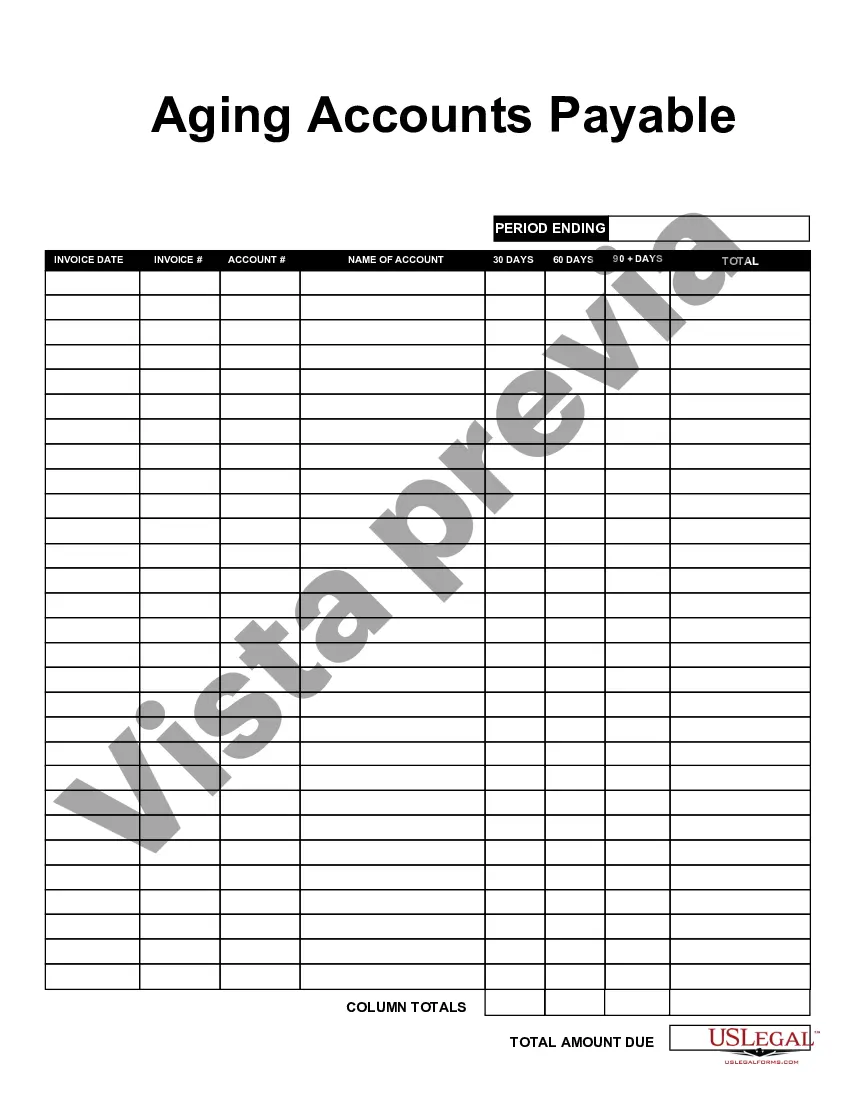

Hawaii Aging Accounts Payable refers to the financial management process in which unpaid invoices or bills are categorized based on the length of time they have been outstanding in the state of Hawaii. It is an essential part of any business or organization's accounting system, as it helps to track and manage outstanding payment obligations. The concept of aging accounts payable enables businesses to monitor their cash flow, identify potential liquidity issues, and take appropriate steps to address overdue payments. By categorizing invoices based on their aging periods, businesses can prioritize payment actions and ensure timely settlement of outstanding obligations. In the context of Hawaii, there are two primary types of Aging Accounts Payable: 1. Current Aging Accounts Payable: This category comprises invoices that are due for payment within the current accounting period. These invoices are usually less than 30 days old and represent the most immediate payment obligations. Businesses prioritize settling current aging accounts payable to maintain healthy relationships with vendors, suppliers, and service providers. 2. Past Due Aging Accounts Payable: This category includes invoices that have exceeded the agreed payment terms and are considered overdue. Past due aging accounts payable can be further classified based on different aging periods, such as: a. 30-60 Days Aging: Invoices that are 30 to 60 days past the due date fall under this category. These late payments may indicate delays in processing invoices, financial constraints, or other internal issues that need to be addressed promptly. b. 60-90 Days Aging: Invoices that are 60 to 90 days overdue are categorized here. Significant delays in payment of this nature can adversely impact business relationships and may result in strained relationships with suppliers or vendors. c. 90+ Days Aging: Invoices that remain unpaid for over 90 days belong to this category. Aging accounts payable exceeding 90 days can indicate severe financial challenges, poor cash flow management, or potential insolvency risks. Managing Hawaii Aging Accounts Payable effectively involves diligent record-keeping, tracking invoice due dates, promptly addressing payment discrepancies, and establishing clear communication channels with vendors and suppliers. By regularly reviewing and analyzing the aging accounts payable, businesses in Hawaii can ensure financial stability, maintain strong working relationships, and preserve their overall credibility in the market.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Antigüedad de cuentas por pagar - Aging Accounts Payable

Description

How to fill out Hawaii Antigüedad De Cuentas Por Pagar?

Are you in a position where you need documents for both company or person reasons just about every day? There are a lot of authorized document templates available on the net, but finding versions you can rely on isn`t simple. US Legal Forms gives thousands of kind templates, just like the Hawaii Aging Accounts Payable, that happen to be created to fulfill state and federal specifications.

Should you be previously informed about US Legal Forms site and also have your account, basically log in. After that, you can obtain the Hawaii Aging Accounts Payable web template.

If you do not have an account and wish to start using US Legal Forms, adopt these measures:

- Obtain the kind you require and make sure it is for that proper city/county.

- Use the Preview button to check the shape.

- See the description to ensure that you have chosen the right kind.

- If the kind isn`t what you`re seeking, take advantage of the Lookup industry to obtain the kind that suits you and specifications.

- Whenever you get the proper kind, just click Purchase now.

- Select the prices strategy you need, complete the desired info to produce your bank account, and pay for the transaction making use of your PayPal or charge card.

- Select a practical paper format and obtain your duplicate.

Locate all the document templates you might have purchased in the My Forms food selection. You can aquire a more duplicate of Hawaii Aging Accounts Payable whenever, if necessary. Just go through the necessary kind to obtain or print the document web template.

Use US Legal Forms, probably the most considerable selection of authorized varieties, to save lots of some time and stay away from errors. The services gives appropriately manufactured authorized document templates which you can use for an array of reasons. Generate your account on US Legal Forms and start generating your life easier.