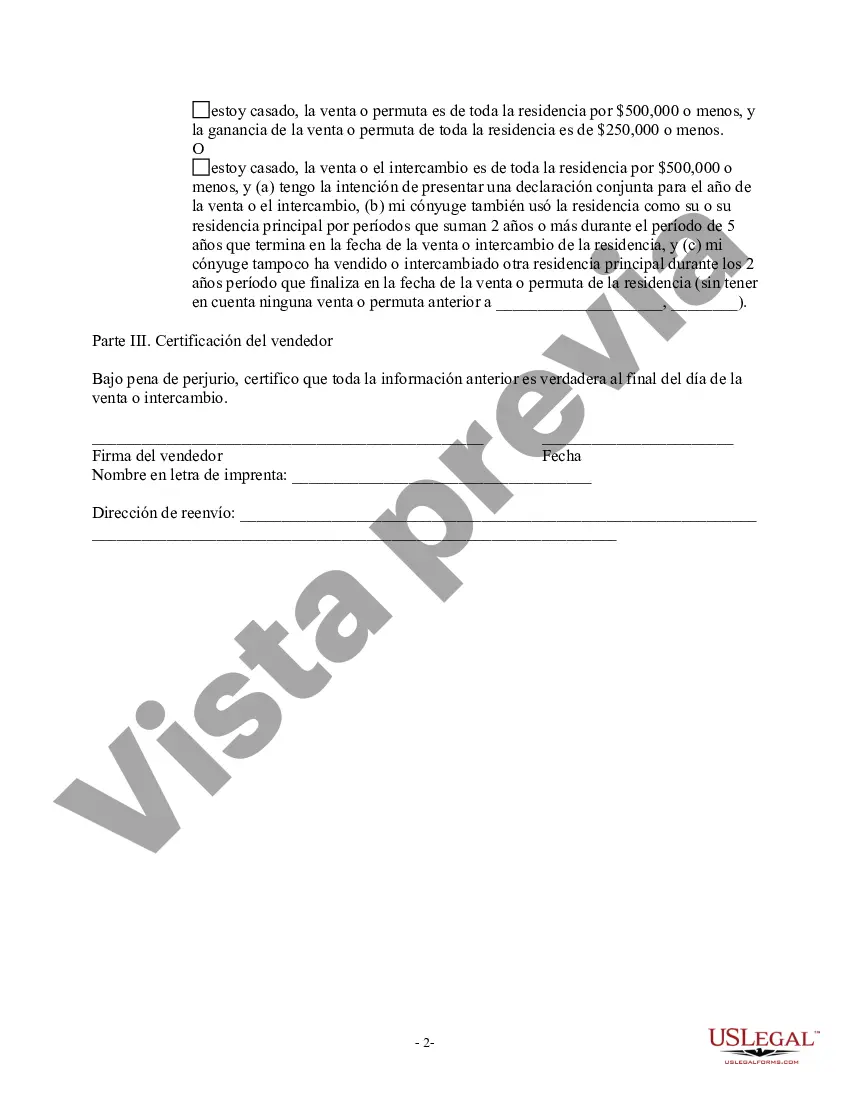

Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is a document that homeowners in Hawaii may need to fill out when they sell or exchange their primary residence. This certification is a way for individuals to claim an exemption from the state's information reporting requirements on the sale or exchange of their principal residence, while also ensuring that they can qualify for certain tax exemptions. The Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is an essential document for homeowners looking to avoid unnecessary reporting obligations and potential tax implications when selling or exchanging their primary residence. By completing this certification, homeowners can achieve peace of mind knowing that they meet the eligibility criteria for certain tax exemptions and are not subject to additional reporting requirements. There are different types of Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, depending on the specific circumstances of the homeowner: 1. Standard Certification: This type of certification is suitable for homeowners who have owned and used their principal residence for at least two out of the last five years and are claiming an exemption under the Internal Revenue Code (IRC) Section 121. Homeowners can provide the necessary details about the property, their ownership, and the duration of principal residence use to qualify for this exemption. 2. Partial Exemption Certification: In some cases, homeowners may have used their principal residence for less than two years due to certain unforeseen circumstances such as job relocation, health issues, or other qualifying factors. This certification allows homeowners to claim a partial exemption from reporting requirements and qualify for IRS-provided percentage calculations related to their specific circumstances. 3. Combined Exemption Certification: Homeowners who are eligible for both the standard and partial exemption can utilize this certification to claim both exemptions and ensure complete compliance with the reporting requirements for the sale or exchange of their principal residence. This certification allows individuals to provide the necessary information to qualify for the appropriate exemptions under the IRC Section 121. By completing the Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption correctly and submitting it alongside the required documentation, homeowners can fulfill their reporting obligations while taking advantage of potential tax exemptions. It is crucial to consult with a tax professional or legal advisor to ensure accuracy and compliance with the specific requirements outlined by the state of Hawaii.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Hawaii Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

Discovering the right legitimate record template might be a battle. Obviously, there are a variety of layouts available on the Internet, but how can you find the legitimate develop you want? Make use of the US Legal Forms web site. The assistance offers thousands of layouts, including the Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which can be used for company and private demands. Every one of the varieties are examined by experts and satisfy federal and state demands.

If you are presently registered, log in in your profile and click on the Acquire key to have the Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Utilize your profile to search through the legitimate varieties you might have bought previously. Proceed to the My Forms tab of your respective profile and have yet another backup of your record you want.

If you are a new end user of US Legal Forms, here are basic instructions that you can stick to:

- First, make certain you have chosen the proper develop to your city/county. You may look through the form making use of the Review key and look at the form information to make sure it is the best for you.

- When the develop fails to satisfy your needs, take advantage of the Seach discipline to obtain the appropriate develop.

- When you are sure that the form is acceptable, click the Purchase now key to have the develop.

- Pick the rates plan you want and type in the required information. Build your profile and pay money for the order with your PayPal profile or credit card.

- Pick the submit structure and download the legitimate record template in your device.

- Full, edit and print and indication the received Hawaii Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

US Legal Forms may be the greatest local library of legitimate varieties where you can find various record layouts. Make use of the service to download professionally-manufactured documents that stick to state demands.