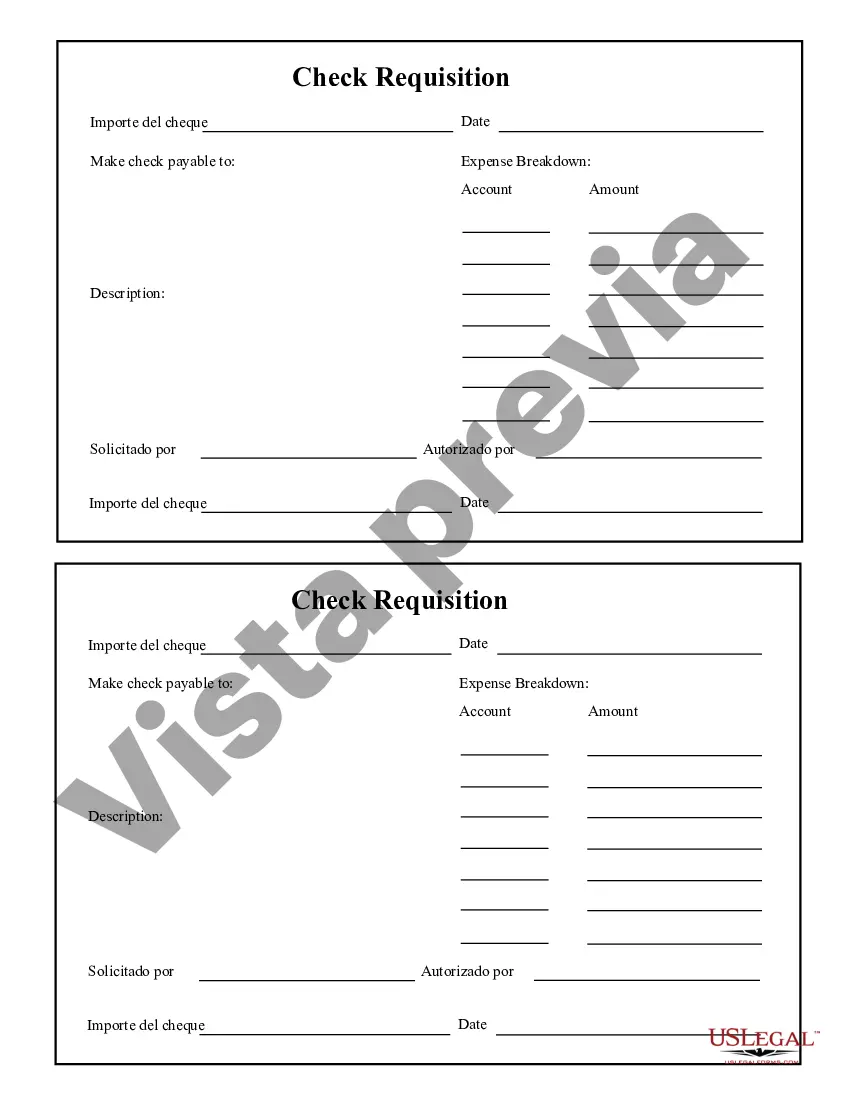

The Hawaii Check Requisition Report is a vital document used in financial management to ensure accurate and efficient payment processing. This report serves as a detailed record that allows organizations to track and monitor their check transactions effectively. The Hawaii Check Requisition Report includes comprehensive information about each payment made through checks. It typically comprises relevant details such as the check number, date issued, payee's name, payment amount, purpose of payment, and related account information. This report helps organizations maintain transparency, accountability, and accuracy in their financial operations. There can be various types of Hawaii Check Requisition Reports, depending on the specific requirements and preferences of an organization. Some common variations may include: 1. Standard Check Requisition Report: This type of report represents the basic format and information structure necessary for tracking check transactions effectively. It includes essential details such as check number, payee, amount, and date. 2. Detailed Check Requisition Report: This variant provides a more elaborate breakdown of each transaction. Apart from the basic details, it may include additional information like department or project charged, account codes, funding sources, and authorization signatures. 3. Summary Check Requisition Report: As the name suggests, this report provides a condensed overview of all check transactions within a given period. It presents the total number of checks issued, their cumulative amounts, and general expenditure categorization. This type of report is often useful for high-level management or financial audits. 4. Customized Check Requisition Report: Organizations may create customized reports to align with their specific needs. This type of report allows flexibility in design and includes additional data fields to track specialized information deemed critical by the organization. The Hawaii Check Requisition Report plays a crucial role in maintaining financial integrity, preventing errors, and providing accurate financial records. It serves as a significant tool for financial analysis, budgeting, and internal/external auditing processes. By documenting crucial payment details, organizations can ensure proper documentation, reconciliation, and adherence to financial regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hawaii Informe de solicitud de cheques - Check Requisition Report

Description

How to fill out Hawaii Informe De Solicitud De Cheques?

Discovering the right legitimate papers web template could be a struggle. Needless to say, there are a variety of layouts available on the Internet, but how would you discover the legitimate kind you require? Take advantage of the US Legal Forms web site. The support offers a large number of layouts, including the Hawaii Check Requisition Report, that you can use for business and personal demands. All the forms are checked out by professionals and meet state and federal demands.

Should you be previously authorized, log in for your accounts and click the Down load option to find the Hawaii Check Requisition Report. Use your accounts to check with the legitimate forms you have purchased earlier. Go to the My Forms tab of the accounts and get one more copy from the papers you require.

Should you be a fresh customer of US Legal Forms, allow me to share easy instructions so that you can follow:

- Initially, make certain you have chosen the appropriate kind for the city/state. You are able to look over the form utilizing the Review option and look at the form explanation to make certain it is the best for you.

- In case the kind fails to meet your expectations, utilize the Seach industry to obtain the proper kind.

- Once you are positive that the form is suitable, go through the Purchase now option to find the kind.

- Opt for the prices plan you would like and enter in the needed details. Design your accounts and pay for the transaction with your PayPal accounts or charge card.

- Opt for the file file format and obtain the legitimate papers web template for your product.

- Total, edit and print out and signal the acquired Hawaii Check Requisition Report.

US Legal Forms is definitely the largest catalogue of legitimate forms where you can find various papers layouts. Take advantage of the service to obtain appropriately-manufactured files that follow state demands.