Hawaii Joint Trust with Income Payable to Trustors During Joint Lives

Description

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

Have you ever found yourself in a scenario where you require documents for either business or personal reasons quite frequently.

There are numerous approved document templates accessible online, yet finding ones you can trust is challenging.

US Legal Forms offers thousands of template options, such as the Hawaii Joint Trust with Income Payable to Trustors During Joint Lives, which are crafted to meet state and federal regulations.

Once you identify the suitable form, click Get now.

Select the pricing plan you want, enter the necessary information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you can access the Hawaii Joint Trust with Income Payable to Trustors During Joint Lives template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Choose the form you need and ensure it is appropriate for your city/state.

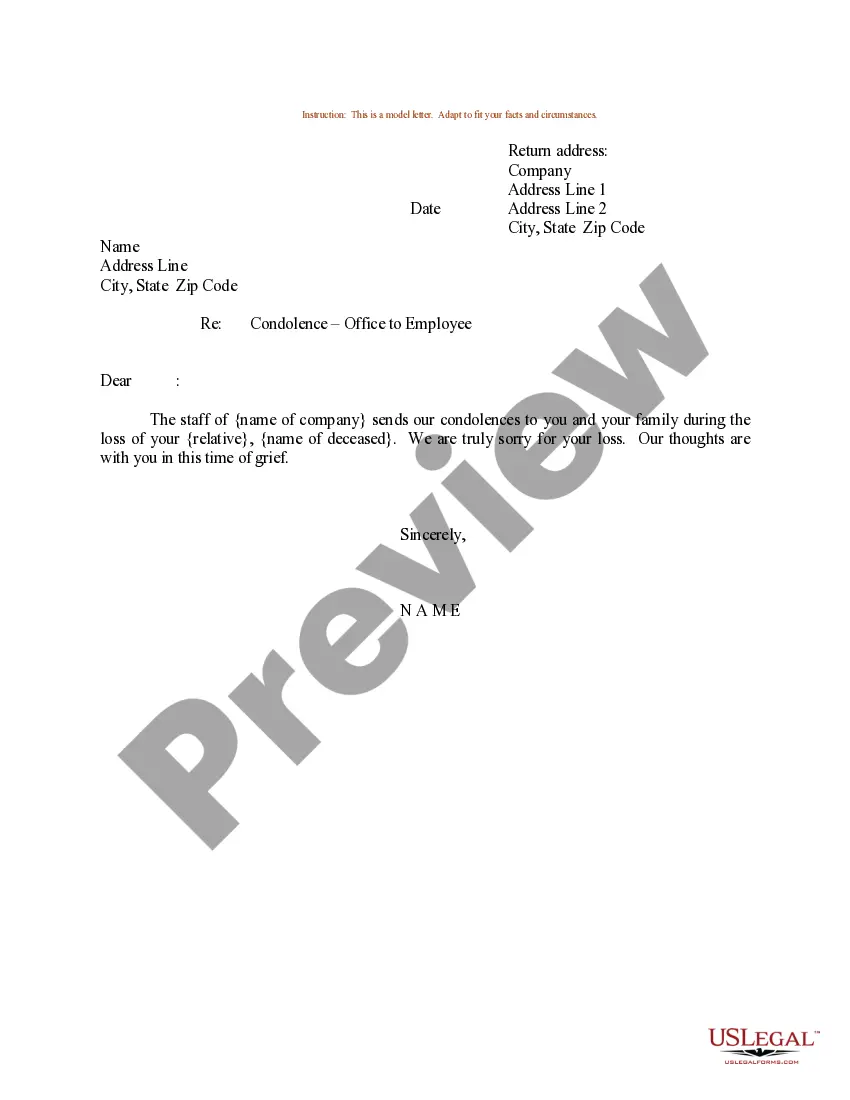

- Use the Review button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form does not meet your needs, use the Lookup field to find the form that suits your requirements.

Form popularity

FAQ

The settlor decides how the assets in a trust should be used - this is usually set out in a document called the 'trust deed'. Sometimes the settlor can also benefit from the assets in a trust - this is called a 'settlor-interested' trust and has special tax rules.

Loan repayment to the settlor. Under a loan trust the loan is repayable to the settlor on demand. This means that the settlor can ask for a part or full repayment of the loan at any time.

This is why the Cleardocs discretionary trust deed expressly prohibits the settlor (or their children) from being a beneficiary of the trust or otherwise receiving a benefit from the trust.

Discretionary trusts appoint a number of beneficiaries, which gives them the potential to benefit from the assets held in the trust. Potential beneficiaries will often include family groups like the settlor's (the person who creates the trust) children and grandchildren.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.

When considering who to distribute the income of a family trust to, it must be noted that all income of a family trust must be distributed to beneficiaries each financial year (or else it is taxed at the top marginal rate).

Can a trustee refuse to pay a beneficiary? Yes, a trustee can refuse to pay a beneficiary if the trust allows them to do so. Whether a trustee can refuse to pay a beneficiary depends on how the trust document is written. Trustees are legally obligated to comply with the terms of the trust when distributing assets.

But when the Trustee of a Revocable Trust dies, it is up to their Successor to settle their loved one's affairs and close the Trust. The Successor Trustee follows what the Trust lays out for all assets, property, and heirlooms, as well as any special instructions.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

Interest in possession trust the beneficiary can get income from the trust straight away, but doesn't have a right to the cash, property or investments that generate that income. The beneficiary will need to pay Income Tax on the income received.